http://theautomaticearth.blogspot.com/2011/12/december-29-2011-trends-2012-end-of.html

From those to whom much has been given, from them much shall be expected. -- Luke

Thursday, December 29, 2011

The Automatic Earth

http://theautomaticearth.blogspot.com/2011/12/december-29-2011-trends-2012-end-of.html

Thursday, December 22, 2011

Ron Paul for president

Absolute disgust with the state of America fills the writers in the blogosphere that I read (most of it referenced to the left, but I also recommend www.theburningplatform.com ‘s last few posts).

I share it. And after considerable thought about the possible downside risks, I have come to support Ron Paul for president. He is the only candidate who is uncompromised.

I supported Obama, despite the Clinton’s warnings that he was not authentic, and have come to view him as a servant of the ruling class.

On the issue of class: class exists, always has. When one class rigs the system for its own benefit, and another class resents it and fights back, that’s justified.

The corporate oligarchy has assumed control of the world’s capital, not as owners, but as pirates looting the treasuries of their corporations, and when those run dry, the taxpayers.

I hesitated a long time to support Ron Paul because he would not regulate the markets, and I feared that complete lack of regulation would collapse the economy. But we have regulation now that has been captured by the regulated to worse effect than no regulation at all (cf. MF Global; watch this). Our financial markets are rigged, just like the big corporations that are decimating small business. Wall Street bankers whose banks would have failed without bailouts of taxpayer funds paid themselves their biggest bonuses ever after being bailed out. They know their time is running short.

Dr. Paul is a physician. I trust him to take care of the innocent people who are being hurt by the collapse of our system.

The other cause requiring immediate support is an amendment to the Constitution to undo the Citizens vs. U.S. decision that declared “corporations are people” when it comes to funding—anonymously even—political campaigns. I view this decision as treasonous, as the source of such funding could be coming from anywhere in the world.

And finally, until the dominant mythology of our age—neoclassical economics—is replaced by an understanding of the prime true driver of human welfare, namely, living a fully connected life in a just society (one that the empirical results suggests will have considerably less inequality than America currently suffers under)—until the pernicious mythology of Economics is cast aside, we will suffer further at the hands of an oligarchy armed with bogus ideas of entitlement to justify their greed. See Wilkinson talk at ted.org for the effects of inequality on human welfare.

Happy Chanukah and Merry Christmas, all.

Saturday, December 10, 2011

Secular exhilaration! take 2

So what happened to the stock market in the early ‘Seventies episode, you might ask.

The market peaked right at the New Year of 1973. By analogy we might expect the same for 2012. From the previous post note the leading nature of the Michigan Sentiment series, which recently had its own pop to the upside. Expect some delusional holiday cheer out of Old Europe to keep the fake rally going, but after New Year’s Eve and the first few trading days of 2012, it might be time to say “risk off.”

N.B. This is research, not investment advice. You invest at your own risk, unlike the Wall Street banks, who also invest at your risk. Just wait until the Euro sovereign CDSs come home to roost, how the Wall Street bankers come to Uncle Bernie with their hands out (Uncle Sam doesn’t have the cojones to give them any more money, afraid of being tarred and feathered).

Friday, December 2, 2011

Secular exhilaration!

Let the secular exhilaration begin!

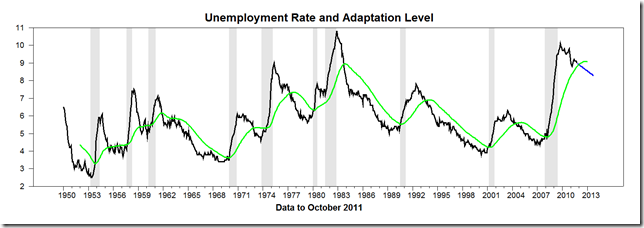

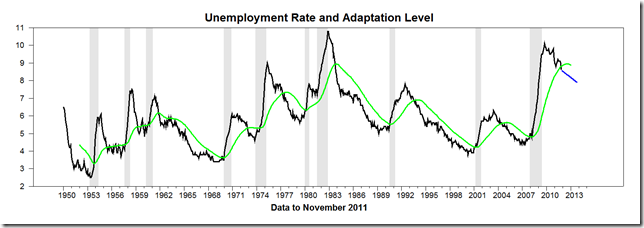

The green line is the Michigan survey measure of consumer sentiment. The forecast of the unemployment rate is judgmental and follows the pattern of the early ‘Seventies approximately.

Confidence has a momentum of its own, visual examination of the series suggests. The unemployment rate rarely crosses quickly back above its moving average once it has crossed below. It happened a few times in the 'Fifties and ‘Sixties but did not signal the imminent start of a recession. We may expect positive economic momentum for several quarters in the U.S.

If we track the early ‘Seventies episode, when the Michigan series was in the dumps as it is now but our “animal spirits” metric went positive, we can expect about a year of positive economic growth before the next collapse of confidence.

Why Shiller and Akerlof didn’t cite the important 1996 paper in the Journal of Economic Psychology on “animal spirits” published by an obscure professor at a small, non-snob school somewhere in fly-over land, is simply evidence of how long our neo-feudal class system has been forming. Denial is so easy when the little people are so far removed of our social sphere of reference.

Monday, November 28, 2011

Sunspot cycle ramping up

Sunspots have historically been associated with major market tops (2000), wars and social unrest.

Sunday, November 27, 2011

‘Animal spirits’ update

Recall that the theory of “animal spirits” that we channel from an obscure article in the Journal of Economic Psychology in 1996, “Adaptation level and ‘animal spirits,’ callously and dishonestly ignored in Shiller and Akerlof’s book on “animal spirits,” posits that the general level of confidence or “animal spirits” in America is largely determined by where the unemployment rate is relative to a recent adaptation level represented by an exponential moving average relative to the standard deviation of the unemployment rate over the past 48 months:

A = – (U – UMEAN)/Sigma(U)

where the minus sign makes the measure a positive confidence measure.

Currently the adaptation level of the unemployment rate is 8.8 percent, while the current reading is 9.0. The adaptation level is also rising. So the possibility that I have mentioned before of a secular exhilaration in 2012 is still before us; if the reported U3 unemployment rate falls to 8.8 or below before the election, “animal spirits” as proxied in this model will “go positive:”

As can be seen from the history, when the A metric crosses below the zero line from above the economy has generally been at the onset of recession (an acceleration and change of sign of the real growth rate).

The situation today, with the abysmal levels of survey-reported consumer confidence (the Michigan sentiment series is in green) most resembles late 1971-1972, when there was a brief swing into positive “animal spirits” during the election year, followed by up-till-then most serious recession of the postwar period.

In 1972 the A metric went positive in exactly the election month of November and continued upward until October 1973, almost exactly coincidental with start of the severe early ‘Seventies recession (when I was working my first job out of college, and was required to take a ten percent cut in pay from $8,000 annually in New York City—I went to graduate school). Note the anticipatory pattern of the Michigan index, then created quarterly.

By whatever means—civilian labor force participation rate shrinking faster than employment contracts—the psychologically sensitive unemployment rate may decline in coming months enough to trigger a secular exhilaration, that is likely to be followed by deepening depression unless the unbalanced nature of the U.S. distribution is altered quickly, which appears unlikely.

2012 is going to be an interesting year.

