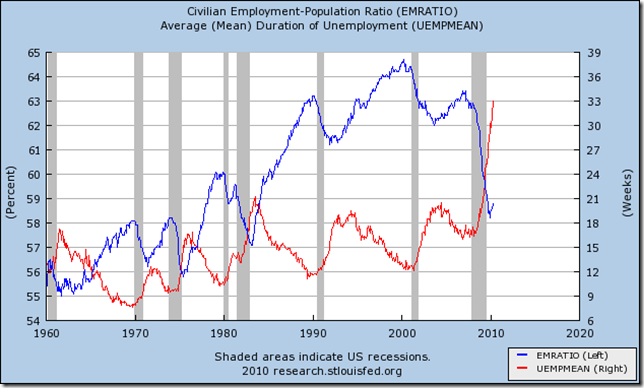

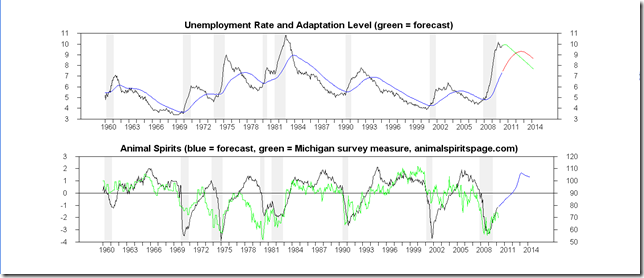

The primary insight driving the business cycle forecasts on this web site is that recessions and depressions are primarily psychologically driven collapses of demand caused by conditions in the labor market as measured by the unemployment rate becoming worse than what people are accustomed to over the past four years.

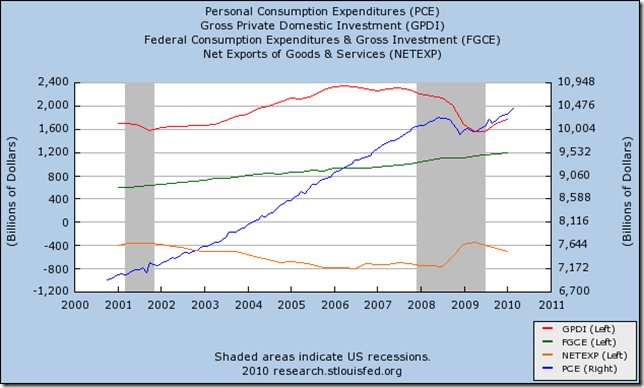

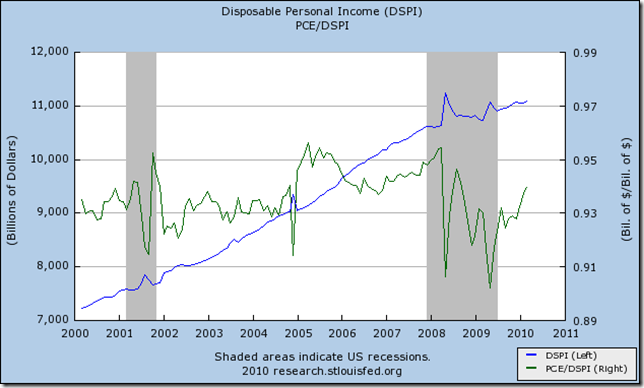

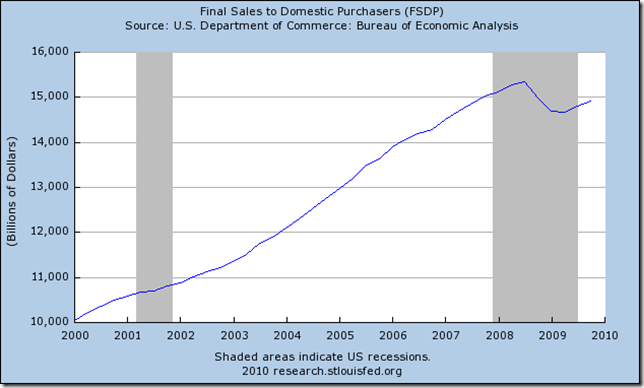

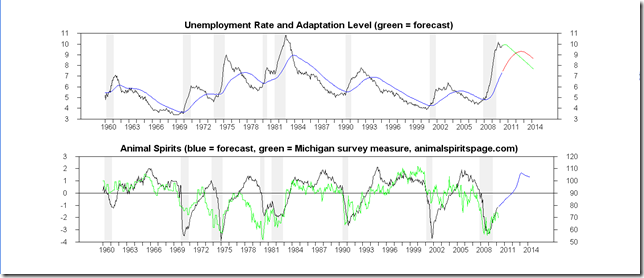

The increase in the unemployment rate caused mild downtick in the confidence of Americans, but “animal spirits” are still chugging upward toward the next cyclical high in about 2012-2013. There is no recession in sight, although demand is fundamentally unbalanced by the extreme inequality in incomes and wealth, and will probably enter a sustained collapse in the next downturn due to debt deflation.

“Animal spirits” is given by A = – (U-UMEAN)/Sigma(U). U is still above adaptation level, signifying that “animal spirits” are depressed. Given my freehand forecast of unemployment, “animal spirits” should become marginally positive at just about the time of the next presidential election. Although it is too far out to forecast with a high degree of confidence, the next recession should arrive in 2013-2014. I expect this collapse to be a full-fledged depression. This will begin the final stage of Strauss and Howe’s generational crisis; it will begin the long-wave winter’s coldest days.

