Via: Newsweek Big picture stuff worth reading.

From those to whom much has been given, from them much shall be expected. -- Luke

Monday, November 30, 2009

Sunday, November 29, 2009

Is global warming unstoppable?

Via: Science Daily

ScienceDaily (Nov. 24, 2009) — In a provocative new study, a University of Utah scientist argues that rising carbon dioxide emissions -- the major cause of global warming -- cannot be stabilized unless the world's economy collapses or society builds the equivalent of one new nuclear power plant each day.

"It looks unlikely that there will be any substantial near-term departure from recently observed acceleration in carbon dioxide emission rates," says the new paper by Tim Garrett, an associate professor of atmospheric sciences.

Garrett's study was panned by some economists and rejected by several journals before acceptance by Climatic Change, a journal edited by Stanford University climate scientist Stephen Schneider. The study will be published online the week of November 23.

The study -- which is based on the concept that physics can be used to characterize the evolution of civilization -- indicates:

- Energy conservation or efficiency doesn't really save energy, but instead spurs economic growth and accelerated energy consumption.

- Throughout history, a simple physical "constant" -- an unchanging mathematical value -- links global energy use to the world's accumulated economic productivity, adjusted for inflation. So it isn't necessary to consider population growth and standard of living in predicting society's future energy consumption and resulting carbon dioxide emissions.

- "Stabilization of carbon dioxide emissions at current rates will require approximately 300 gigawatts of new non-carbon-dioxide-emitting power production capacity annually -- approximately one new nuclear power plant (or equivalent) per day," Garrett says. "Physically, there are no other options without killing the economy."

Getting Heat for Viewing Civilization as a "Heat Engine"

Garrett says colleagues generally support his theory, while some economists are critical. One economist, who reviewed the study, wrote: "I am afraid the author will need to study harder before he can contribute."

"I'm not an economist, and I am approaching the economy as a physics problem," Garrett says. "I end up with a global economic growth model different than they have."

Article continues here.

Read the paper at arXiv.org here. Should be read in conjunction with that oldie-but goodie, “Finite-time singularity in the dynamics of the world population, economic and financial indices” found here.

Moral: Prepare for a lower standard of living.

Friday, November 27, 2009

The triumph of social Darwinism or American self-reliance?

Americans of all stripes seem poised to renounce with a certain finality any shred of unselfishness or social responsibility in an understandable rejection of “government” as we have come to know it in the latter days of the plutocracy, as the oligarchs of Wall Street complete their vacuum-cleaning of the incomes and assets of the drowning American middle class.

Can you blame good-hearted Americans for rejecting the calls of Keynesians to spend even more money on projects to be chosen by a kept Congress? More pork for the friends of the Democrats this time, when we just finished watching the Republicans enrich Halliburton and Blackwater (now Xe) and untold others in military Keynesianism and financial deregulation, both now getting a second wind under Obomba?

Americans are a self-selected group of self-reliant risk-takers and establishment-leave-takers. It is my guess that the majority of Americans are ready to leave the existing establishment in their dust. Whether they succeed in creating a new American social contract, with a government that works for them and not the elite—or are ground down under the heel of the empire for another century or more in a fascist neo-feudalism—this will be the central drama of the twenty-first century. The world is watching.

But let me say to Americans of the left and right and center, as you reject government, remember that you cannot reject each other, for no man or woman is an island, and as the probable failure of the American state unfolds, we will need each other’s help more than ever.

Happy Thanksgiving, gentle readers, and may your Black Friday be sustainable.

Sunday, November 22, 2009

Global warming cooling

With the hacking of the East Anglia climate lab’s data and documents, and the revelations therein (that Mish does an adequate job of summarizing) I am reminded of the late Michael Crichton’s remarks on the subject to the National Press Club. Crichton was admirable for maintaining throughout his life—even after becoming rich and celebrated—the ability to apply critical thinking skills typical of college graduates of the early postwar period to current events. In other words, he resisted spin. I recommend reading “The Case for Skepticism on Global Warming” (2005). Crichton shows that just on the face of the research presented, global warming was a fraud.

