Here is a cogent exposé of America’s bankrupt value system. And even America’s poor have been taught to blame themselves (Low incomes make poor more conservative, study finds - physorg). It is instructive that it is the “liberal”—and often bellicose—Paul Krugman gets the honor of being shredded here.

Reconsidering Japan and Reconsidering Paul Krugman

Sunday 12 December 2010

by: Steven Hill, t r u t h o u t | News Analysis

Shibuya, Tokyo. (Photo: - reuben -)

The New York Times is doing a series on Japan, which the Times describes as an examination of "the effects on Japanese society of two decades of economic stagnation and declining prices." Reading the series is about as cheery a task as rubbernecking at a car wreck on I-95, but, unfortunately, the Times series simply repeats the "conventional wisdom" about Japan put out by the same economic experts who missed an $8 trillion housing bubble in the United States, and, in fact, have been wrong on most of the big economic issues over the past two decades.

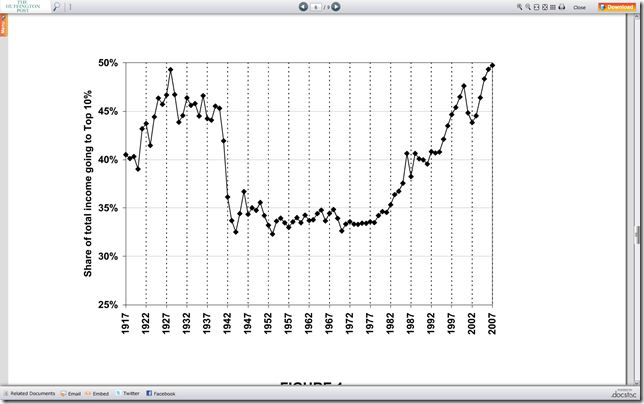

Look at it this way: In the midst of the Great Recession, the United States is suffering through nearly 10 percent unemployment and 50 million people without health insurance. A new report has found over 14 percent of Americans living below the poverty line, including 20 percent of children and 23 percent of seniors, the highest numbers since President Lyndon Johnson's War on Poverty. That's in addition to declining prospects for the middle class and a general increase in economic insecurity.

How, then, should we regard a country that has 5 percent unemployment, health care for all of its people, the lowest income inequality and is one of the world's leading exporters? This country also scores high on life expectancy, low on infant mortality, at the top in literacy, and low on crime, incarceration, homicides, mental illness and drug abuse. It also has a low rate of carbon emissions and is doing its part to reduce global warming. In all of these categories, this particular country beats both the US and China by a country mile.

Doesn't that sound like a country from which Americans might learn a thing or two about how to get out of the mud hole in which we are stuck?

Not if that place is Japan. During and before the current economic crisis, few countries have been vilified as an economic basket case as much as the Land of the Rising Sun. Google "Japan and its economy" and you will get numerous hits about Japan's allegedly sclerotic economy, its zombie banks, its deflation and slow economic growth. This malaise has even been called "Japan syndrome," a monicker that sounds like a disease to warn policymakers - as in, "You don't want to end up like Japan."

No one has been more influential in defining this narrative than New York Times columnist and Nobel-Prize-winning economist Paul Krugman. Throughout the 1990s, and still occasionally today, Krugman has skewered Japan's economy and its leaders. In the late 1990s, Krugman wrote a series of gloom-and-doom articles, complete with equations, theories and titles like "Japan's Trap" and "Setting Sun," bluntly stating: "The state of Japan is a scandal, an outrage, a reproach. It is operating far below its productive capacity, simply because its consumers and investors do not spend enough."

Krugman was commenting on Japan's so-called "lost decade" of the 1990s, when the Japanese economy was considered sluggish and underperforming. But let's look at some of the Japanese metrics during that time. Throughout the 1990s, the Japanese unemployment rate was - ready for this? - about three percent. Not 30 percent, that's three percent: about half the US unemployment rate at the time. During that allegedly "lost decade," the Japanese also had universal health care, less inequality, the highest life expectancy and low rates of infant mortality, crime and incarceration. Americans should be so lucky as to experience a Japanese-style lost decade.