Tuesday, November 22, 2011

Thank God for Bruce Bartlett

Here’s some tax truth from a Republican:

The truth is that the federal surpluses resulted from specific legislation enacted in 1990 and 1993 that virtually every Republican opposed. In particular, taxes were increased and tight budget controls were put in place that prevented taxes from being cut or spending increased unless offset by tax increases or spending cuts. These budget controls are commonly referred to as “paygo,” for pay-as-you-go.

What happened can be seen in Congressional Budget Office data. When the 1990 budget deal took effect in fiscal year 1991, federal spending was 22.3 percent of G.D.P. and revenue was 17.8 percent. The deficit was 4.5 percent of G.D.P. Revenue rose steadily to 19.9 percent of G.D.P. by fiscal year 1998 and spending fell to 19.1 percent, yielding a budget surplus of almost 1 percent of G.D.P.

Revenue continued to rise to 20.6 percent of G.D.P. in fiscal year 2000, and spending fell to 18.2 percent. The surplus reached 2.4 percent of G.D.P.

These results run 100 percent contrary to Republican dogma, which is that tax increases, especially on the rich, do not yield additional revenue because people will cease working and investing, and the economy will stagnate. Yet the hallmarks of the 1990 and 1993 budget deals were an increase in the top income tax rate; first to 31 percent from 28 percent, and then to 39.6 percent. Revenue clearly rose, as did the economy.

This is a must-read article:

Balancing the Budget, for Real – New York Times

Bernanke serves his Wall Street masters

The Top 0.1% Of The Nation Earn Half Of All Capital Gains – Forbes

Capital gains are the key ingredient of income disparity in the US-- and the force behind the winner takes all mantra of our economic system. If you want even out earning power in the U.S, you have to raise the 15% capital gains tax.

Income and wealth disparities become even more absurd if we look at the top 0.1% of the nation's earners-- rather than the more common 1%. The top 0.1%-- about 315,000 individuals out of 315 million-- are making about half of all capital gains on the sale of shares or property after 1 year; and these capital gains make up 60% of the income made by the Forbes 400.

It's crystal clear that the Bush tax reduction on capital gains and dividend income in 2003 was the cutting edge policy that has created the immense increase in net worth of corporate executives, Wall St. professionals and other entrepreneurs.

Bernanke Speech Moves Markets: No New Stimulus – ABC News

The effectiveness of first two QEs has been questioned. Critics acknowledge that easing has brought temporary benefits, but they argue those have accrued primarily to the stock market. They question whether flooding the markets with yet more cheap money is a good thing for the economy long-term.

Just so that it’s perfectly clear what’s going on. The country’s markets are being looted by the central bank to benefit of the ruling class. I personally, while supposedly a “sophisticated investor,” am terrified of our totally rigged and corrupt stock market.

Have a good day.

For Deficit Panel, Failure Cuts Two Ways - NYTimes.com

Leading from behind.

Monday, November 21, 2011

Saturday, November 19, 2011

Lenders Flee Debt of European Nations and Banks - NYTimes.com

Either multiple miracles are going to occur--simultaneous resolutions of European and American debt crises--or this is a no-brainer from an investing standpoint.

The world appears to be entering a monumental clusterfork in the road.

Do not harden your heart, as the only thing that will keep you alive is love.

Thursday, November 17, 2011

The great sorting-out

Americans are becoming more and more divided along class lines, even geographically. This does not bode well for social cohesiveness or the ability to execute effective social policies. (And you can say “government is the problem” all you want, but I tell you we will have government for the rest of our lives, and I’d rather have government that works.)

Middle-class areas shrinking in US: study – yahoo.com

I recently reread my oldie-but-goodie, “On the coming neo-feudalism,” from two and a half years ago, and was amazed at its prescience.

Sunday, November 6, 2011

What Mankiw doesn’t teach: the costs of inequality

I posted on Wilkinson over a year ago, and I’m glad to see www.angybearblog.com [corrected] covering his work. This is an oldie but goodie, definitely must-watch even if you’ve seen it before.

Thirty-some years ago, having completed an honors English degree from Yale, I decided to get a Ph.D. in Economics to study the dominant mythology of our age. It can’t fall soon enough….

Saturday, November 5, 2011

Review of ‘Margin Call’

Saw the hot new Wall Street movie “Margin Call” last night with a special appearance from New York City via Skype of the director, whose father, it turns out, was a New York City investment banker.

The movie sugar coats the cynicism of the investment bankers. Kevin Spacey gives a nice portrayal of a long time investment banker and trader who knows that screwing one’s customers is not good for repeat business.

But the movie merely makes the greatest sin of its Goldman Sachs-like fictional firm (GS-like because it doesn’t go bankrupt) the beat-the-crowd unloading of its tons of merde, toxic MBS assets that a young engineer quant has figured are going to bankrupt the firm in an environment of increasing levels of market volatility, due to the extreme leverage the firm has put on.

No, JC Chandor backs off of showing what really happened, which was that some investment banks and colluding hedge funds actually shorted the same securities they were selling at the same time.

Most people would call that fraud.

JC Chandor missed the opportunity to capture the truly depraved language of the traders, which has been displayed in transcripts of Enron’s traders’ conversations and emails.

When a forest fire shut down a major transmission line into California, cutting power supplies and raising prices, Enron energy traders celebrated, CBS News Correspondent Vince Gonzalesreports.

"Burn, baby, burn. That's a beautiful thing," a trader sang about the massive fire.

Four years after California's disastrous experiment with energy deregulation, Enron energy traders can be heard – on audiotapes obtained by CBS News – gloating and praising each other as they helped bring on, and cash-in on, the Western power crisis.

"He just f---s California," says one Enron employee. "He steals money from California to the tune of about a million."

"Will you rephrase that?" asks a second employee.

"OK, he, um, he arbitrages the California market to the tune of a million bucks or two a day," replies the first.

Though Mr. Tourre was a more junior member of the Goldman team, the S.E.C. case against him was bolstered by colorful e-mails he wrote, calling mortgage securities like those he created monstrosities and joking that he sold them to “widows and orphans.”

I have a number of investment banking and hedgie friends, and I find all of them extraordinarily double-minded when it comes to the ethics of what they do. In that regard, Spacey’s character accurately reflects the tensions some, if not all, folks in the toxic Wall Street environment feel.

But the movie Disney-fies the moral dimensions of what Wall Street has become in recent years.

Too bad.

The tombstone blues

As of now, democracy and the rule of law are pretty dead in America. Bill Black, who sent a lot of crooks to prison in the aftermath of the S&L crisis twenty years ago, knows from personal experience. How far we have fallen. Must watch.

Western economy growth rates portend recession

This indicator has been making the rounds. Recession soon follows when real GDP year-over-year falls below two percent, as it has for the past two quarters. The indicator has a pretty good track record over the past 60+ years, never having missed signaling an ensuing recession a year or so in advance with no false positives.

And the situation in Europe is similar, with a garnish of extreme political instability thrown on for seasoning:

Friday, November 4, 2011

Growing Economies, Stagnant Wages - NYTimes.com

Capital has become concentrated and internationally mobile. It is beggaring labor everywhere. The new ruling class is the international corporate elite, who have no national loyalties to speak of.

Wednesday, November 2, 2011

Move to amend

The national campaign to Abolish Corporate Personhood and Defend Democracy.

