From those to whom much has been given, from them much shall be expected. -- Luke

Friday, July 29, 2011

Author: U.S. may be on the verge of another revolution | Raw Replay

The two essentially agreed that the United States may be in for a series of events on the magnitude of the revolution, civil war or great depression.

Speaking of the generational differences between today’s new guard and the retiring baby boomers, Howe said that cultural forces have essentially forced this crisis, with “culture warriors” and “values voters” in direct contention with “gen x” for control of the national budget.

“Are we on the verge of another ‘fourth turning’ — another major crash leading to a world war and a world-wide depression?” Hartmann asked.

“No,” Howe said. “I hope it won’t be bad. I hope the destructive will be avoided to the furthest extent possible and the constructive, which always comes out of a fourth turning… will be maximized.”"

Click through to watch the video.

US debt breakdown (pun intended)

Via: New York Times

Click through for an excellent graphic showing which administrations accrued the debt and who holds it. Note that China holds less than ten percent of the debt, and that the lion’s share of the debt was accumulated under George W. Bush.

Via: Foreign Affairs – How Scary Is the Deficit – Setser and Roubini. Very, in their view.

Thursday, July 28, 2011

Competitive inflation or deflation?

It has been widely asserted that the only way for the Western world out of its debt problems is competitive inflation. But it is hard to get an inflation going during a debt deflation. If we are on the verge of a deflation, what will the competition involve?

Deflation is the reverse of inflation. Therefore, if winning involved having the fastest inflation rate in competitive inflation, then the country with the slowest fall in prices should win, as, just like inflation, it will relatively reduce the value of its debt the best.

Europe stands a pretty good chance of deflation if the EU fails and debt loads collapse economies (see Simon Johnson’s analysis here). Europe’s debt problems are worse than America’s.

And, as always in deflations, commodities fall, U.S. Treasury interest rates fall, risk premia rise, stocks fall, and the vastly neglected real economy tanks yet again. More people lose their jobs, and more children go hungry in the emerging banana republics of the developed world.

Then a bigger war and the big inflation begin, if history rhymes.

Is crisis necessary? Apparently.

If one subscribes to the hypothesis of The Fourth Turning, the answer is yes. There is a truly Old Testament feel to Strauss and Howe’s uncannily accurate “prophesy” from fifteen years ago. American society enters a crisis phase every eighty years or so (1780, 1860, 1940… 2020). There is abundant macro evidence that our situation resembles the 1930s in many ways—high debt-to-GDP load, rampant inequality, labor beaten down—with a couple of significant differences. In the 1930s the common people had a strong ally in Roosevelt; today the well-heeled direct the President. In the 1930s, the United States was the world’s greatest creditor nation, today it is the world’s greatest debtor. In the 1930s, a lot of bad debts were charged off and banks allowed to fail, today bad debts are being shuffled between banks and governments (taxpayers) in countries ‘round the world.

There seems to be a need for a depression to shake the society out of its old ways, or at least to increase the likelihood of radical change. There is no guarantee America will reform itself. Devolution into several centuries of neo-feudalism, a la late Roman Empire, is a distinct possibility.

So I watch the debt ceiling charade believing it is rehearsal for a more major screw-up to come. It seems to be required by the nonlinear dynamics of history. Phase change begins soon.

Ranks of hungry children swell, worrying doctors - The Boston Globe

Many families are unable to afford enough healthy food to feed their children, say the Boston Medical Center doctors. The resulting chronic hunger threatens to leave scores of infants and toddlers with lasting learning and developmental problems.

Before the economy soured in 2007, 12 percent of youngsters age 3 and under whose families were randomly surveyed in the hospital’s emergency department were significantly underweight. In 2010, that percentage jumped to 18 percent, and the tide does not appear to be abating, said Dr. Megan Sandel, an associate professor of pediatrics and public health at BMC.

“Food is costing more, and dollars don’t stretch as far," Sandel said. “It’s hard to maintain a diet that is healthy."

The emergency room survey found a similarly striking increase in the percentage of families with children who reported they did not have enough food each month, from 18 percent in 2007 to 28 percent in 2010.

Pediatricians at hospitals in four other cities - Baltimore; Little Rock, Ark.; Minneapolis; and Philadelphia - also reported increases in the ranks of malnourished, hungry youngsters in their emergency rooms since 2008. But Boston’s increases were more dramatic, said Sandel, a lead investigator with Children’s HealthWatch, a network of researchers who track children’s health. Researchers said higher housing and heating costs in Massachusetts probably exacerbated the state’s surge.

BMC has also seen a 58 percent increase, from 24 in 2005 to 38 in 2010, in the number of severely underweight babies under the age of 1 who were referred by family physicians to its Grow Clinic, where doctors provide intensive nutritional, medical, and other services to boost babies’ growth. Such malnourishment is similar to what is more typically seen in developing countries, Sandel said.

Tuesday, July 26, 2011

Bruce Bartlett: Are the Bush Tax Cuts the Root of Our Fiscal Problem? - NYTimes.com

These facts notwithstanding, it has become a Republican talking point that the Bush tax cuts did not, in fact, reduce revenue at all — something the Bush administration itself never asserted.

