Sometimes someone else, two people in this case, say it better. It is now clear that President Obama is a clever puppet of the ruling class, the military-industrial-financial complex. As regular readers know, our working hypothesis is that we’re on the leading edge of the ending of the American republic as we have known it since World War II (see this and this). What will come next, and how will it be achieved? Who will win, the ruling class or democracy? These are the questions of the next decade. Immediately, we need to raise marginal tax rates on incomes over $1 million to 90 percent to bring the ruling class down to earth before America is turned into a feudal state. But this is not likely. Our social contract is broken. Total upheaval is coming.

Why the U.S. Has Really Gone Broke [via mondediplo.com]

This is a difficult essay for an American of this generation to read, because we have grown up with the assumption that the security of the United States is intimately tied to massive amounts of spending for military preparedness. The first response to any essay such as this is often an emotional one: "What about the troops?"

It requires an effort to realize that the vast majority of this spending has absolutely nothing to do with what the troops want or need. The recent examples of the lack of adequate armor on vehicles carrying troops, to the abysmal conditions in the military hospital system, are more than just anomalies. The military industrial complex, of which we had been warned in the farewell address of Dwight Eisenhower, does not value the troops, the US citizen army, highly in its equations.

The United States has reached its limit. It can no longer aspire to be 'the world's policeman.' We are not able to do this and maintain a viable and healthy democracy at home. We are not protecting ourselves and our liberties; we are promoting the interests of pseudo-american global corporations around the world. As Mussolini observed, corporatism is fascism.

The global corporate complex, though nominally based in part in the US, exists for its own purposes, serves its own purposes, and consumes everything which we the American people hold most valuable: our lives, our liberties, and our pursuit of peace and happiness with justice for all.

"Some of the damage can never be rectified. There are, however, some steps that the U.S. urgently needs to take. These include reversing Bush's 2001 and 2003 tax cuts for the wealthy, beginning to liquidate our global empire of over 800 military bases, cutting from the defense budget all projects that bear no relationship to national security and ceasing to use the defense budget as a Keynesian jobs program. If we do these things we have a chance of squeaking by. If we don't, we face probable national insolvency and a long depression."

Why the U.S. Has Really Gone Broke

Chalmers Johnson

Le Monde Diplomatique

February, 2008

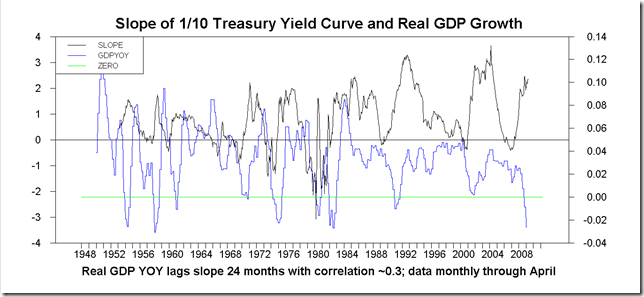

Global confidence in the US economy has reached zero, as was proved by last month’s stock market meltdown. But there is an enormous anomaly in the US economy above and beyond the subprime mortgage crisis, the housing bubble and the prospect of recession: 60 years of misallocation of resources, and borrowings, to the establishment and maintenance of a military-industrial complex as the basis of the nation’s economic life

The military adventurers in the Bush administration have much in common with the corporate leaders of the defunct energy company Enron. Both groups thought that they were the “smartest guys in the room” — the title of Alex Gibney’s prize-winning film on what went wrong at Enron. The neoconservatives in the White House and the Pentagon outsmarted themselves. They failed even to address the problem of how to finance their schemes of imperialist wars and global domination.

As a result, going into 2008, the United States finds itself in the anomalous position of being unable to pay for its own elevated living standards or its wasteful, overly large military establishment. Its government no longer even attempts to reduce the ruinous expenses of maintaining huge standing armies, replacing the equipment that seven years of wars have destroyed or worn out, or preparing for a war in outer space against unknown adversaries. Instead, the Bush administration puts off these costs for future generations to pay or repudiate. This fiscal irresponsibility has been disguised through many manipulative financial schemes (causing poorer countries to lend us unprecedented sums of money), but the time of reckoning is fast approaching.

There are three broad aspects to the US debt crisis.

First, in the current fiscal year (2008) we are spending insane amounts of money on “defence” projects that bear no relation to the national security of the US. We are also keeping the income tax burdens on the richest segment of the population at strikingly low levels.