But remember, Al Gore (allegedly) invented the Internet, so he must know what he’s talking about. And he also got really rich selling fear, a topic that Crichton addressed in his novel State of Fear. George W. Bush made fear-mongering his stock in trade, and Dick Cheney is pathetically still carrying the torch.

We have so many fear-mongers now that it’s hard to get good panic attack going. Was that a meteor streaking across the Western sky that if it had been bigger could have started the next ice age in six months? Oh well, back to worrying about the collapse of the world economy….

Maybe people will wake up, learn to think, and shut the fear-mongers up.

***

Movie rental recommendation: Food, Inc. Eye-popping. Corporate consolidation of the food industry based on mass production and the horrors thereof; the demand for organic food by consumers is the only hope as Walmart and others come on board.

When the Supreme Court gave corporations the right to patent life forms, they set the stage for evil on a planetary scale by agribusinesses. Thank you, Clarence Thomas.

Crichton’s novel Next is an entertaining diatribe on this topic, although he seems to have given up the fight spiritually. It was one of his last novels.

The housecleaning that the human race faces over coming decades is truly staggering, if we are not to perish by our own misdeeds.

Tuesday, November 17, 2009

What will it take to forge a new social contract?

Via: FT

Clive Crook reviews Creating An Opportunity Society by Elizabeth Sawhill and Ron Haskins.

By international standards, intergenerational mobility in the US is quite low. This will surprise few who have ventured into a US public housing project or troubled inner-city school, but many middle-class Americans never have. The figures show that US children born in the lowest and highest quintiles of the income distribution are more likely to stay there than in Britain, for example, and much more likely than in countries such as Sweden and Denmark.

But what to do about it? The book confirms a finding well established in the literature, that transition to the middle class is all but guaranteed for poor children if they do three things: finish high school, work full time and marry before having children. The US underperforms as an opportunity society because so many of its young people fail at one or more. The book focuses on these areas.

Education, as the Obama administration recognises, is pivotal. The book calls for gradual increases in spending on early education programmes for the poor, an exceptionally productive investment according to all the research.

The authors also suggest policies to improve schools, such as adopting national standards (a strengthening of the state-based standards of the No Child Left Behind law); new federal incentives (like those being introduced by the Obama administration) to encourage the hiring and retention of good teachers; and support for “paternalistic” schools that stress order, good attendance, basic skills and frequent assessment. Teachers’ unions find plenty to object to here.

Incentives to find and stay in work could be improved by extending the earned-income tax credit, say the authors, and through support for vocational training. But work requirements under the 1990s welfare reforms should be maintained or tightened, they say. At this many liberals will bridle, as they will at the claim that the “success sequence” of school, employment, and children after marriage requires firmer pro-family suasion and incentives. “To those who argue that this goal is old-fashioned or inconsistent with modern culture, we argue that modern culture is inconsistent with the needs of children.” So there.

The cost of these new and expanded interventions, net of savings from schemes the book wants trimmed, would be about $20bn (€13.4bn, £12bn) a year. This seems modest by current standards, but, as good fiscal conservatives, the authors think the country cannot afford its present commitments, let alone new ones. Here, therefore, they make their boldest suggestion of all. The US social contract needs to be revised, so that the elderly, many of whom are comparatively well off, receive less so that the poor can get more.

The authors lay out an admirable agenda. The only problem is that it would require a new social contract already in place to get it legislated.

I had a neighbor years ago when I was living in an apartment complex in Philadelphia who first expressed to me what I have come to think of as the “perennial wisdom” on this topic:

“It will take a depression to bring people back to their senses,” the cantankerous gentleman said.

Monday, November 16, 2009

The worst is yet to come

I agree with Noriel Roubini that the worst is yet to come, but even Roubini falls prey to the figment that a fiscal stimulus involving “shovel-ready” infrastructure spending “creates jobs”:

There's really just one hope for our leaders to turn things around: a bold prescription that increases the fiscal stimulus with another round of labor-intensive, shovel-ready infrastructure projects, helps fiscally strapped state and local governments and provides a temporary tax credit to the private sector to hire more workers. Helping the unemployed just by extending unemployment benefits is necessary not sufficient; it leads to persistent unemployment rather than job creation.

