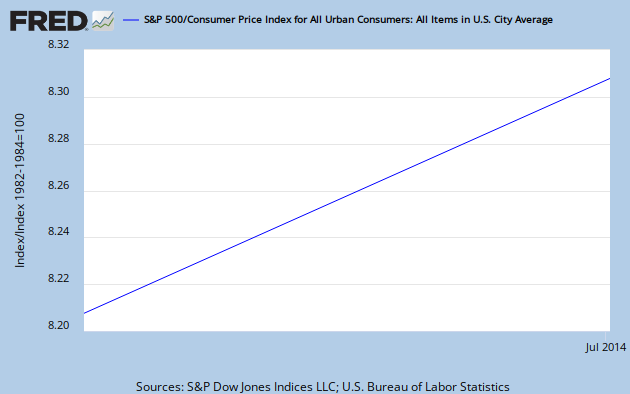

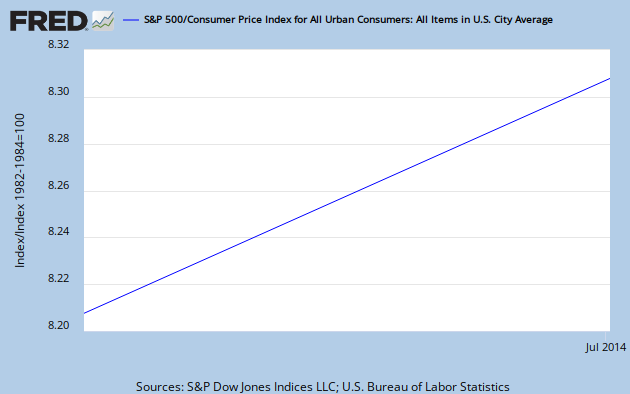

Here is a graph of the S&P 500 deflated by the CPI. Which way do you think it is going?

From those to whom much has been given, from them much shall be expected. -- Luke

Here is a graph of the S&P 500 deflated by the CPI. Which way do you think it is going?

The entertaining Jim Quinn has put up the third in his series of "Trying to Stay Sane in an Insane World." Quinn works at Wharton and his website is either one of the cleverest honeypots around, or Wharton — a bastion of, let's face it, Wall Street think — actually allows some free speech.

However, here's my response to the Austrians who say — who chant — "Government bad! Government bad!" — and, "Free markets good! Free markets good!"

Feudalism bad! The Middle Ages were based on a system of highly concentrated ownership of the means of production, which at that time was mostly land. You had your lords and your serfs. With the assistance of rapidly improving technology are getting closer and closer to a new age of feudalism.

The Crisis still looks to peak after 2020. Buckle up.

I am pleased to recommend a new thriller, Freedom’s Sunset, which is currently in the top 50 in Amazon’s political thriller category. Please support this new author by reading the book and (if you like it) giving it a five-star review. Amazon’s algo's are very sensitive to the reviews.

Book Description

Are you concerned about the collapse of the American economy? Here is a thriller about the collapse of the Soviet empire that provides historical insight into that collapse. It is June 1990. Mikhail S. Gorbachev, President of the Union of Soviet Socialist Republics, fears that his policies of glasnost--openness--will cause the union to split apart. The Berlin Wall fell in the past November.

His political rival, Boris Yeltsin, appears to be gaining popularity. On a cold day Gorbachev comes to Minnesota in the American heartland for a historic visit. A product of the Russian countryside himself, Gorbachev is happy to be free of the intrigues of Washington, D.C. and Moscow for a day.

But he will face an encounter with Zack Pedersen, a troubled youth from South Dakota, on Summit Avenue in St. Paul that sheds light on two very different empires in different stages of collapse.

Written in a style combining John le Carré with The Hunger Games, this book will appeal to those around the world who yearn for freedom and are willing to pay the price to keep it. The story contains strong language and adult themes.

This book includes a lot biographical flashbacks on Gorbachev’s life. Reviewers find that it provides a lot of historical insight into the collapse of the USSR, and what has happened there subsequently. Gorbachev’s personal story is especially compelling.

Russia currently has a sovereign debt to GDP ratio of approximately 10-15 percent. They defaulted on much of the USSR’s debt. Putin must be laughing at the what the bankers are doing to the Europeans.