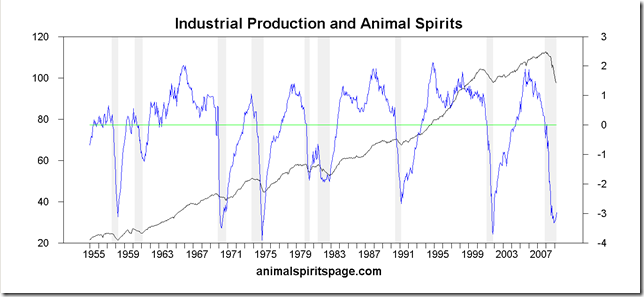

Second, we continue to believe that we can compensate for the accelerating erosion of our base and our loss of jobs to foreign countries through massive military expenditures — “military Keynesianism” (which I discuss in detail in my book Nemesis: The Last Days of the American Republic). By that, I mean the mistaken belief that public policies focused on frequent wars, huge expenditures on weapons and munitions, and large standing armies can indefinitely sustain a wealthy capitalist economy. The opposite is actually true.

Third, in our devotion to militarism (despite our limited resources), we are failing to invest in our social infrastructure and other requirements for the long-term health of the US. These are what economists call opportunity costs, things not done because we spent our money on something else. Our public education system has deteriorated alarmingly. We have failed to provide health care to all our citizens and neglected our responsibilities as the world’s number one polluter. Most important, we have lost our competitiveness as a manufacturer for civilian needs, an infinitely more efficient use of scarce resources than arms manufacturing.

Fiscal disaster

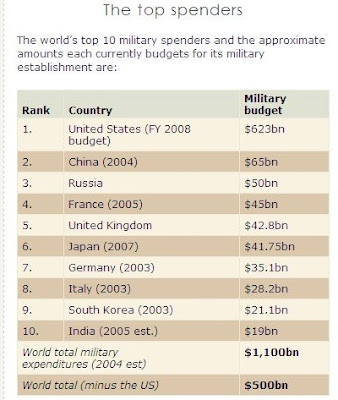

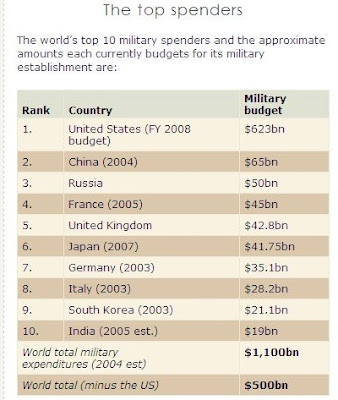

It is virtually impossible to overstate the profligacy of what our government spends on the military. The Department of Defense’s planned expenditures for the fiscal year 2008 are larger than all other nations’ military budgets combined. The supplementary budget to pay for the current wars in Iraq and Afghanistan, not part of the official defence budget, is itself larger than the combined military budgets of Russia and China. Defence-related spending for fiscal 2008 will exceed $1 trillion for the first time in history. The US has become the largest single seller of arms and munitions to other nations on Earth. Leaving out President Bush’s two on-going wars, defence spending has doubled since the mid-1990s. The defence budget for fiscal 2008 is the largest since the second world war.

Before we try to break down and analyse this gargantuan sum, there is one important caveat. Figures on defence spending are notoriously unreliable. The numbers released by the Congressional Reference Service and the Congressional Budget Office do not agree with each other. Robert Higgs, senior fellow for political economy at the Independent Institute, says: “A well-founded rule of thumb is to take the Pentagon’s (always well publicised) basic budget total and double it” (1). Even a cursory reading of newspaper articles about the Department of Defense will turn up major differences in statistics about its expenses. Some 30-40% of the defence budget is “black”,” meaning that these sections contain hidden expenditures for classified projects.

There is no possible way to know what they include or whether their total amounts are accurate.

There are many reasons for this budgetary sleight-of-hand — including a desire for secrecy on the part of the president, the secretary of defence, and the military-industrial complex — but the chief one is that members of Congress, who profit enormously from defence jobs and pork-barrel projects in their districts, have a political interest in supporting the Department of Defense. In 1996, in an attempt to bring accounting standards within the executive branch closer to those of the civilian economy, Congress passed the Federal Financial Management Improvement Act. It required all federal agencies to hire outside auditors to review their books and release the results to the public. Neither the Department of Defense, nor the Department of Homeland Security, has ever complied. Congress has complained, but not penalised either department for ignoring the law. All numbers released by the Pentagon should be regarded as suspect.