In the past, I have also recommended infrastructure spending or workfare instead of just a livable poverty-level dole. But upon reflection, and watching the way our government malfunctions, I have become more conservative. I don’t trust the government to spend my money on anything other than humanitarian aid for my fellow citizens. And “extending unemployment benefits” is not an adequate answer to the abject lives that Americans confront when they become unemployed long-term (most Americans don’t even qualify for unemployment benefits, to begin with).

I don’t know any other commentator who is singing my song, which is that the current collapse of effective demand is a distributional problem, to solve which quantitative easing and fiscal stimulus are a fool’s tools. If the problem is distributional, the solution needs to be as well.

Provide spending power to the disenfranchised and let the system self-organize. That’s the one thing markets do well. I never bought John Stuart Mill’s argument that redistributional strategies always ultimately fail. As I recall it was tied up with that marginal productivity fairy tale. The rich in America have done very well redistributing income and wealth in their own direction via manipulation of corporate compensation and personal taxes.

The more that government is involved in job creation, the more worthless the resulting jobs will be, generally. Otherwise, I don’t object to workfare in principle, I just think it will be botched and disagreements (pork-squabbling) over what jobs to create will be used as an excuse for delaying direct humanitarian aid. People on a livable dole can engage in search for jobs that use their actual skills, rather than just blistering their hands with a shovel. Or they can engage in training for real jobs. Government jobs create vast Sargasso Seas of waste in the economy that tend never to go away.

Tax credits for hiring new workers, or as Yves referenced recently, mandatory short work hours per the German solution make a lot of sense (although they don’t have a prayer of being tried here).

But there will be no excuse for letting our fellow Americans fall into a life on the streets when the next collapse occurs.

Saturday, November 14, 2009

Stock market still riding a thermal

Warning: this is research, not investment advice. You invest at your own risk.

Birds can stay aloft for hours riding thermals or updrafts of warm air. I look at the human responses to adaptation level effects in much the same way. When things are better than what we have in recent memory, we feel good, relatively speaking. The stock market now is riding an emotional thermal upward and may continue to do so for a while. Of course, it is also riding a tsunami of Fed-supplied liquidity that has engendered a new carry trade in paper assets.

My best guess is still that the market will make a final top this winter before entering a multi-year period of turbulence and flat to negative growth as the most severe economic contractions and bear markets tend to occur early in the decade (see this). The current period most resembles 1970, 1974-1975, or 2001-2003.

The graph shows my “animal spirits” stock market oscillator and the venerable Coppock Guide, both of which are still coming off impressive bottoms.

Just for kicks, here is the picture if you adjust the S&P 500 by the CPI. We could very easily have another big down leg coming in real terms (using any reasonable price index). Note that it took fourteen years from the 1968 top to hit a final bottom in 1982. A similar interval from the top in 2000 would put our final bottom in 2014, which is consistent with my general view of the current business cycle. It’s also generally consistent with the Great Depression experience. The biggest debt-deflationary collapse is yet to come, and may be “stagflationary” in the event given tightness in critical commodity markets.

Tuesday, November 10, 2009

A picture of the collapse of effective demand

Aggregate Demand = Consumption + Investment + Government + Net Exports

I’ve included all series in nominal dollar terms because that’s what matters in the end, whether the dollars are flowing or not. All series are relative to an index equal to 100 in 1990:1. Net exports was more volatile so it got its own scaling on the right axis (note that the index is positive, even as we ran a negative trade balance).

Investment and net exports have collapsed the most. Consumption is bravely trying to get back to where it was in early 2008, but will probably not get there. At the risk of a busy graph I’ve included wage and salary compensation of employees; it has tanked more than consumption. So there is some question what’s going on with the consumption numbers, as Contrary Investor points out, possibly transfer payments. The (ridiculously named) Permanent Income Hypothesis tells us consumers may just be adjusting to the new realities slowly. (Why couldn’t Friedman just call it an adaptation level, and fall in line with the central currents of scientific thought? Why couldn’t Shiller and Akerlof cite the most important paper published on “animal spirits” in the past twenty years? Such is arrogance and provinciality of economists.)