Sign the Petition: http://MoveToAmend.org/motion-to-amend

* * *

Good morning Benign

Last night Boulder became the second city in the nation to pass a ballot measure

calling for an amendment to the US Constitution that would state that corporations

are not people and the legal status of money as free speech! At midnight, with 93%

of the ballots counted, the measure was handily winning with 74% of voters in support.

Boulder’s campaign is the latest grassroots effort by Move to Amend, a national coalition

working to abolish corporate personhood.

“From Occupy Wall Street to Boulder, Colorado and every town in between, Americans are

fed up with corporate dominance of our political system,” said Kaitlin Sopoci-Belknap, a

national spokesperson for Move to Amend. “Local resolution campaigns are an opportunity

for citizens to speak up and let it be known that we won’t accept the corporate takeover

of our government lying down. We urge communities across the country to join the Move

to Amend campaign and raise your voices.”

Earlier this year voters in Madison and Dane County, Wisconsin overwhelmingly approved

similar measures calling for an end to corporate personhood and the legal status of money

as speech by 84% and 78% respectively. Next week voters in Missoula, Montana will have

an opportunity to vote on a similar initiative in their community.

Move to Amend volunteers in dozens of communities across the country are working to place

similar measures on local ballots next year.

“Working on this campaign was electrifying,” said Scott Silber, a local Move to Amend organizer

in Boulder. “We had such an outpouring of enthusiasm from our community. Folks were so thrilled

to finally have an opportunity to have their voices heard and resoundingly call for an end to

corporate corruption of our democracy. From here we’re taking the campaign to Denver, and then

on to Washington, DC.”

Move to Amend’s strategy is to pass community resolutions across the nation through city councils

and through direct vote by ballot initiative. “Our plan is build a movement that will drive this issue

into Congress from the grassroots. The American people are behind us on this and our federal

representatives will see that we mean business. Our very democracy is at stake,” stated

Sopoci-Belknap.

WHAT YOU CAN DO

- Help Move to Amend get on the Daily Show with John Stewart and the Colbert Report!

With both John Stewart and Stephen Colbert talking about Corporate Personhood a lot these days,

we think that a Move to Amend spokesperson would be perfect for these shows! Help us

make the case by writing to the Daily Show and the Colbert Report and urging them to

contact us. Include the link to our press release about Boulder!

- Email the Daily Show [thedailyshow@comedycentral.com] - Let John Stewart

know you want to see him interview MTA! - Email The Colbert Report [colbertweb@gmail.com] - Let Stephen Colbert know

you want to see him interview MTA!

- Email the Daily Show [thedailyshow@comedycentral.com] - Let John Stewart

- Pass a resolution in your town! Click here to get started. We'll be offering a special

webinar soon with organizers from Boulder so they can tell you what they did to get it

done - stay tuned!

FOR PRESS INQUIRIES ABOUT THE BOULDER CAMPAIGN

kaitlin@movetoamend.org

Move to Amend

P.O. Box 260217

Madison, WI 53726-0217

United States

End Corporate Rule. Legalize Democracy. Move to Amend.

Tuesday, November 1, 2011

Mexican standoff

We have entered one of those periods when things are happening so fast it’s difficult to update one’s mental maps in a meaningful way. You know what was there, but you don’t know what’s there now. The last time I felt this way was in the fall of 1990 when the Iron Curtain fell. The map was crumbling.

In the past week we’ve learned that because of “language arbitrage,” another word for sharp business dealings, the entire CDS market is compromised. The Greek default may be deemed “voluntary” by the banks who wrote the worthless paper, and, surprise surprise, also comprise the “regulatory agency” that makes the rules about what is and is not a default.

As the formidable Reggie Middleton says, the CDS market is shot to hell one way or the other, and the five big banks that hold the vast majority of the trillions of dollars of exposure and now effectively unhedged.

It’s a Mexican standoff. Can we trust bankers to honor the rules of Mutual Assured Destruction? Not hardly. Look at how Hank Paulson took advantage of the opportunity to nuke Lehman. At the first whiff of blood in the water the sharks will attack.

The miracle cure of inflation, which really would have been a better way to get out from under bad debt, is not going to happen in a debt deflation. In the banks unwillingness to recognize that their bad debt is not going to be repaid in full, and the whorish accounting profession’s willingness to let them carry it at fictitious values on their books, the downward spiral of debt deflation is guaranteed.

One of the scariest things I’ve seen this Halloween was an interview with Larry Fink of Blackrock Investments on FT in which he (licking his lips) expressed a willingness on the part of the trillions of dollars of Big Money parked on the sidelines worldwide to participate in the rebuilding of some of these troubled economies at equity-like rates of return (with credit enhancements provided by governments and the IMF, if they could only learn how to behave and keep mostly out of the way)….

If the Greeks are smart they’ll tell the EU to shove and just default on their debts. Once bad debts are written down, it’s amazing how quickly new money can appear.

The world economy will stagnate and tend toward war until honesty returns to the financial statements of the big banks.

As John Hussman has pointed out recently, and as I’ve pointed out all along, the failure of big financial institutions does not necessarily mean the economy falls into depression. In the 1930s, the problem was that deposits were wiped out. All the Feds had to do when the crisis hit was to tell Americans their deposits were insured. When a bank fails, the biggest change from a depositor’s point of view is that the sign changes.

Would the investors in the bank, equity holders and probably most bond holders, have been wiped out? Sure. That’s what risk taking is all about.

But our leaders elected to send good money after bad, and bail the banks out on the taxpayers’ backs. The Germans and French and Americans should just admit they made some really bad loans—and were stupid enough to believe the toilet paper CDSs they were selling each other were actually going to protect them from anything. But then, the big banks were stupid enough, in some cases, to hold the “AAA'” securitizations of sub-prime mortgage paper that Wall Street conned them into creating on their own balance sheets.

There’s plenty of equity-backed liquidity sitting on corporate balance sheets.

Can the global financial oligarchy survive a Mexican standoff? That’s what this historical moment will decide.

And if the oligarchs turn to fratricide, and the strongest become even stronger, and exercise their greed even more, how long until the population of the world coalesces into a hard-edged resistance to financial feudalism through outright rebellion?

See also:

Consent Needed for Debt Repayments Michael Hudson, Credit Writedowns

In Praise of Papandreou's Referendum Decision; Eurocrats Terrified of Democracy; Parade of Cowards – Mish

Give the People a Vote on Bank Bailouts? Markets and Politicians Horrified at the Thought – Economic Populist

Monday, October 31, 2011

America’s Exploding Pipe Dream - NYTimes.com

Tuesday, October 25, 2011

Hussman Funds - Weekly Market Comment: Penny Wise and Euro Foolish - October 24, 2011

Must read. Our national priorities are almost incalculably screwed up. Thanks to the money the corporations and the rich in general are pouring into Congress to protect their own assets. And of course thanks to the Fed, who grovels before Wall Street just because the reality distortion field of being in New York or Washington seems to demand it. "And that's what we've come to - government of the banks, by the banks, and for the banks (because banks are people too) ."

Monday, October 24, 2011

Wages, Expectations, and Prospects for Inflation :: Brent Meyer :: Economic Trends :: 05.27.11 :: Federal Reserve Bank of Cleveland

Brent Meyer

Over the past six months, food and energy prices have risen at an annualized rate of 17 percent, prompting speculation of a possible price-wage spiral that will result in rampant inflation. A wage-price spiral occurs when wage earners start to demand higher nominal wages just to keep up with rising inflation (trying to hold real incomes constant). In turn, these wage increases raise the costs of production, which squeezes margins and induces business owners to raise prices. These even-higher prices then push wage earners to try and negotiate even higher wages, which again prods businesses to raise prices, and so on¦resulting in a rapid run-up in inflation."