It should be evident now that "money printing" is not a sufficient cause of inflation or hyperinflation. Excess reserves pile up in the banking system and the Fed ends up "pushing on a string" with little effect on either price level or output. Hence John Williams' massive miss on his hyperinflation call. The first Great Depression taught us this.

Wikipedia helpfully defines two trigger mechanisms for hyperinflation: the "velocity" model and the "money in circulation" model. Also, please recall my fundamental definition of inflation:

Inflation is a labor market phenomenon, i.e., a wage price spiral, accommodated by monetary policy. Here I am adopting the "economics" definition of inflation as a general rise on the price level.

Now, so long as the capitalists continue to subject labor to diminishing real incomes, the only inflation that can exist is asset bubbles, financed by the increasing incomes of the capitalist class. While there is at least a feeble attempt by households to rebuild balance sheets, filling up one's gas tank with gas to beat rising gas prices does not constitute a sufficient increase in the velocity of money to trigger a hyperinflation. Fundamentally, the budget constraint on the vast majority of real incomes precludes accelerating inflation. So much for the velocity means of triggering a hyperinflation.

With the recent speculation that Lawrence Summers is the President's favorite for the new Fed chief, there is some reason to attend to the "money in circulation" model of hyperinflation. Summers is an advocate of taking on lots of new federal debt to stimulate the economy. The way that this will be accomplished may end up being a close facsimile of the Modern Monetary Theory prescriptions in that the Fed will essentially print these dollars and send them into the economy as "new money in circulation" through the Treasury. However, Janet Yellen is likely to do the same thing.

There is certainly an argument for undertaking large infrastructure projects while interest rates are extremely low. And the massive increase in debt is consistent with Sornette's estimations of the worldwide debt bubble's trajectory referenced a couple of posts ago. (Ron Paul has suggested that the Fed might simply forgive such debt held by the Fed, which would make it a pure MMT exercise.)

The point being that much of such spending might conceivably flow to the people as incomes (although the last bout of stimulus demonstrably did not, some 90+% of it winding up in the pockets of the 1%) and ignite an inflationary or hyper inflationary outcome. But I doubt it. More likely I think is that essentially carry trade-generated asset bubbles persist wherever the hot money flows, while labor's compensation remains stagnant. The vanishing middle classes around the world will experience stagflation, but not concomitantly rising wages.

Hence, Sornette's finite time singularity is likely to be profoundly deflationary when the bubble pops. There might at last be something like a global debt jubilee around 2020, simply because the debt service finally overtakes the ability of markets to absorb the debt required to pay it. This will be the End of the Modern Age, possibly, if complete monetary chaos halts much of international trade. The 2020s may be the decade when large scale barter becomes the norm between nations.

In the CIA's humint (human intelligence) areas, the study of faces is a recognized discipline. One needs to know very little about Lawrence Summers to realize he is a complete ass. The only public faces in recent memory that show such obvious bad intent are those of Phil Gramm and Paul Wolfowitz.

But it doesn't matter who is appointed to the Fed chair, because Janet Yellen will do the same thing as Summers, only possibly less aggressively.

In spite of the downtick in the unemployment rate—due to lowered labor force participation—the topping process in “animal spirits” continues; there was no break of the recent high.

As the history of the A metric shows, when it crosses the zero line from above a collapse of confidence is virtually guaranteed.

When will we get there? Frequently entry into NBER-defined recession precedes the crossing of the zero line, so my forecast of a collapse of confidence before the end of year may be plausible. Otherwise it will occur in 2014. With job growth (especially full-time, “good” job growth) at the pathetic levels it’s at, it’s hard to see how a collapse of confidence before the actually crossing of the zero line won’t take place.

Here’s a close up of my judgmental unemployment rate forecast and its attendant adaptation level forecast:

Sooner or later a lot of the unemployed are going to have to start looking for work, and that will push the unemployment rate up, precipitating the collapse of confidence as the published unemployment rate rises.

I have taken a brief look at whether coming within a “just noticeable difference” of the adaptation level is sufficient to cause the collapse, and I don’t think it is. Confidence is especially sensitive to the A metric actually attaining a negative value. However, as can be seen from the history, in many cases the NBER-defined recession occurs before that happens.