http://theautomaticearth.blogspot.com/2011/12/december-29-2011-trends-2012-end-of.html

From those to whom much has been given, from them much shall be expected. -- Luke

Thursday, December 29, 2011

The Automatic Earth

http://theautomaticearth.blogspot.com/2011/12/december-29-2011-trends-2012-end-of.html

Thursday, December 22, 2011

Ron Paul for president

Absolute disgust with the state of America fills the writers in the blogosphere that I read (most of it referenced to the left, but I also recommend www.theburningplatform.com ‘s last few posts).

I share it. And after considerable thought about the possible downside risks, I have come to support Ron Paul for president. He is the only candidate who is uncompromised.

I supported Obama, despite the Clinton’s warnings that he was not authentic, and have come to view him as a servant of the ruling class.

On the issue of class: class exists, always has. When one class rigs the system for its own benefit, and another class resents it and fights back, that’s justified.

The corporate oligarchy has assumed control of the world’s capital, not as owners, but as pirates looting the treasuries of their corporations, and when those run dry, the taxpayers.

I hesitated a long time to support Ron Paul because he would not regulate the markets, and I feared that complete lack of regulation would collapse the economy. But we have regulation now that has been captured by the regulated to worse effect than no regulation at all (cf. MF Global; watch this). Our financial markets are rigged, just like the big corporations that are decimating small business. Wall Street bankers whose banks would have failed without bailouts of taxpayer funds paid themselves their biggest bonuses ever after being bailed out. They know their time is running short.

Dr. Paul is a physician. I trust him to take care of the innocent people who are being hurt by the collapse of our system.

The other cause requiring immediate support is an amendment to the Constitution to undo the Citizens vs. U.S. decision that declared “corporations are people” when it comes to funding—anonymously even—political campaigns. I view this decision as treasonous, as the source of such funding could be coming from anywhere in the world.

And finally, until the dominant mythology of our age—neoclassical economics—is replaced by an understanding of the prime true driver of human welfare, namely, living a fully connected life in a just society (one that the empirical results suggests will have considerably less inequality than America currently suffers under)—until the pernicious mythology of Economics is cast aside, we will suffer further at the hands of an oligarchy armed with bogus ideas of entitlement to justify their greed. See Wilkinson talk at ted.org for the effects of inequality on human welfare.

Happy Chanukah and Merry Christmas, all.

Saturday, December 10, 2011

Secular exhilaration! take 2

So what happened to the stock market in the early ‘Seventies episode, you might ask.

The market peaked right at the New Year of 1973. By analogy we might expect the same for 2012. From the previous post note the leading nature of the Michigan Sentiment series, which recently had its own pop to the upside. Expect some delusional holiday cheer out of Old Europe to keep the fake rally going, but after New Year’s Eve and the first few trading days of 2012, it might be time to say “risk off.”

N.B. This is research, not investment advice. You invest at your own risk, unlike the Wall Street banks, who also invest at your risk. Just wait until the Euro sovereign CDSs come home to roost, how the Wall Street bankers come to Uncle Bernie with their hands out (Uncle Sam doesn’t have the cojones to give them any more money, afraid of being tarred and feathered).

Friday, December 2, 2011

Secular exhilaration!

Let the secular exhilaration begin!

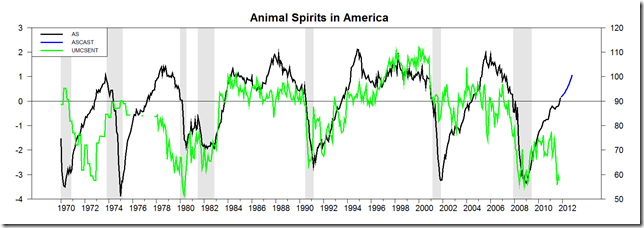

The green line is the Michigan survey measure of consumer sentiment. The forecast of the unemployment rate is judgmental and follows the pattern of the early ‘Seventies approximately.

Confidence has a momentum of its own, visual examination of the series suggests. The unemployment rate rarely crosses quickly back above its moving average once it has crossed below. It happened a few times in the 'Fifties and ‘Sixties but did not signal the imminent start of a recession. We may expect positive economic momentum for several quarters in the U.S.

If we track the early ‘Seventies episode, when the Michigan series was in the dumps as it is now but our “animal spirits” metric went positive, we can expect about a year of positive economic growth before the next collapse of confidence.

Why Shiller and Akerlof didn’t cite the important 1996 paper in the Journal of Economic Psychology on “animal spirits” published by an obscure professor at a small, non-snob school somewhere in fly-over land, is simply evidence of how long our neo-feudal class system has been forming. Denial is so easy when the little people are so far removed of our social sphere of reference.