Not happening if demand continues to collapse. Check out the graphs.

Saturday, October 22, 2011

Europe on the breadline: 'Chaos is a Greek word' | World news | guardian.co.uk

Read. Conditions on the ground.

Friday, October 21, 2011

When No. 1 Financial-Strength Ranking Spells Doom - Bloomberg

Then last weekend, 86 days after getting its clean bill of health, Dexia took a government bailout to avoid collapsing. Nobody was surprised this happened. Nor should anyone have been."

Americans for Greater Inequality - NYTimes.com

Ms. Kuziemko, a professor at Princeton, and Mr. Norton, a professor at Harvard, argue that greater opposition to redistributive policies may actually be a predictable reaction to having slipped in the distribution oneself:

People exhibit a fundamental loathing for being near or in last place — what we call “last place aversion.” This fear can lead people near the bottom of the income distribution to oppose redistribution because it might allow people at the very bottom to catch up with them or even leapfrog past them.This statement is based on a study of theirs based on survey data. The surveys found that people making just above the minimum wage are the most likely to oppose an increase in it."

I see this as a perverse extension of the "you too can be rich" thinking that Ronald Reagan exploited in getting his regressive tax agenda under way. It's also part and parcel of the "beggar thy neighbor" complex that arises in contractionary periods in international trade. I continue to be hopeful that humankind can effect a major evolutionary shift in thinking that will lead to greater equality and peaceful conflict resolution.

Wednesday, October 19, 2011

Occupy Wall Street needs to occupy Congress and lobbyists - The Washington Post

It was born in the late 1990s on an unholy trinity of accounting swindles, the dot-com collapse and analyst scandals. It grew on a housing boom and bust that created 5 million (and counting) foreclosures, leaving more than a quarter of bank-financed homes worth less than their mortgages. It matured on a growing wealth disparity that eviscerated the middle class and brought back the plutocracy of the 1920s. It reached its peak with the bailout of reckless bankers, who were rewarded for their irresponsibility with what may be the greatest wealth transfer in human history."

Worth a read. Barry's three-pronged reform program makes a lot of sense.

Monday, October 17, 2011

Consumption going down

More Important than Historical Statistics--Private Debt Decline – Comstock

I’ve been saying for years that Consumption at 70% of GDP is unsustainable. Comstock calls a double dip recession in the works, as Rosenberg does in last post, but the implications of Consumption falling back to its long-term average percent of GDP are secular, not cyclical.

The central bank shell game

Per David Rosenberg, h/t www.patrick.net

Banks pump and dump bad debt on to securitization markets (with the help of greedy fee-earning Wall Street banks and whoring ratings agencies)… bad debt spreads to banks across the face of the Earth, destabilizing financial markets… central banks buy up bad debt to hide it on their opaque balance sheets… sovereign governments back the bad debt purchased by the central banks… commercial banks in the meanwhile load up on sovereign bonds to have some assets on their balance sheets while consumers and businesses are not doing a lot of borrowing… and, mirabile dictu, the sovereigns start to wobble and the commercial banks are back where they started from….

Thanks Richard Nixon, for putting the world on fiat money. Thanks Alan Greenspan and Ben Bernanke for saying there’s no loan that can’t be made.

If the Republicans win the White House, we will have fiscal contraction that will precipitate a second financial crisis as the bad debt pigeons come home to roost (not to mention the trillions of dollars of derivative bets that were made by institutions collecting “free money” by selling un-backed “protecition” on sovereign debt and all manner of other hideous paper out there….

Out of options – David Rosenberg

Saturday, October 15, 2011

Hussman Funds - Weekly Market Comment: Talking Points for the "Occupy Wall Street" Protesters - October 10, 2011

Background: When Wall Street talks about the "failure" of a bank or other financial institution it means the failure of the company to pay off its own bondholders. It does not mean that depositors, counterparties or other bank customers lose money ...."

Definitely worth reading if you're struggling to articulate what's wrong with Wall Street and Washington today.

Tuesday, October 11, 2011

The 12 years war

It occurs to me that it will probably take a dozen years—if it ever happens—to amend the Constitution to take the money out of politics, to recognize that democracies are made up of human beings, not corporations.

As I pointed out a couple of posts ago, it will probably have to come up from the grass roots, through the state legislatures, and not through Congress, which is hopelessly corrupt.

The John Roberts Supreme Court has done its best to hand the country over to the plutocrats with a decision that is stunning in its idiocy, namely, that corporations are people. We now have super-pacs that are able to accept unlimited amounts of money on an anonymous basis to interfere with any political campaign in the country. Do you think all that money will come from onshore?

The “conservative” members of the Roberts court should be prosecuted for treason.

It’s going to be a long war, that will be fought in meetings with neighbors and local politicians, to take back our state and local governments first. The money will come down to the local level and poison the atmosphere, for sure. The battle comes down to convincing the conservatives that democracy is for people, not corporations. It’s all about conserving our democracy.

Let’s make our goal amending the Constitution to overturn Citizens vs. United States—at least. Even better, let’s introduce spending limits on campaigns and make them stick.

Let’s see if we can get this done by 2023, close to the forecasted end of the fourth turning.

Why Obomba is a loser

Jeffrey Immelt has his head up his butt. Look at the smugness on that self-satisfied face. This picture is worth a thousand words about how far out of touch our ruling class is with the American people.

From www.firedoglake.com:

In a 60 Minutes interview on Sunday, Obama’s chosen go-to guy on job creation, General Electric’s chairman and CEO Jeffrey Immelt, our Jobs Czar, had this to say about the misconceptions of those protesting Wall Street in over 800 cities across the nation by the tens of thousands,

I want you to root for me. Look, every one in Germany roots for Siemens, everyone in Japan roots for Toshiba, everyone in China roots for China South Rail, I want you to say, win GE.

I think this notion that it’s the population of the US against big companies is just wrong.

Well Jeff, let’s take an unvarnished look at the differences between those companies in Japan and Germany as regards the ratio of pay for a ceo to that of the average worker compared to ceo’s like yourself in American corporations, shall we?

In Japan the ratio of pay for a ceo compared to that of the average worker is…… 11 to 1,

In Germany that ratio expands to a dizzying…… 12 to 1,

and in the the old US of A Jeff ?….. it’s 475 to 1.

In addition Jeff, your company has one of the worst records of any American corporation for exporting American jobs overseas. Since you assumed control of GE, you have cut one-fifth of your company’s U.S. work force while increasing the number of your companies overseas employees dramatically. Your company, the largest corporation in America, paid no taxes in 2010 despite making $145.2 billion in profits and receiving nearly over $5 billion in federal subsidies in that same period.

The adage “with friends like you, who needs enemies” comes to mind.

You and your ilk, as well as those who appointed you to the position you now hold in government, belong in jail for destroying the economic well being of millions here and abroad, and for forcing the American population into the streets to address the problem because of the harm you have caused to the machinery of democracy in America.

Thursday, October 6, 2011

Neither capitalism nor democracy

America has neither capitalism nor democracy currently.