Reopening the case of Japan raises some important questions. How do economists such as Krugman decide what to value and prioritize, or what to measure? What is an economy for? To produce the prosperity, security and services that people need? Or to satisfy economists and their equations, theories and models? For too many economic Cassandras, if their spreadsheet columns don't add up, if the surplus nations don't balance the deficit nations and the supply doesn't meet the demand, then disaster surely awaits.

Krugman has gone on the attack again recently, this time in a debate over fiscal stimulus versus deficit reduction as a strategy toward economic recovery. As a stimulus hawk, he has written that the Germans - one of the few economic bright spots in a struggling global economy - "seem to be getting their talking points from the collected speeches of Herbert Hoover." He is criticizing Germany for the same reason he criticizes Japan; he says the country is not spending or consuming enough to stimulate its economy.

But what exactly are the Germans or the Japanese supposed to buy more of? Surely Krugman has visited both countries, and it's plainly evident that neither are lacking in any material goods or modern trinkets to speak of. Americans are the only ones who seem to think they need three refrigerators, four televisions and a car for everyone in the household. Too many economists have yet to figure out that it is this consumer-driven economic model that has crashed and burned.

Japan's economy has been and remains successful. Germany's is thriving as well. Unlike the trickle-down US economy, Japan and Germany have reached an economic steady state in which they don't need roaring growth rates to provide for their people, and here's why: they are better at sharing the wealth produced by their economies to foster a more broadly shared prosperity among their populaces.

But for the economic experts, apparently, it doesn't matter if people's needs are being met; what matters is whether their theories and equations balance. It's no different with media outlets such as The New York Times, which has been getting it wrong for years – they also missed an $8 trillion housing bubble, as well as the lie on weapons of mass destruction in Iraq (prompting the Times to issue an unprecedented mea culpa to their readers). In the same way, the Times and the rest of the media have been missing the real story about what is occurring in Japan and Europe.

As a result, there is a commonsense aspect to this story that gets lost amid the rhetoric and the headlines. Two lessons of our times are that economic bubbles eventually burst, and that the environmental consequences of unbridled growth in this age of global warming are severe. The world needs to figure out how advanced economies can provide for their people without relying on roaring growth rates driven by asset bubbles. If consumer-driven growth was the order of the day in the post-World War II era, going forward it is going to be steady-state economic growth - growing not too fast, but not too slowly - and learning to do more with less. Yet stimulus hawks like Krugman don't seem to get this; they want to crank the "growth machine" into full gear with huge government stimulus spending.

But the real game is no longer strictly about economic growth; it's also about sustainability. The era of US-style trickle-down economies is over for wealthy countries because trickle-down is neither economically sound nor ecologically sustainable. The developed nations must lead the way towards a different path of development. This is not an easy challenge, yet it is the course that Japan and Germany have chosen. If the US didn't have such a trickle-down economy that has produced so much inequality - if it was better at sharing its wealth - perhaps it wouldn't need so much fiscal stimulus and growth.

At the recent G-20 meeting in Seoul, South Korea, German Chancellor Angela Merkel rebuffed President Barack Obama and Treasury Secretary Timothy Geithner's appeals to go back to the toxic economics of Wall Street capitalism. Said Merkel, "It is essential to return to a sustainable growth path." One cause of the crisis, she said, was that "we did not have sustainable growth. In many countries growth was built on debt and [speculative] bubbles."

Her finance minister, Wolfgang Schauble, was even more blunt. He described American policy as "clueless" and said the American growth model is stuck in a deep crisis. "The USA lived off credit for too long, inflated its financial sector massively and neglected its industrial base." Catch the irony: Germany - previously sneered at by US pundits for its "weak and sclerotic" economy - is lecturing America about how to grow our economy. Given Germany's 6.7 percent unemployment (compared to 9.6 percent in the US) and an impressive record at manufacturing things that the rest of the world wants to buy, the Obama administration, as well as Paul Krugman, should be listening attentively.

This work by Truthout is licensed under a Creative Commons Attribution-Noncommercial 3.0 United States License.