How many times have you heard that “the banks have stopped lending—something has to be done to get the toxic assets off their books”?

There may be a few large banks that have a load of crap on their books, who have stopped lending and have their hands out to the government for a bailout, but the effect does not extend to the industry. The industry slowdown in lending is a cyclical phenomenon.

I decided to go the Federal Reserve Bank of St. Louis’s FRED database to see what the data says. I’m not going to burn up a lot of bandwidth (the link above takes you to the page the graphs below come from—you can customize them to be levels or year-over-year percentage changes or other forms):

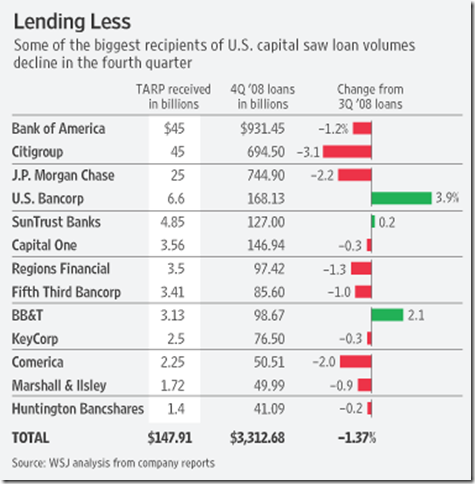

Note that commercial and industrial loan volume fell after the last two recessions were over, and can be expected to do so again in the current climate of deleveraging. You can almost tell from their behavior in the fourth quarter of 2008 who’s got crap on their books:

So the experience of the Summers-Geithner plan will likely be this: banks will reduce their lending after getting the new bailout money, some private equity-hedge fund types will get richer, and American taxpayers will have a bigger stone on their backs.

If a Treasury auction fails and short-term rates have to rise after Bernanke has blown yet more high-powered money into the long end of the yield curve—in other words, if the yield curve inverts between now and, say, November 2011—we can safely predict that Obama will be a one-term president. Our “animal spirits” forecasting model will give ample warning of the next recession, as it appears to be calling some sort of recovery pretty well about now.

No comments:

Post a Comment