http://research.stlouisfed.org/fred2/graph/?s%5B1%5D%5Bid%5D=EMRATIO

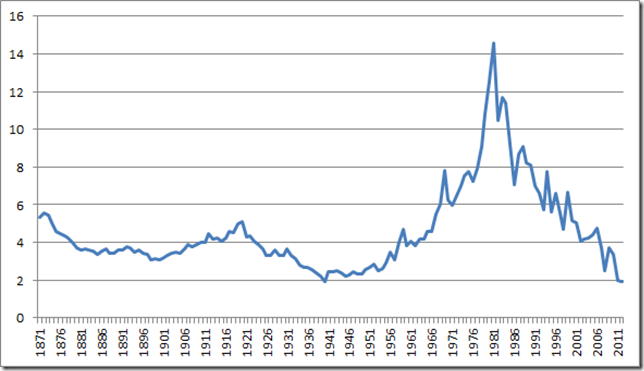

The Great Debt Illusion began with "Supply Side Economics" in Reagan I, a con game that provided definitive proof that tax cuts for the rich do not provide growth that "trickles down" to everyone else. Here's the picture of federal debt:

http://research.stlouisfed.org/fred2/series/GFDEGDQ188S

Notice where the take-off occurs. Add to this insight that it was a Republican, Nixon, who took us off the gold standard in 1971, setting the stage for massive monetization of federal debt, and it is hard not to conclude that the modern-era Republicans are the most fiscally-irresponsible party in American history. All their talk of austerity is in fact mere mean-spiritedness. This is the distinguishing characteristic of the Republican Party today.

Today, the House Republicans take pride in being the most hard-hearted folks in the country, proving it by taking their greedy frustration out on women and children by cutting funding for food stamps.

This is a party without a future.

On the employment issue: in the Sixties, it was possible to support a family on one (male) income. Not so today except for the top few percent. Multi-generational living is a growing trend, and maybe not such a bad one if it brings families closer together.

Shalom.