Capitalism would require that government let bankrupt firms fail. Capitalism would require that the owners of capital—not corporate managements—would have a majority say in how companies are run. Capitalism would never permit the rich to impose their personal investment losses on the rest of tax-paying Americans. In-your-face bonuses paid to Wall Street executives whose firms and jobs were saved on the taxpayers’ back would not have happened under a capitalist system.

Democracy would require that “persons” be people, human beings, not cash-bloated corporations. Democracy would require that the desires of the people would be effected, to a reasonable and rational degree, by their elected representatives, not cynically ignored as they grovel for their campaign dollars before their moneyed donors, a rich class that controls not only the politicians but corporate governance (which they’ve lock up tight), and to an increasing degree, national governments around the world.

In reflecting upon what it would take to amend the Constitution, the phrase “no exit” occurred to me. Here’s the process:

Article V of the Constitution spells out the processes by which amendments can be proposed and ratified.

To Propose Amendments

- Two-thirds of both houses of Congress vote to propose an amendment, or

- Two-thirds of the state legislatures ask Congress to call a national convention to propose amendments. (This method has never been used.)

To Ratify Amendments

- Three-fourths of the state legislatures approve it, or

- Ratifying conventions in three-fourths of the states approve it. This method has been used only once -- to ratify the 21st Amendment -- repealing Prohibition.

The Supreme Court has stated that ratification must be within "some reasonable time after the proposal." Beginning with the 18th amendment, it has been customary for Congress to set a definite period for ratification. In the case of the 18th, 20th, 21st, and 22nd amendments, the period set was 7 years, but there has been no determination as to just how long a "reasonable time" might extend.

Of the thousands of proposals that have been made to amend the Constitution, only 33 obtained the necessary two-thirds vote in Congress. Of those 33, only 27 amendments (including the Bill of Rights) have been ratified. (source)

It will require a Congress, or two thirds of the state legislatures—both of whom are dependent on rich donors—willing to vote above their own narrow self-interest to get an amendment even proposed. I would guess that it will remain impossible for inside-the-Beltway politicians ever to achieve that state of mind. A proposal to amend will have to come from the state legislatures.

What we have now is a semi-feudal system, a class system supported in principle and in effect by the Republican party, who, as shown a few posts ago, are the party of increasing inequality. So the red states will be hard to get on board with a proposal to amend unless the commoners suddenly wake up to their exploited state.

The Reid tax proposal, to impose a 5 percent surcharge on incomes over a million dollars a year is estimated to generate about half a trillion in incremental revenue, or about a third of the projected deficits near-term. That’s how unequal things are. If only the average Republican could see that they’re being snookered with a load of Reaganite bunkum….

It will take a sea-change of popular opinion about government, taxes, sharing, work, reward, democracy for America to exit the one-way street to neo-feudalism we’re on now.

Wednesday, October 5, 2011

"We the corporations" | Move to Amend

On January 21, 2010, with its ruling in Citizens United v. Federal Election Commission, the Supreme Court ruled that corporations are persons, entitled by the U.S. Constitution to buy elections and run our government. Human beings are people; corporations are legal fictions.

We, the People of the United States of America, reject the U.S. Supreme Court's ruling in Citizens United, and move to amend our Constitution to:

* Firmly establish that money is not speech, and that human beings, not corporations, are persons entitled to constitutional rights.

* Guarantee the right to vote and to participate, and to have our vote and participation count.

* Protect local communities, their economies, and democracies against illegitimate "preemption" actions by global, national, and state governments.

The Supreme Court is misguided in principle, and wrong on the law. In a democracy, the people rule. We Move to Amend."

The "revolution" is a joke. As we learned with Katrina, Americans live in an occupied land where mercenaries can spring out of the woodwork at the slightest sign of civil unrest. While Occupy Wall Street might be a start, only Constitutional amendment has a chance of making real, lasting change.

Saturday, October 1, 2011

Meltdown

Part 1 here. This Aljazeera documentary is chockerblot with high-profile insiders from the Western financial world. What does that tell you?

If you haven’t watch Inside Job, watch it now. It used to be available for free online, but I don’t find it now.

Thursday, September 29, 2011

America and Europe: Saving the Rich and Losing the Economy

For years, Paul Craig Roberts has decried the behavior of corporate America (really, the international corporate ruling class) for being like a cancer upon the developed world, trashing their countrymen and women for personal gain. I am reproducing this from globalresearch.ca. This ruling class currently has a death-grip on the American political system that will only be broken loose by concerted democratic action.

America and Europe: Saving the Rich and Losing the Economy

by Dr. Paul Craig Roberts

Economic policy in the United States and Europe has failed, and people are suffering.

Economic policy failed for three reasons: (1) policymakers focused on enabling offshoring corporations to move middle class jobs, and the consumer demand, tax base, GDP, and careers associated with the jobs, to foreign countries, such as China and India, where labor is inexpensive; (2) policymakers permitted financial deregulation that unleashed fraud and debt leverage on a scale previously unimaginable; (3) policymakers responded to the resulting financial crisis by imposing austerity on the population and running the printing press in order to bail out banks and prevent any losses to the banks regardless of the cost to national economies and innocent parties.

Jobs offshoring was made possible because the collapse of the Soviet Union resulted in China and India opening their vast excess supplies of labor to Western exploitation. Pressed by Wall Street for higher profits, US corporations relocated their factories abroad. Foreign labor working with Western capital, technology, and business know-how is just as productive as US labor. However, the excess supplies of labor (and lower living standards) mean that Indian and Chinese labor can be hired for less than labor’s contribution to the value of output. The difference flows into profits, resulting in capital gains for shareholders and performance bonuses for executives.

As reported by Manufacturing and Technology News (September 20, 2011) the Quarterly Census of Employment and Wages reports that in the last 10 years, the US lost 54,621 factories, and manufacturing employment fell by 5 million employees. Over the decade, the number of larger factories (those employing 1,000 or more employees) declined by 40 percent. US factories employing 500-1,000 workers declined by 44 percent; those employing between 250-500 workers declined by 37 percent, and those employing between 100-250 workers shrunk by 30 percent. http://www.manufacturingnews.com/

These losses are net of new start-ups. Not all the losses are due to offshoring. Some are the result of business failures.

US politicians, such as Buddy Roemer, blame the collapse of US manufacturing on Chinese competition and “unfair trade practices.” However, it is US corporations that move their factories abroad, thus replacing domestic production with imports. Half of US imports from China consist of the offshored production of US corporations.

The wage differential is substantial. According to the Bureau of Labor Statistics, as of 2009, average hourly take-home pay for US workers was $23.03. Social insurance expenditures add $7.90 to hourly compensation and benefits paid by employers add $2.60 per hour for a total labor compensation cost of $33.53.

In China as of 2008, total hourly labor cost was $1.36, and India’s is within a few cents of this amount. Thus, a corporation that moves 1,000 jobs to China saves saves $32,000 every hour in labor cost.These savings translate into higher stock prices and executive compensation, not in lower prices for consumers who are left unemployed by the labor arbitrage.

Republican economists blame “high” US wages for for the current high rate of unemployment. However, US wages are about the lowest in the developed world. They are far below hourly labor cost in Norway ($53.89), Denmark ($49.56), Belgium ($49.40), Austria ($48.04), and Germany ($46.52). The US might have the world’s largest economy, but its hourly workers rank 14th on the list of the best paid. Americans also have a higher unemployment rate. The “headline” rate that the media hypes is 9.1 percent, but this rate does not include any discouraged workers or workers forced into part-time jobs because no full-time jobs are available.