In discussing the fiscal 2008 defence budget, as released on 7 February 2007, I have been guided by two experienced and reliable analysts: William D Hartung of the New America Foundation’s Arms and Security Initiative (2) and Fred Kaplan, defence correspondent for Slate.org (3). They agree that the Department of Defense requested $481.4bn for salaries, operations (except in Iraq and Afghanistan), and equipment. They also agree on a figure of $141.7bn for the “supplemental” budget to fight the global war on terrorism — that is, the two on-going wars that the general public may think are actually covered by the basic Pentagon budget. The Department of Defense also asked for an extra $93.4bn to pay for hitherto unmentioned war costs in the remainder of 2007 and, most creatively, an additional “allowance” (a new term in defence budget documents) of $50bn to be charged to fiscal year 2009. This makes a total spending request by the Department of Defense of $766.5bn.

But there is much more. In an attempt to disguise the true size of the US military empire, the government has long hidden major military-related expenditures in departments other than Defense. For example, $23.4bn for the Department of Energy goes towards developing and maintaining nuclear warheads; and $25.3bn in the Department of State budget is spent on foreign military assistance (primarily for Israel, Saudi Arabia, Bahrain, Kuwait, Oman, Qatar, the United Arab Republic, Egypt and Pakistan). Another $1.03bn outside the official Department of Defense budget is now needed for recruitment and re-enlistment incentives for the overstretched US military, up from a mere $174m in 2003, when the war in Iraq began. The Department of Veterans Affairs currently gets at least $75.7bn, 50% of it for the long-term care of the most seriously injured among the 28,870 soldiers so far wounded in Iraq and 1,708 in Afghanistan. The amount is universally derided as inadequate. Another $46.4bn goes to the Department of Homeland Security.

Missing from this compilation is $1.9bn to the Department of Justice for the paramilitary activities of the FBI; $38.5bn to the Department of the Treasury for the Military Retirement Fund; $7.6bn for the military-related activities of the National Aeronautics and Space Administration; and well over $200bn in interest for past debt-financed defence outlays. This brings US spending for its military establishment during the current fiscal year, conservatively calculated, to at least $1.1 trillion.

Military Keynesianism

Such expenditures are not only morally obscene, they are fiscally unsustainable. Many neo-conservatives and poorly informed patriotic Americans believe that, even though our defence budget is huge, we can afford it because we are the richest country on Earth. That statement is no longer true. The world’s richest political entity, according to the CIA’s World Factbook, is the European Union. The EU’s 2006 GDP was estimated to be slightly larger than that of the US. Moreover, China’s 2006 GDP was only slightly smaller than that of the US, and Japan was the world’s fourth richest nation.

A more telling comparison that reveals just how much worse we’re doing can be found among the current accounts of various nations. The current account measures the net trade surplus or deficit of a country plus cross-border payments of interest, royalties, dividends, capital gains, foreign aid, and other income. In order for Japan to manufacture anything, it must import all required raw materials. Even after this incredible expense is met, it still has an $88bn per year trade surplus with the US and enjoys the world’s second highest current account balance (China is number one). The US is number 163 — last on the list, worse than countries such as Australia and the UK that also have large trade deficits. Its 2006 current account deficit was $811.5bn; second worst was Spain at $106.4bn. This is unsustainable.

It’s not just that our tastes for foreign goods, including imported oil, vastly exceed our ability to pay for them. We are financing them through massive borrowing. On 7 November 2007, the US Treasury announced that the national debt had breached _$9 trillion for the first time. This was just five weeks after Congress raised the “debt ceiling” to $9.815 trillion. If you begin in 1789, at the moment the constitution became the supreme law of the land, the debt accumulated by the federal government did not top $1 trillion until 1981. When George Bush became president in January 2001, it stood at approximately $5.7 trillion. Since then, it has increased by 45%. This huge debt can be largely explained by our defence expenditures.

Our excessive military expenditures did not occur over just a few short years or simply because of the Bush administration’s policies. They have been going on for a very long time in accordance with a superficially plausible ideology, and have now become so entrenched in our democratic political system that they are starting to wreak havoc. This is military Keynesianism — the determination to maintain a permanent war economy and to treat military output as an ordinary economic product, even though it makes no contribution to either production or consumption.

This ideology goes back to the first years of the cold war. During the late 1940s, the US was haunted by economic anxieties. The great depression of the 1930s had been overcome only by the war production boom of the second world war. With peace and demobilisation, there was a pervasive fear that the depression would return. During 1949, alarmed by the Soviet Union’s detonation of an atomic bomb, the looming Communist victory in the Chinese civil war, a domestic recession, and the lowering of the Iron Curtain around the USSR’s European satellites, the US sought to draft basic strategy for the emerging cold war. The result was the militaristic National Security Council Report 68 (NSC-68) drafted under the supervision of Paul Nitze, then head of the Policy Planning Staff in the State Department. Dated 14 April 1950 and signed by President Harry S Truman on 30 September 1950, it laid out the basic public economic policies that the US pursues to the present day.

