American confidence levels will rebound in the first half of 2009 from generational lows as Americans become adapted to the new realities of the economy. Americans will feel as if they've "been down so long it looks like up to me."

The primary determinant of "animal spirits" (confidence levels) is how high the current unemployment rate is relative to recent experience. All perception is relative, as was recognized by Max Wilhelm Wundt, the first experimental psychologist and the founder of adaptation level theory.

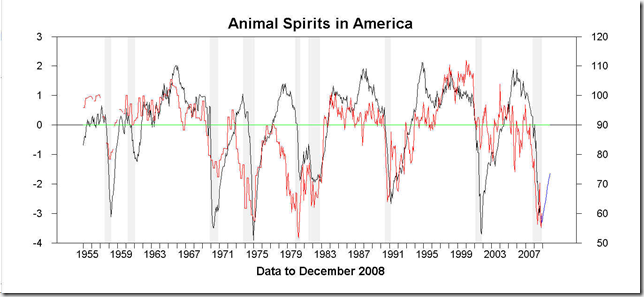

The "animal spirits" of Americans can be modeled accurately by

A = - (U - UMEAN)/Stdev(U)

where U is the current unemployment rate, UMEAN is an exponential moving average over the past three years, and Stdev(U) is the standard deviation of U over the past three years. This measure correlates highly with the Michigan consumer sentiment index (red; blue is forecast based the unemployment rate forecast below).

"Animal spirits" hover at very low levels. However, continued increases in unemployment will have little effect on confidence. We are at or very near the nadir of "animal spirits" for this cycle.

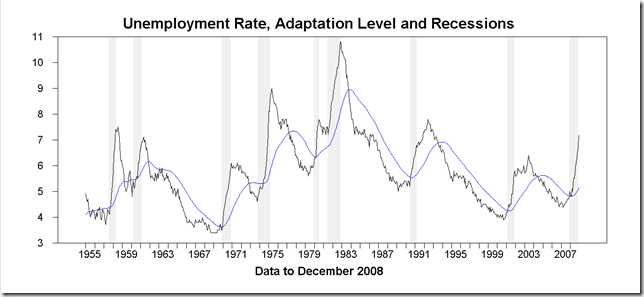

To understand why we are within a few months of the confidence low it is important to understand that after rises in the unemployment rate, people get used to it. In the 1980s, when unemployment began to drop from its highs over 10 percent, confidence soared. The adaptation level is now catching up with the current rate. Other things equal, confidence will increase as the difference between the two decreases. The blue line below is the adaptation level.

The blue line below represents an unemployment rate forecast.

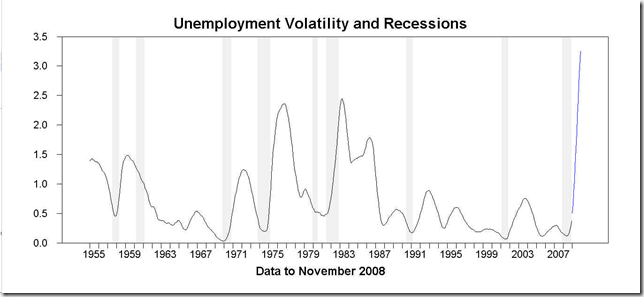

The other thing impacting confidence in the model is how much volatility people are used to. If you're sitting in the library and a book falls off the shelf, you may be startled; the same noise at a parade would go unnoticed. In part due to excessively accommodative efforts to "stabilize" the American economy in recent years, unemployment volatility fell to very low levels. The blue line in the graph below represents what will happen to volatility over the next 12 months if unemployment rises to over 9 percent over the next 12 months as shown above.

The net result of the adaptation level rising to catch up with current unemployment and volatility rescaling perceptions of the gap between adaptation level and current unemployment is that even if unemployment increases in 2009, confidence will bottom and turn up. And this generally signifies the end of a recession in the American economy. Look again at the blue line below, the forecast of "animal spirits." Even if unemployment goes to 11 percent over the next 12 months, "animal spirits" will recover. The University of Michigan series is red again.

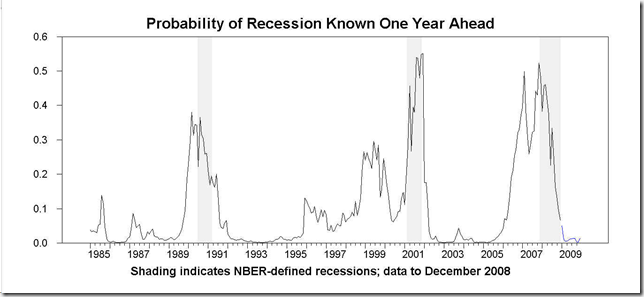

The "animal spirits" variable can be combined with the slope of the yield curve, a powerful forecasting tool in its own right, to create a recession forecasting model that gives an estimated "probability" of a recession occurring from a full year in advance without forecasting any explanatory variables. This model has forecast the onset of the last two recessions in real time well ahead of the consensus of professional economic forecasters, and now forecasts an end to the current recession in first half 2009. (It was featured in Nature's prestigious Science News column in August 2001 when it was forecasting a recession and the consensus was not; see references.)

This model has an excellent record over the past 55 years as the next graph shows.

The model's forecasts are qualitative, of the sort generally found most useful by practical people. As one of my professors in graduate school liked to say, "It is better to be approximately correct than precisely wrong." There is a rough proportionality between the size of the forecasted recession's probability and severity of the ensuing recession, but not much should be made of this in light of the current global slump in economic activity. The parameters of the model worked well over the postwar period, but the parameters may have changed. If there is a recovery in GDP growth in 2009, it will be from a far lower level for the simple reason that much of recent GDP (especially consumption) was debt-financed, and that isn't happening any more. The best we can expect is an "L-shaped" recovery at a much lower run rate of GDP.

The unemployment rate will probably remain elevated for some time. In the opinion of this commentator, the Government should make income support for the involuntarily unemployed its top priority. They are the victims of a systemic credit crisis not of their own making. Also, income support to the unemployed is guaranteed to be spent, and will enter the spending stream faster than any other fiscal stimulus.

The strongest prediction of the model is that "animal spirits" will recover within the next couple of quarters, coinciding with the beginning of the Obama administration. One can hope that in an atmosphere of increasing confidence our leaders will be able to take bold and correct action to set priorities for a nation already weighing heavily on world capital markets.

References

Middleton, Elliott, ‘Animal spirits’ and expectations in U.S. recession forecasting, http://arxiv.org/abs/nlin/0108012, 8 August 2001.

This paper provides citation for Middleton (1996) "Adaptation level and 'animal spirits'", JEconPsych.

Ball, Philip, “Hard times ahead: depressions caused by lack of economic confidence might be predictable,” Nature, http://www.nature.com/news/2001/010815/full/news010816-12.html, 15 August 2001.