The US government has another unemployment rate (U6) that includes workers who have been too discouraged to seek a job for six months or less. This unemployment rate is over 16 percent. Statistician John Williams (Shadowstats.com) estimates the unemployment rate when long-term discouraged workers (more than six months) are included. This rate is over 22 percent.

Most emphasis is on the lost manufacturing jobs. However, the high speed Internet has made it possible to offshore many professional service jobs, such as software engineering, Information Technology, research and design. Jobs that comprised ladders of upward mobility for US college graduates have been moved offshore, thus reducing the value to Americans of many university degrees. Unlike former times, today an increasing number of graduates return home to live with their parents as there are insufficient jobs to support their independent existence.

All the while, the US government allows in each year one million legal immigrants, an unknown number of illegal immigrants, and a large number of foreign workers on H-1B and L-1 work visas. In other words, the policies of the US government maximize the unemployment rate of American citizens.

Republican economists and politicians pretend that this is not the case and that unemployed Americans consist of people too lazy to work who game the welfare system. Republicans pretend that cutting unemployment benefits and social assistance will force “lazy people who are living off the taxpayers” to go to work.

To deal with the adverse impact on the economy from the loss of jobs and consumer demand from offshoring, Federal Reserve chairman Alan Greenspan lowered interest rates in order to create a real estate boom. Lower interest rates pushed up real estate prices. People refinanced their houses and spent the equity. Construction, furniture and appliance sales boomed. But unlike previous expansions based on rising real income, this one was based on an increase in consumer indebtedness.

There is a limit to how much debt can increase in relation to income, and when this limit was reached, the bubble popped.

When consumer debt could rise no further, the large fraudulent component in mortgage-backed derivatives and the unreserved swaps (AIG, for example) threatened financial institutions with insolvency and froze the banking system. Banks no longer trusted one another. Cash was hoarded. Treasury Secretary Paulson, browbeat Congress into massive taxpayer loans to financial institutions that functioned as casinos. The Paulson Bailout (TARP) was large but insignificant compared to the $16.1 trillion (a sum larger than US GDP or national debt) that the Federal Reserve lent to private financial institutions in the US and Europe.

In making these loans, the Federal Reserve violated its own rules. At this point, capitalism ceased to function. The financial institutions were “too big to fail,” and thus taxpayer subsidies took the place of bankruptcy and reorganization. In a word, the US financial system was socialized as the losses of the American financial institutions were transferred to taxpayers.

European banks were swept up into the financial crisis by their unwitting purchase of the junk financial instruments marketed by Wall Street. The financial junk had been given investment grade rating by the same incompetent agency that recently downgraded US Treasury bonds.

The Europeans had their own bailouts, often with American money (Federal Reserve loans). All the while Europe was brewing an additional crisis of its own. By joining the European Union and (except for the UK) accepting a common European currency, the individual member countries lost the services of their own central banks as creditors. In the US and UK the two countries’ central banks can print money with which to purchase US and UK debt. This is not possible for member countries in the EU.

When financial crisis from excessive debt hit the PIIGS (Portugal, Ireland, Italy, Greece, and Spain) their central banks could not print euros in order to buy up their bonds, as the Federal Reserve did with “quantitative easing.” Only the European Central Bank (ECB) can create euros, and it is prevented by charter and treaty from printing euros in order to bail out sovereign debt.

In Europe, as in the US, the driver of economic policy quickly became saving the private banks from losses on their portfolios. A deal was struck with the socialist government of Greece, which represented the banks and not the Greek people. The ECB would violate its charter and together with the IMF, which would also violate its charter, would lend enough money to the Greek government to avoid default on its sovereign bonds to the private banks that had purchased the bonds. In return for the ECB and IMF loans and in order to raise the money to repay them, the Greek government had to agree to sell to private investors the national lottery, Greece’s ports and municipal water systems, a string of islands that are a national preserve, and in addition to impose a brutal austerity on the Greek people by lowering wages, cutting social benefits and pensions, raising taxes, and laying off or firing government workers.

In other words, the Greek population is to be sacrificed to a small handful of foreign banks in Germany, France and the Netherlands.

The Greek people, unlike “their” socialist government, did not regard this as a good deal. They have been in the streets ever since.

Jean-Claude Trichet, head of the ECB, said that the austerity imposed on Greece was a first step. If Greece did not deliver on the deal, the next step was for the EU to take over Greece’s political sovereignty, make its budget, decide its taxation, decide its expenditures and from this process squeeze out enough from Greeks to repay the ECB and IMF for lending Greece the money to pay the private banks.

In other words, Europe under the EU and Jean-Claude Trichet is a return to the most extreme form of feudalism in which a handful of rich are pampered at the expense of everyone else.

This is what economic policy in the West has become--a tool of the wealthy used to enrich themselves by spreading poverty among the rest of the population.

On September 21 the Federal Reserve announced a modified QE 3. The Federal Reserve announced that the bank would purchase $400 billion of long-term Treasury bonds over the next nine months in an effort to drive long-term US interest rates even further below the rate of inflation, thus maximizing the negative rate of return on the purchase of long-term Treasury bonds. The Federal Reserve officials say that this will lower mortgage rates by a few basis points and renew the housing market.

The officials say that QE 3, unlike its predecessors, will not result in the Federal Reserve printing more dollars in order to monetize US debt. Instead, the central bank will raise money for the bond purchases by selling holdings of short-term debt. Apparently, the Federal Reserve believes it can do this without raising short-term interest rates, because back during the recent debt-ceiling-government-shutdown-crisis, the Federal Reserve promised banks that it would keep the short-term interest rate (essentially zero) constant for two years.

The Fed’s new policy will do far more harm than good. Interest rates are already negative. To make them more so will have no positive effect. People aren’t buying houses because interest rates are too high, but because they are either unemployed or worried about their jobs and do not see a recovering economy.

Already insurance companies can make no money on their investments. Consequently, they are unable to build their reserves against claims. Their only alternative is to raise their premiums. The cost of a homeowner’s policy will go up by more than the cost of a mortgage will decline. The cost of health insurance will go up. The cost of car insurance will rise. The Federal Reserve’s newly announced policy will impose more costs on the economy than it will reduce.

In addition, in America today savings earn nothing. Indeed, they produce an ongoing loss as the interest rate is below the inflation rate. The Federal Reserve has interest rates so low that only professionals who are playing arbitrage with algorithm programmed computer models can make money. The typical saver and investor can get nothing on bank CDs, money market funds, municipal and government bonds. Only high risk debt, such as Greek and Spanish bonds, pay an interest rate that is higher than inflation.

For four years interest rates, when properly measured, have been negative. Americans are getting by, maintaining living standards, by consuming their capital. Even those with a cushion are eating their seed corn. The path that the US economy is on means that the number of Americans without resources to sustain them will be rising. Considering the extraordinary political incompetence of the Democratic Party, the right-wing of the Republican Party, which is committed to eliminating income support programs, could find itself in power. If the right-wing Republicans implement their program, the US will be beset with political and social instability. As Gerald Celente says, “when people have have nothing left to lose, they lose it.”

Dr. Roberts was Assistant Secretary of the Treasury for Economic Policy and Associate Editor of the Wall Street Journal.

Sunday, September 25, 2011

Income growth under Republican and Democrat presidents

The first thing Bartels did was break down economic performance by income class. The unsurprising result is shown in the chart….