In its conclusions, NSC-68 asserted: “One of the most significant lessons of our World War II experience was that the American economy, when it operates at a level approaching full efficiency, can provide enormous resources for purposes other than civilian consumption while simultaneously providing a high standard of living” (4).

In its conclusions, NSC-68 asserted: “One of the most significant lessons of our World War II experience was that the American economy, when it operates at a level approaching full efficiency, can provide enormous resources for purposes other than civilian consumption while simultaneously providing a high standard of living” (4).

With this understanding, US strategists began to build up a massive munitions industry, both to counter the military might of the Soviet Union (which they consistently overstated) and also to maintain full employment, as well as ward off a possible return of the depression. The result was that, under Pentagon leadership, entire new industries were created to manufacture large aircraft, nuclear-powered submarines, nuclear warheads, intercontinental ballistic missiles, and surveillance and communications satellites. This led to what President Eisenhower warned against in his farewell address of 6 February 1961: “The conjunction of an immense military establishment and a large arms industry is new in the American experience” — the military-industrial complex.

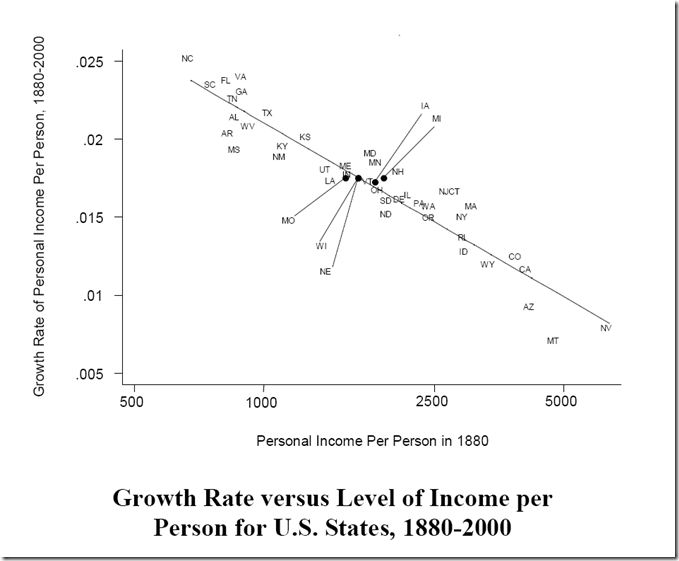

By 1990 the value of the weapons, equipment and factories devoted to the Department of Defense was 83% of the value of all plants and equipment in US manufacturing. From 1947 to 1990, the combined US military budgets amounted to $8.7 trillion. Even though the Soviet Union no longer exists, US reliance on military Keynesianism has, if anything, ratcheted up, thanks to the massive vested interests that have become entrenched around the military establishment. Over time, a commitment to both guns and butter has proven an unstable configuration. Military industries crowd out the civilian economy and lead to severe economic weaknesses. Devotion to military Keynesianism is a form of slow economic suicide.

Higher spending, fewer jobs

On 1 May 2007, the Center for Economic and Policy Research of Washington, DC, released a study prepared by the economic and political forecasting company Global Insight on the long-term economic impact of increased military spending. Guided by economist Dean Baker, this research showed that, after an initial demand stimulus, by about the sixth year the effect of increased military spending turns negative. The US economy has had to cope with growing defence spending for more than 60 years. Baker found that, after 10 years of higher defence spending, there would be 464,000 fewer jobs than in a scenario that involved lower defence spending.

Baker concluded: “It is often believed that wars and military spending increases are good for the economy. In fact, most economic models show that military spending diverts resources from productive uses, such as consumption and investment, and ultimately slows economic growth and reduces employment” (5).

These are only some of the many deleterious effects of military Keynesianism.

It was believed that the US could afford both a massive military establishment and a high standard of living, and that it needed both to maintain full employment. But it did not work out that way. By the 1960s it was becoming apparent that turning over the nation’s largest manufacturing enterprises to the Department of Defense and producing goods without any investment or consumption value was starting to crowd out civilian economic activities. The historian Thomas E Woods Jr observes that, during the 1950s and 1960s, between one-third and two-thirds of all US research talent was siphoned off into the military sector (6). It is, of course, impossible to know what innovations never appeared as a result of this diversion of resources and brainpower into the service of the military, but it was during the 1960s that we first began to notice Japan was outpacing us in the design and quality of a range of consumer goods, including household electronics and automobiles.

Can we reverse the trend?