Investment spending is usually more responsive to my “animal spirits” measure. A technician would look at the government spending line and say “looks hyperbolic” and therefore unsustainable. Government spending has been growing at a faster than exponential rate over the past couple of years. The econophysicists have shown us that faster than exponential growth is a signature of a process heading toward a “singularity,” or phase change, or crash, in the case of stock markets. It’s reasonable to suppose a similar process must organize government spending.

Monday, November 9, 2009

Animal spirits update

Data to October. Unemployment is assumed to climb to 11.1 percent in a year and then decline. I still expect “animal spirits” to climb up to about zero in 2012. The last couple of times they rose to zero from depressed levels in a presidential election year were 1972, followed by Nixon’s resignation, and 1976, followed by the electorate’s rejection of the Republicans. President Obama faces an ugly national mood.

Confidence will stagger upward till 2012 even if unemployment rises to 13 percent over coming quarters according to the “animal spirits” model.

The recession forecasting model, which forecast the last two recessions a year or more ahead in real time, well ahead of the consensus, sees no NBER-defined “recession” in the coming year. Output and demand aggregates can be expected to grow, although I think the collapse of consumption (November 2009 commentary) due to increased saving will crimp growth.

This economic situation is unfortunate in that a majority of people will retain their jobs and houses and will have very little incentive to adopt changes that appear risky or expensive to them. The process of marginalization of the lower strata that has been so evident over the post-Reagan years will become pronounced. I think any American can understand how this can happen. Most of us have little job security, much to lose, and there is no safety net to speak of. Congress’s recent extension of unemployment benefits only highlights this sad fact. Most of us have friends who have lost their jobs and are dealing with losing their houses and their family’s way of life in short order if adequate employment is not found. And of course our politicians will do nothing fundamental until events force their hand, in which case they are likely to serve the hand that feeds them.

This is what the late stages of failure of the social contract might look like. As regular readers know, I subscribe to the thesis of Strauss and Howe’s The Fourth Turning in this regard. It is a couple of economists’ melding of economic long wave theory with a theory of generational archetypes. Anglo-American history has been punctuated by crises about every saeculum, the length of a long human lifetime, or about 80 years, in a sequence like this: 1688, 1776, 1860, 1940,…2020?

The crisis will unfold with bankruptcies of the federal government, states, pensions, banks, and anything else that is insolvent and resistant to the Fed’s ministrations of reflation. Will Hank Paulson’s threat to impose martial law come true? Will the unemployed cease to pay taxes on whatever pick-up work they can get? Will a barter economy emerge? Will we all be living hand to mouth? Certainly there is another hard leg down coming—for most people, maybe not so much for the rich. One way to look at the past thirty years is to note that to counter a slowing economy the rich have simply increased their share of income and lowered the tax rates they pay on it. The fact the share of taxes paid by the rich has gone up only shows that inequality has increased faster than tax rates have gone down.

It is not necessary to comment on the obscene remarks by the head of Goldman Sachs alleging that he is “doing God’s work.”

See Robert Samuelson’s article on the IMF’s view of world fiscal policy. Note that even a sustained 6 percent inflation won’t solve our problem, even if it didn’t damage our currency.

I still expect the next debt-deflationary collapse to come in 2013 or 2014. There doesn’t seem to be much danger of inflation before then.

Thursday, November 5, 2009

Resistance for S&P 500 at 1121.44

Warning: this is research, not investment advice. You invest at your own risk.

A convincing clearing of 1121.44 will indicate the rally has another leg to run. Seasonality favors such a move, sentiment probably doesn’t (too bullish). If not this fall, this winter will see the final topping before the early decennial plunge.

Magical misdirection from the ruling class

Reading the summaries of the Treasury-blogger love-fest (see interfluidity) brings to mind some recent stuff I’ve read about magic, that it’s all about misdirection. Get the people looking in the wrong places and you can fool them every time.