Under Democratic presidents, every income class did well but the poorest did best. The bottom 20% had average pretax income growth of 2.63% per year while the top 5% showed pretax income growth of 2.11% per year.

Republicans were polar opposites. Not only was their overall performance worse than Democrats, but it was wildly tilted toward the well off. The bottom 20% saw pretax income growth of only .6% per year while the top 5% enjoyed pretax income growth of 2.09% per year. (What's more, the trendline is pretty clear: if the chart were extended to show the really rich — the top 1% and the top .1% — the Republican growth numbers for them would be higher than the Democratic numbers.)

In other words, Republican presidents produce poor economic performance because they're obsessed with helping the well off. Their focus is on the wealthiest 5%, and the numbers show it. At least 95% of the country does better under Democrats. (source)

The Republicans are salivating over the opportunity to send America into the twenty-first century as the first developed nation to return to a state of feudalism.

The 2005 Kevin Drum article cited as source above (based on the Bartels paper and subsequent book) goes on to show that Republican presidents tend to produce their best economic performance in the year of the election, to induce lower income groups to vote for them.

So it would appear the Pyrrhic victory sought by the Republicans—an economic collapse under President Obama to usher in their king—is part of a longer pattern of election year economic manipulations of long standing.

God help us.

Friday, September 23, 2011

Tuesday, September 20, 2011

In Class Warfare, Guess Which Class Is Winning

[...] It turned out that Mr. Buffett, with immense income from dividends and capital gains, paid far, far less as a fraction of his income than the secretaries or the clerks or anyone else in his office. Further, in conversation it came up that Mr. Buffett doesn’t use any tax planning at all. He just pays as the Internal Revenue Code requires. “How can this be fair?” he asked of how little he pays relative to his employees. “How can this be right?”As I've said before, we now have an international class of corporate elite who consider themselves gamesmen above the reach of national governments.

Even though I agreed with him, I warned that whenever someone tried to raise the issue, he or she was accused of fomenting class warfare.

“There’s class warfare, all right,” Mr. Buffett said, “but it’s my class, the rich class, that’s making war, and we’re winning.”

Seems like only in countries with high across-the-population kinship coefficients that egalitarian income distributions and tax systems can exist in today's international cut-throat business world (i.e., Sweden, Denmark, Norway, Germany, Japan and a few others). Might these countries not enjoy a long-term competitive advantage, as the costs of throwing more and more people into prison and social discord and non-cooperation mount in the big developed banana republics like the United States?

The closest analog to the Scandinavian "socialist" egalitarian mind-set in America is Minnesota, heavily settled by Germans and Scandinavians, which has most recently produced Michelle Bachman... not an encouraging sign for where we're going...

America is arguably in a pre-fascist state.

Monday, September 19, 2011

The theft of the American pension - Economics - Salon.com

In the last decade, the country's biggest companies have raided worker benefits for profit. An expert explains how"

America is in the midst of a retirement crisis. Over the last decade, we've witnessed the wholesale gutting of pension and retiree healthcare in this country. Hundreds of companies have slashed and burned their way through their employees' benefits, leaving former workers either on Social Security or destitute -- and taxpayers with a huge burden that, as the baby boomer generation edges towards retirement, is likely to grow. It's a problem that is already affecting over a million people -- and the most shocking part is, none of this needed to happen.

As Ellen E. Schultz, an investigative reporter for the Wall Street Journal, reveals in her new book, "Retirement Heist," it wasn't the dire economy that led these companies to plunder their own employees' earnings, it was greed. Over the last decade, some of the biggest companies -- including Bank of America, IBM, General Motors, GE and even the NFL -- found loopholes, abused ambiguous regulations and used litigation to turn their employees' hard-earned retirement funds into profits, and in some cases, executive compensation. Schultz's book offers a relentlessly infuriating look at the mechanisms they used to get away with it.

Whose cash?

I keep hearing that “corporations have $2 trillion of cash on their balance sheets,” and that if they would just spend it, the economy would recover.

This is further evidence to me of the separation of ownership and control of the American corporation, in effect since Berle and Means' seminal book of the same title (link). From one of the reviews of the book: “The plain and simple bottom line is that unless you're an insider, you're nothing more than overhead to be tolerated.”

This money supposedly belongs to the shareholders, many of whom are pension funds (remember Peter Drucker’s dream of pension fund socialism)? He got off that horse quickly and joined the board of GE to tutor Jack Welch and feed his five kids.

The gang leaders of today’s dominant gangs, the modern multinational corporations, are simply waiting the for the right moment to loot their corporate treasuries, again.

Perhaps we can see CEO salaries climb to a thousand times the (declining) median household income! They can start to give themselves titles, and perhaps permanent inheritable seats in Congress, so that they don’t have to buy every election!

Who will be king? Don’t we need a king to complete the picture?

Wednesday, September 7, 2011

‘It’s the debt, stupid,’ redux

Watch for unprecedented manipulation of the unemployment rate, as the administration comes to terms with the fact it is the relationship of the unemployment rate to its adaptation level that is the strongest single determinant of confidence in the United States of America. The general public, including unsophisticated investors and even types like yours truly with a Ph.D. in economics, distrust the stock market and look at any manufactured gains there as simply more evidence of the expropriation of the public by the kleptocracy.

We learned in macro thirty-five years ago that when effective demand collapses in the depression, increased monetary “stimulus” is like “pushing on a string”—the public and businesses don’t want to borrow in a collapsing economy. The only lesson Bernanke seems to have taken from his studies of the Depression (and from his current crop of colleagues) is that banks can’t be permitted to lose any money.

Three links by sources I trust sum it up pretty well:

It's A Long Hard Road – www.contraryinvestor.com (may be in the archives after September 2011)

An Imminent Downturn: Whom Will Our Leaders Defend? – John Hussman. Hussman has developed a robust logistic model on more than just the yield curve, something I would do if I were paid to to do.

‘Helicopter Ben’ risks destroying credit creation – Bill Gross. An almost comical whine seemingly on behalf of the banks by Bill Gross, who points out that the proposed contortionist “Operation Twist” will not help the banks to create credit, of course missing the main point that in a multi-generational deflationary collapse of effective demand very few want to borrow except the carry trade operators who are having fun blowing bubbles right and left to sucker the poor forcibly “risk on” public in to parting with more of their money.

By the way, I may have been the first to coin the phrase, “It’s the debt, stupid,” but I welcome any contributions to substantiating that claim. Here’s the earliest reference I can find on the site:

Friday, September 2, 2011

‘Animal spirits’ update

There is still the potential for an election year secular exhilaration if the unemployment rate declines even marginally, as the government forecasts it to:

This would bring our “animal spirits” measure up above zero:

Thus from our point of view an Obama reelection appears possible in spite of the high unemployment rate. See Never Wrong Forecasting Model Predicts an Obama Victory In 2012. Last time we had a Republican Congress and a “liberal” Democratic president we ended up with a surplus, not that this would be likely this time, the problems are too big after Georgy-Porgy Budget Buster and Obomba the guns and butter reactionary Democrat.

Any sustained increases in the unemployment rate will, however, destroy our implicit confidence determinant utterly, and it will fall to match the levels of the Michigan sentiment measure (green in lower graph).

It is pretty much guaranteed that we’ll get infrastructure stimulus with money printed by the Fed, unless the Republicans decide it is more important to torpedo Obomba and the economy and probably the viability of their party for some time to come.