Nuclear weapons furnish a striking illustration of these anomalies. Between the 1940s and 1996, the US spent at least $5.8 trillion on the development, testing and construction of nuclear bombs. By 1967, the peak year of its nuclear stockpile, the US possessed some 32,500 deliverable atomic and hydrogen bombs, none of which, thankfully, was ever used. They perfectly illustrate the Keynesian principle that the government can provide make-work jobs to keep people employed. Nuclear weapons were not just America’s secret weapon, but also its secret economic weapon. As of 2006, we still had 9,960 of them. There is today no sane use for them, while the trillions spent on them could have been used to solve the problems of social security and health care, quality education and access to higher education for all, not to speak of the retention of highly-skilled jobs within the economy.

The pioneer in analysing what has been lost as a result of military Keynesianism was the late Seymour Melman (1917-2004), a professor of industrial engineering and operations research at Columbia University. His 1970 book, Pentagon Capitalism: The Political Economy of War, was a prescient analysis of the unintended consequences of the US preoccupation with its armed forces and their weaponry since the onset of the cold war. Melman wrote: “From 1946 to 1969, the United States government spent over $1,000bn on the military, more than half of this under the Kennedy and Johnson administrations — the period during which the [Pentagon-dominated] state management was established as a formal institution. This sum of staggering size (try to visualize a billion of something) does not express the cost of the military establishment to the nation as a whole. The true cost is measured by what has been foregone, by the accumulated deterioration in many facets of life, by the inability to alleviate human wretchedness of long duration.”

In an important exegesis on Melman’s relevance to the current American economic situation, Thomas Woods writes: “According to the US Department of Defense, during the four decades from 1947 through 1987 it used (in 1982 dollars) $7.62 trillion in capital resources. In 1985, the Department of Commerce estimated the value of the nation’s plant and equipment, and infrastructure, at just over _$7.29 trillion… The amount spent over that period could have doubled the American capital stock or modernized and replaced its existing stock” (7).

The fact that we did not modernise or replace our capital assets is one of the main reasons why, by the turn of the 21st century, our manufacturing base had all but evaporated. Machine tools, an industry on which Melman was an authority, are a particularly important symptom. In November 1968, a five-year inventory disclosed “that 64% of the metalworking machine tools used in US industry were 10 years old or older. The age of this industrial equipment (drills, lathes, etc.) marks the United States’ machine tool stock as the oldest among all major industrial nations, and it marks the continuation of a deterioration process that began with the end of the second world war. This deterioration at the base of the industrial system certifies to the continuous debilitating and depleting effect that the military use of capital and research and development talent has had on American industry.”

Nothing has been done since 1968 to reverse these trends and it shows today in our massive imports of equipment — from medical machines like _proton accelerators for radiological therapy (made primarily in Belgium, Germany, and Japan) to cars and trucks.

Our short tenure as the world’s lone superpower has come to an end. As Harvard economics professor Benjamin Friedman has written: “Again and again it has always been the world’s leading lending country that has been the premier country in terms of political influence, diplomatic influence and cultural influence. It’s no accident that we took over the role from the British at the same time that we took over the job of being the world’s leading lending country. Today we are no longer the world’s leading lending country. In fact we are now the world’s biggest debtor country, and we are continuing to wield influence on the basis of military prowess alone” (8).

Some of the damage can never be rectified. There are, however, some steps that the US urgently needs to take. These include reversing Bush’s 2001 and 2003 tax cuts for the wealthy, beginning to liquidate our global empire of over 800 military bases, cutting from the defence budget all projects that bear no relationship to national security and ceasing to use the defence budget as a Keynesian jobs programme.

If we do these things we have a chance of squeaking by. If we don’t, we face probable national insolvency and a long depression.

(1) Robert Higgs, “The Trillion-Dollar Defense Budget Is Already Here” , The Independent Institute, 15 March 2007, http://www.independent.org/newsroom ...

(2) William D Hartung, “Bush Military Budget Highest Since WWII”, 10 February 2007, http://www.commondreams.org/views07 ...

(3) Fred Kaplan, “It’s Time to Sharpen the Scissors”, 5 February 2007, http://www.slate.com/id/2159102/pag ...

(4) See http://www.encyclopedia.com/doc/1G1 ...

(5) Center for Economic and Policy Research, 1 May 2007, http://www.cepr.net/content/view/11 ...

(6) Thomas E Woods, “What the Warfare State Really Costs”, http://www.lewrockwell.com/woods/wo ...

(7) Thomas E Woods, Ibid.

(8) John F Ince, “Think the Nation’s Debt Doesn’t Affect You? Think Again”, 20 March 2007, http://www.alternet.org/story/49418 /