The cause of our current collapse of effective demand, which is not going to go away soon (proof: consumption is falling 5-10 percentage points from 71 percent of GDP, and the government is too broke to make up the aggregate demand with government investment spending, not to mention that they’re too incompetent to do it, and private investment is still to scared to jump in) is not fundamentally too much debt, although that is a proximate cause, it is mal-distribution of income (and increasingly and massively so, of wealth).

Once the glorification of greed really got going 30 years ago under Reagan, the rich started to manipulate the system (taxes, incomes) more and more to their benefit, with the assent of the masses, who all expected to grab the gold ring themselves at some point. As I point here, as the rich started to pull away, everyone else took on too much debt to try to keep up. The way things are going, I am not alone in worrying about the US becoming a neo-feudal society; Emmanuel Saez, the establishment economics profession’s leading expert on income and wealth inequality, shares the concern. I qualify the profession because the best research on what’s actually happening has been coming from alternative sources for some time now, e.g., Robert Prechter’s book Conquering the Crash, which was early on the timing, as is so often the case, but got the big picture right, which is more than you can say for Bob Rubin, Larry Summers, or any of the other clowns in Washington with the possible exception of Ron Paul.

So all the talk about reforming regulation (Right! We’ll trust them to do their jobs next time?), putting in a systemic risk regulator (we already had one, called the Fed, totally compromised by Wall Street—they let the whole thing happen so the Wall Street bankers could get rich quick), about “too big too fail” and so on ad nauseum is pure misdirection, a shell game. So long as the crooks are running the show there will be no reform.

And why don’t shareholders, who by and large own the companies of America through their pension funds, and who, by and large, are not fat cats—why don’t the shareholders attack the obscene compensation the small club or CEOs and board members arrange for themselves? Peter Drucker wrote about “pension fund socialism” thirty years ago. It didn’t happen, did it? The pension administrators are in on the game. Peter, with whom I discussed this years ago, must be rolling over in his grave

Obscene greediness needs to become so socially unacceptable that its practitioners wither away. Or go away. And lots of luck trying to get your money out of the country.

This is why when I write to my elected representatives I stress that America is a fiscal basket case, and that we need to begin to practice triage, providing necessary human services—a poverty level dole, education and health care—to the unemployed and abandon all stupid imperial ambitions and obscene bail-outs for the well-heeled.

And for crying out loud, get the investment banks out of the Fed’s cookie jar. The carry trade that’s happening now is obscene beyond measure and “will not end well.”