Last year, Mitch McConnell of Kentucky, the Senate minority leader, said: “There’s no evidence whatsoever that the Bush tax cuts actually diminished revenue. They increased revenue because of the vibrancy of these tax cuts in the economy.”

On June 10, former Minnesota Gov. Tim Pawlenty said, “Keep in mind, whether it be the Bush tax cuts, the Reagan tax cuts or other tax cuts, they always produce an increase in revenue.”"

Worth reading the whole article, written by a Republican.

Friday, July 15, 2011

Consumer sentiment tanks

NEW YORK (Reuters) - Consumer sentiment deteriorated in early July to the lowest level since March 2009 on increasing pessimism over falling income and rising unemployment, a survey released on Friday showed.

Confidence in government economic policies also curdled, the Thomson Reuters/University of Michigan survey showed. U.S. lawmakers are wrangling over a budget deal that would allow the government to raise the debt ceiling -- needed so the United States can fund its obligations next month.

The preliminary reading for the consumer sentiment index dropped to 63.8 in July from 71.5 the month before, falling far short of expectations of an increase to 72.5, according to a Reuters poll of economists.

The survey's barometer of current economic conditions fell to 76.3, the lowest since November 2009, from 82.0. The gauge of consumer expectations was also at its lowest since March 2009, tumbling to 55.8 from 64.8.

"Whenever the Expectations Index has been this low in the past, the economy has been in recession," survey director Richard Curtin said in a statement.

The tanking of the venerable Michigan series at this point resembles nothing so much as its similar tanking in the abortive recovery of 1980-1981 that led into the double dip into the serious recession of 1981-1982.

I have pointed to the divergence between survey measures before, and have alluded to work citing the fading credibility of the unemployment statistics itself as well as the growing awareness of the U6 measure and the average duration of unemployment. The 1981-1982 downturn was caused by tight money to combat inflation. The current divergence and any subsequent downturn will occur in the context of an over-indebted economy in a liquidity trap.

At this point, any tightening of the fiscal reins, especially if not accompanied by increases in taxes on the top income tiers, will not only destroy “animal spirits” and plunge the economy into recession, but will challenge the confidence of most Americans in the very system under which they live, as is consistent with the operating hypothesis here, that the American social contract is broken and can only be fixed by quite revolutionary changes (violence not required).

There is a fetid whiff of depression in the air.

Tuesday, July 12, 2011

The Fed Is Dead… Long Live The Fed?

Here is some mind-bending stuff that I’m just getting on to (h/t/ patrick.net).

The Fed Is Dead… Long Live The Fed

Chancellor Plays Hide The Trojan

Monday, July 11, 2011

As Government Aid Fades, So May the Recovery - NYTimes.com

As Government Aid Fades, So May the Recovery - NYTimes.com

Close to $2 of every $10 that went into Americans’ wallets last year were payments like jobless benefits, food stamps, Social Security and disability, according to an analysis by Moody’s Analytics. In states hit hard by the downturn, like Arizona, Florida, Michigan and Ohio, residents derived even more of their income from the government."

Friday, July 8, 2011

‘Animal spirits’ update

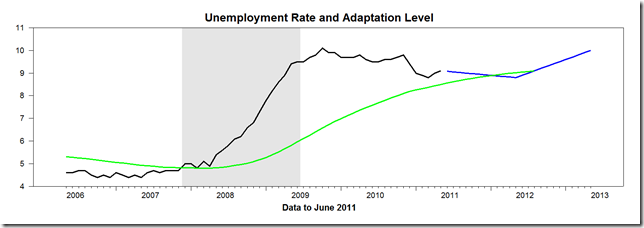

Recall that the primary driver of confidence levels of Americans, in my view, is whether the unemployment rate is above or below an exponential moving average of where it’s been over the past four years. Obviously, it’s been above what we’re used to for a while, which is depressing. The blue line is a forecast, indicating that we might enjoy a transient, weak secular exhilaration in mid-2012. Notice how the unemployment rate shoots up after it crosses from below to above the adaption level, as people lose confidence quickly and a self-organized criticality overtakes the labor market.

This is our “animal spirits” metric: A = – (U – UMEAN)/Sigma(U), shown below.

Symmetrically, a great coincident indicator of the onset of a recession is the A metric falling below zero. Confidence collapses as people start discounting losses instead of gains. Currently, A is trying to rise above zero, as it would have done long ago in a normal expansion, but has failed to do in this jobless “recovery.” Note that the green line, the Michigan Consumer Sentiment series, is lagging in this cycle, as folks look beyond the headline unemployment rate to the truly sick state of the labor market (cf. CR’s graphs).

Here is my judgmental forecast of the unemployment rate up close:

If the unemployment rate manages to dip below 8.9 percent in 2012 there will be the slightest of technical reasons for “animal spirits” to revive. The run-up to a Presidential election year tends to be euphoria-inducing, no matter which side one is rooting for. But any movement toward fiscal tightening, which seems inevitable, will quickly deflate aggregate demand and send unemployment higher, and “animal spirits” back into the hopper. The resulting slump would be the 2010 decade’s analogue to the 1938 slump during the Great Depression, which was an almost 20 percent decline in Personal Income from peak to trough.