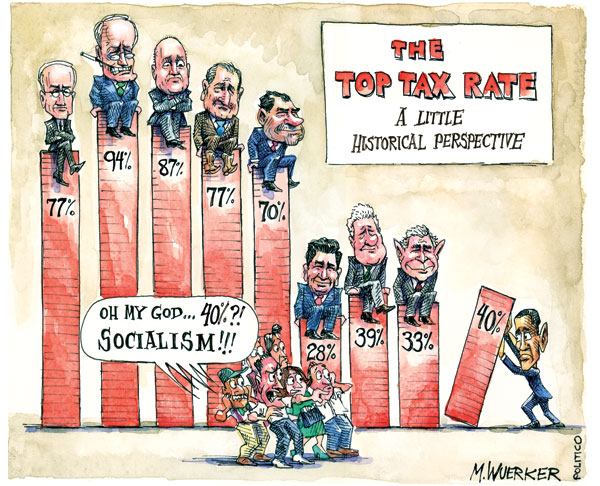

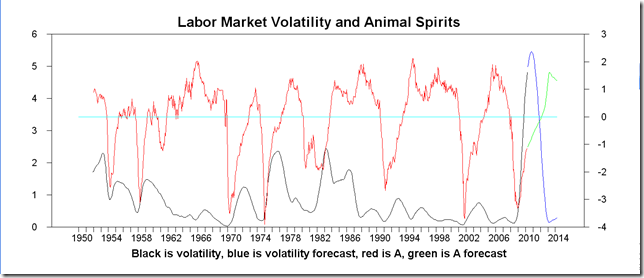

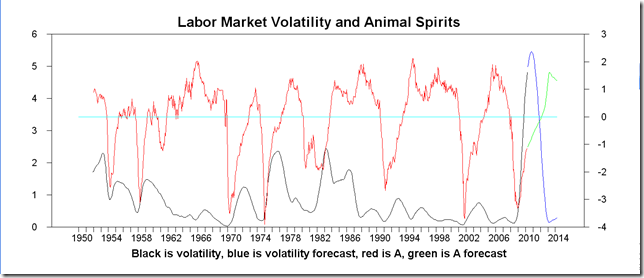

Unemployment volatility will probably peak soon, and this will contribute to the rising good feelings over the next couple of years. The stability will be short-lived, and garnered at the government’s expense. It is well known that the government recently has been spending more on extended unemployment benefits than it has on federal salaries. In the final crisis the government’s access to funds will dry up. The markets will refuse to lend, and the rich will tell their Congress people they won’t pay any more taxes (although marginal tax rates are lower now than at when Ronald Reagan reigned). Greed has triumphed and continue to do so. The rich would rather let the system collapse, and try to take their money elsewhere, than prop up the government once it no longer serves their purposes. IMHO.

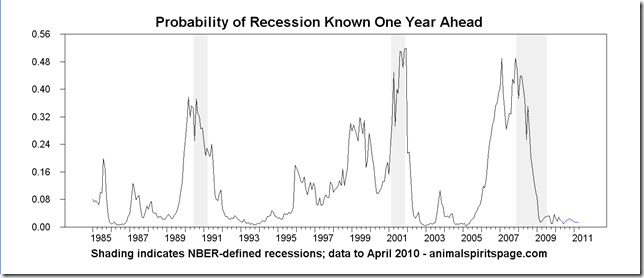

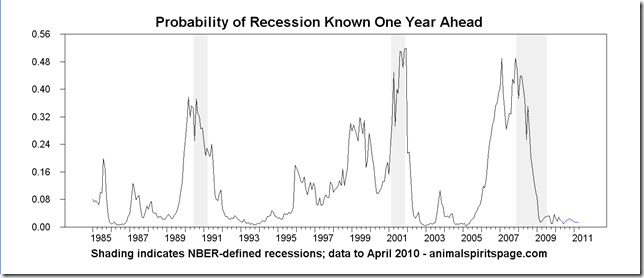

The recession forecasting model featured on this web site has accurately made real-time calls of the past two cycles (2001 and 2007-2009, both the collapses and the recoveries). There are many similar models using the yield curve; the innovation here is “animal spirits.” The model shows no recession in sight over the next year.

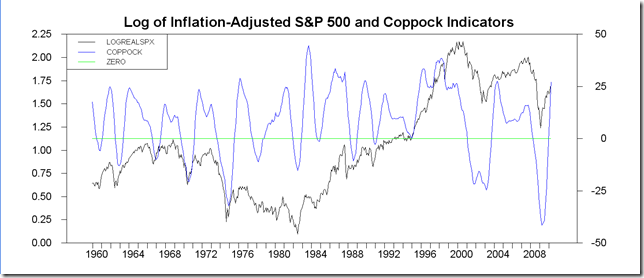

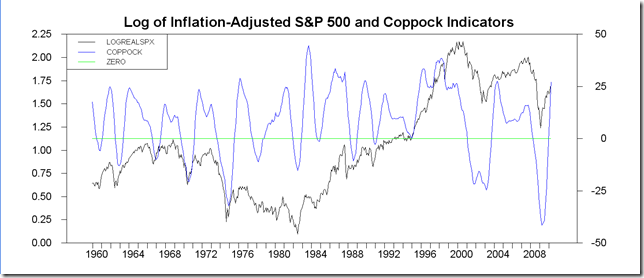

The stock market continues to look like a very dangerous place to be.

The Coppock momentum oscillator, a bottom indicator, having sent a great buy signal in early 2009, is at elated levels, suggesting the market rally has some continuing momentum. But the big picture looks like the market is approaching the crest of a B wave on its way down to a C big bottom. Gold has been killing the stock for ten years and may continue to do so.