Wednesday, November 4, 2009

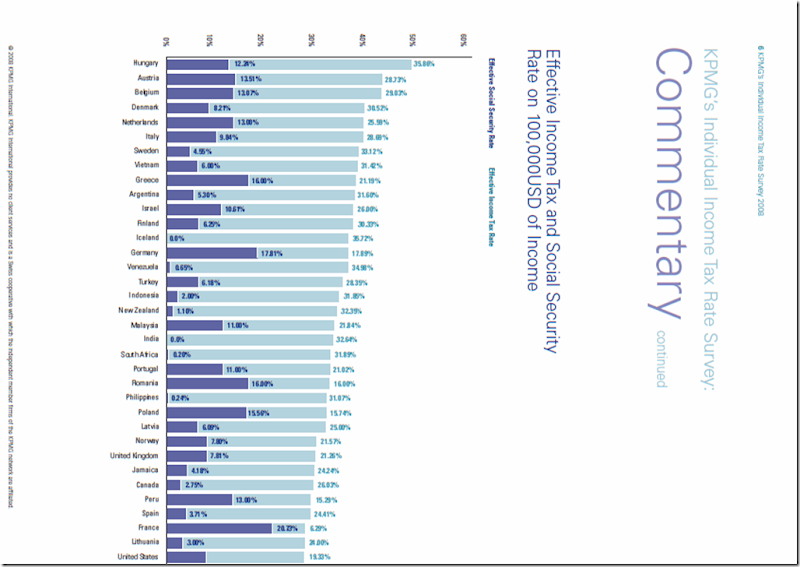

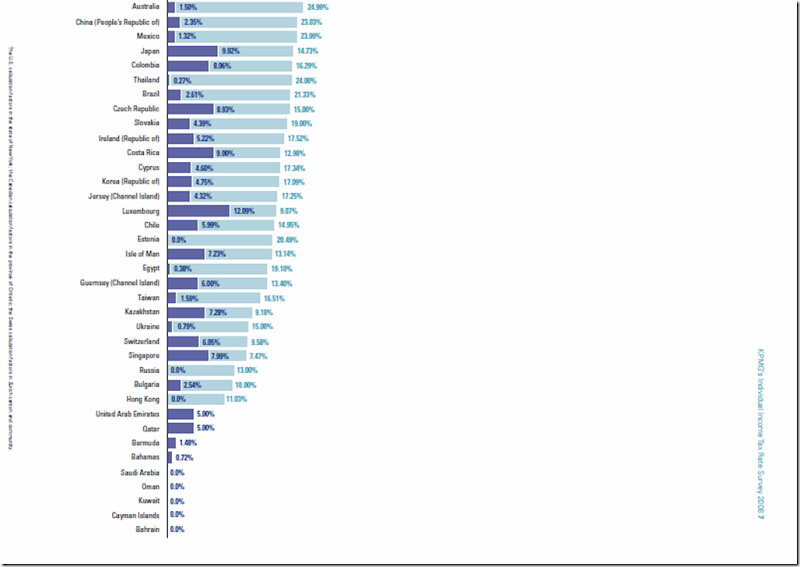

Are American income taxes high relative to other countries?

Not particularly, but Americans are not happy with what they’re getting for their money (unlike the Scandinavians, who are ever so happy, especially the Danish). Our government apparently does not serve the people.

Via: KPMG The presentation is confusing in that the green numbers to the right of the green bar are the effective income tax rate, not the magnitude of the green bar, which is the sum of income and social security taxes. The chart gives results for an income of USD100,000. Tax rates on incomes below USD50,000 are known to be quite low.

Monday, November 2, 2009

Debt deflation

Nice presentation on the unfolding of debt deflation from David Meier that, however, does not cut to the core problem that causes debt deflation and that makes the reflationist “solution” risible: we have too much debt. It’s the debt, stupid! Prudent lenders have always helped their borrowers by examining the cash flows of applicants and making sure that the credit extended isn’t going to put the borrower underwater. On the other hand, if you’re writing trash loans that you’re going to unload into a big Wall Street securitization that is going to get a triple-A credit rating from a rating agency paid by the investment bank floating the Structured Investment Vehicle (and possible taking a short position in it at the same time…), then… well let’s just say that isn’t banking, that’s fraud, and everyone loses except the Wall Street sharpies who invented the shell game and sold it to those bankers greedy enough to go for it (with full knowledge of what they were doing, IMHO—committing fraud to get obscenely rich quick). The borrower who also falls for the ruse then loses his or her house.

What is the solution to debt deflation? Restore honesty and transparency to the financial statements. Write off bad debts, get society back a level of indebtedness that it can handle. Provide a livable dole, health insurance and education to the people. Stop imperial overextension, stupid wars, excessive and corrupt government spending. Get real, in other words, about our fiscal position. America was the world’s greatest creditor in 1933; today America is the world’s greatest debtor. Reflation won’t work because any increase in interest rates given our debt load will cause interest payments to balloon to unmanageable levels faster than incomes can catch up.

Note that those who keep their jobs and houses don’t much get hurt in a debt deflation (see the comment from a friend of Jesse’s in Japan regarding their “lost decade”; turns out it wasn’t bad at all). The lucky employed can refinance at lower rates, and get more for their money at the market. Those who become collaterally unemployed through no fault of their own require social support, if our society believes we share a responsibility to care for one another. Seems to be an open question among those on the right; while the question I have about those on the left is whether they, like the Wall Street grifters, will pile too much debt on the American people.