The mood in 2012 promises to be pretty weird.

Wednesday, August 31, 2011

25 Signs That The Financial World Is About To Hit The Big Red Panic Button

Nice compendium with good links. Sentiment is still so bearish the market may yet rally in the historically weakest month of the year....

This is not investment advice. You trade at your own risk, unlike the Wall Street banks, who also trade at your risk.

Tuesday, August 30, 2011

Bruce Bartlett: The Case Against a Payroll Tax Cut - NYTimes.com

How about just taking the income cap off and leaving the tax cut in place? It's a flat tax that conservatives should be able to support, right? My guesstimate is that taking the income cap off would increase revenues.

Monday, August 29, 2011

Laura D'Andrea Tyson: Recovering From a Balance-Sheet Recession - NYTimes.com

This whole thing is worth a read. When unemployment is concentrated among the less skilled, doesn't it make sense to launch public works infrastructure programs, as FDR did? Can it be done without the pork all ending up in the hands of rich friends of Barack?

If the Tea Party has its way, we have some pretty big pot holes in our future.

Hussman - A Reprieve from Misguided Recklessness [Please!]

On this note, it is critical to remember that nearly all financial institutions have enough capital and obligations to their own bondholders to completely absorb restructuring losses without customers or counterparties bearing any loss at all. So keep in mind that the debate here is not about protecting customers or counterparties - it is really about whether the stockholders and bondholders of banks and other financial institutions should bear a loss. The "failure" of a bank only means that existing stockholders and bondholders are disenfranchised - the company simply takes on a new life under new ownership. Existing stockholders lose everything, unsecured bondholders typically lose something, and senior bondholders get any residual obtained as a result of the sale or transfer of the company. If the global economy is fortunate, the financial system two or three years from now will look much the same as it does today, but the ownership and capital structure will have changed almost entirely. A major restructuring of debt is the clearest path to long-term economic recovery, and the accompanying losses to those who recklessly made bad loans would be the highest realization of Schumpeter's idea of "creative destruction."

From that perspective, Warren Buffett's $5 billion investment in Bank of America preferred stock last week was essentially a defense of the old guard. Buffet observed, "It's a vote of confidence, not only in Bank of America, but also in the country."

Yes - to be specific, it's a vote of confidence that the country will bail out Bank of America in any future crisis. We should all hope that Buffett's investment is successful - provided there is no future crisis - and we should equally hope that Buffett loses the entire investment otherwise."

The monetary madness continues. Hussman's statistically infallible indicators of recession indicate we're already in one; see also Mish here citing the work of several others.

See also Barry Ritholtz's article on the banking crisis at A how-to guide for fixing America’s banks

I will do an "animal spirits" update Friday if the unemployment rate is published. I don't think we've seen the downward acceleration phase of the alleged current recession yet.

Sunday, August 28, 2011

Saturday, August 27, 2011

The slow disappearance of the American working man

The bottom line: As women saw workplace gains in recent decades—68 percent of those 25 to 54 have jobs—men's prospects have diminished."

The numbers behind the headline numbers.

Friday, August 26, 2011

Education & class: can you say “indentured servitude”?

While it is well known that “education pays,” at least for the seasoned worker, the barriers to entry into well-paying jobs are being raised. The popping of the student debt bubble promises to be extremely unpleasant, with many heavily indebted graduates entering a state of virtual indentured servitude. Like health care, education in America seems to be only for those that can afford it. The ruling class tightens its grip on the country.

A few excerpts from articles worth reading in their entirety:

Student debt in America will surge past $1 trillion next year and has already surpassed credit card borrowing, promising to turn out the most hocked generation of college graduates in history.

http://moneywatch.bnet.com/retirement-planning/blog/bank-dad/students-in-debt-1-trillion-hole-and-more-dropouts/740/#ixzz1W9OR3MSEStudent loans are tough. They can follow you for a long time after graduation and can be hard to manage with other debts you take on. Generally, you can't get rid of student loan debt in bankruptcy. This is non-dischargeable debt, which means it remains after bankruptcy and you must pay it.

However, there is one exception you should know about. Some student loans may be considered an undue hardship, and can be discharged, or eliminated, if the loan payments put an extreme burden on you or your family.

Show Your Hardship to the Bankruptcy Court

The first step to filing for undo hardship is to file a separate motion with the court and then meet with the judge to explain your hardship. This isn't easy to do. You have to show three things to prove undue hardship:

- That in your current situation, you can't maintain a minimum standard of living and repay your loans

- Your bad financial situation is likely to continue

- You made honest efforts to pay off the loans

It's almost impossible to show undue hardship unless you're physically unable to work and your situation isn't likely to improve in the future. So, if your student loans make up most of your debt, it probably isn't wise to attempt this unless you're disabled.

In the past, some privately funded student loans could be discharged in a Chapter 7 bankruptcy. However, the law changed with the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005. Now, any education loan that qualifies for a tax deduction is non-dischargeable, unless you show "undue hardship."

http://bankruptcy.lawyers.com/consumer-bankruptcy/Student-Loans-In-Bankruptcy.htmlJust like the labor force as a whole, recent college graduates have seen a near doubling of their unemployment rates. This pattern is similar to the labor market experience of recent college graduates during the cyclical recession of 2001.

http://www.frbsf.org/publications/economics/letter/2011/el2011-09.htmlNow evidence is emerging that the damage wrought by the sour economy is more widespread than just a few careers led astray or postponed. Even for college graduates — the people who were most protected from the slings and arrows of recession — the outlook is rather bleak.

Employment rates for new college graduates have fallen sharply in the last two years, as have starting salaries for those who can find work. What’s more, only half of the jobs landed by these new graduates even require a college degree, reviving debates about whether higher education is “worth it” after all.

“I have friends with the same degree as me, from a worse school, but because of who they knew or when they happened to graduate, they’re in much better jobs,” said Kyle Bishop, 23, a 2009 graduate of the University of Pittsburgh who has spent the last two years waiting tables, delivering beer, working at a bookstore and entering data. “It’s more about luck than anything else.”

The median starting salary for students graduating from four-year colleges in 2009 and 2010 was $27,000, down from $30,000 for those who entered the work force in 2006 to 2008, according to a study released on Wednesday by the John J. Heldrich Center for Workforce Development at Rutgers University. That is a decline of 10 percent, even before taking inflation into account.

Of course, these are the lucky ones — the graduates who found a job. Among the members of the class of 2010, just 56 percent had held at least one job by this spring, when the survey was conducted. That compares with 90 percent of graduates from the classes of 2006 and 2007. (Some have gone for further education or opted out of the labor force, while many are still pounding the pavement.)

Even these figures understate the damage done to these workers’ careers. Many have taken jobs that do not make use of their skills; about only half of recent college graduates said that their first job required a college degree.

The choice of major is quite important. Certain majors had better luck finding a job that required a college degree, according to an analysis by Andrew M. Sum, an economist at Northeastern University, of 2009 Labor Department data for college graduates under 25.

Young graduates who majored in education and teaching or engineering were most likely to find a job requiring a college degree, while area studies majors — those who majored in Latin American studies, for example — and humanities majors were least likely to do so. Among all recent education graduates, 71.1 percent were in jobs that required a college degree; of all area studies majors, the share was 44.7 percent.

http://www.nytimes.com/2011/05/19/business/economy/19grads.html