A modern-day prophet Isaiah speaks to the graduates.

From those to whom much has been given, from them much shall be expected. -- Luke

Saturday, June 23, 2012

Tuesday, June 19, 2012

When ‘capitalism’ fails

Capitalism fails when capital, or the control of capital, as currently in our corporatist system, becomes too concentrated.

When the majority of real incomes are falling, aggregate demand fails. Duh! And when people have already borrowed too much, trying to keep up or make a quick buck like the rich folk do, increasing the monetary base and encouraging people to borrow more is a fool’s errand.

Private property is great, and encourages people to work, except when ownership becomes too concentrated, when they feel locked out.

For capitalism to survive, its leaders—the owner class—will have to adopt an ethos that, “For everyone to whom much is given, of him shall much shall be required.”

Otherwise the owner class invites revolution of one form or another.

Before that happens their greed causes a massive deflation that may very well expropriate themselves (see Comstock’s excellent deflation overview, which inspired these comments).

Democracy exists to allow people to make laws to fix broken systems.

Our democracy is also now broken.

Lot of work to do.

Wednesday, June 13, 2012

Chimerica and the global predator class

Two must-read posts:

Charles Ferguson: Predator Nation, Global Predator Class – jesse

The Macroeconomics of Chinese kleptocracy – bronte capital Deflation = revolution in China. Great insights into how Chinese demographics impact saving and investment.

The specter of global neofeudalism looms….

Add: see also You Should Be Mad As Hell About This [CHARTS] (businessinsider.com) h/t patrick.net In case you had any doubt…. mind-blowing set of charts.

Tuesday, June 12, 2012

Kindleberger: cutting to the chase

Professors DeLong and Eichengreen have an oh-so-hagiographic foreword to a new edition of Kindleberger’s classic text, which I will admit to not having read. However, as a believer that financial fundamentals matter, as much as politics, in a political economy, I find their worship and Kindleberger’s analysis strangely obtuse. Kindleberger’s three main points about financial crises make no mention of leverage.

First, panic. Kindleberger argued that panic, defined as sudden overwhelming fear giving rise to extreme behaviour on the part of the affected, is intrinsic in the operation of financial markets.[…]

Kindleberger’s second key lesson, closely related, is the power of contagion.[…]

[T]he third positive alternative of international institutions with real authority and sovereignty is pressing.”

(source)

Well, doh! We created a fiat monetary system that confers huge benefits of seigniorage on banks (just as MMT would do for governments) and one thing you can say about human primates is that, historically speaking, they’re as greedy and nasty as chimpanzees. What group of humans given the ability to print money wouldn’t end up abusing the privilege?

Once the banks capture the regulators, leverage shoots up, and the potential for entirely rational panic, and rationally justifiable contagion, skyrocket.

Only Acemoglu and Robinson get it, fundamentally. Mainstream economics is still discussing mechanical models of the economy in the Newtonian mode.

There will be no economic recovery until there is political reform. And that won’t happen as long as Citizens United vs. US stands as is.

The priests of the status quo always look to the pope for the solution….

As we write, the North Atlantic world appears to have fallen foul to his bad outcome (c), with extraordinary political dysfunction in the US preventing its government from acting as a benevolent hegemon, and the ruling mandarins of Europe, in Germany in particular, unwilling to step up and convince their voters that they must assume the task.

I love that—a “benevolent hegemon”! If only I could believe that what they don’t mean by that is transferring more bad debt onto the backs of taxpayers, whether overtly or through monetary debasement, aka QE.

Monday, June 11, 2012

The politics of envy and austerity

Via: America’s Hidden Austerity Program – nytimes.com

[T]here is something historically different about this recession and its aftermath: in the past, local government employment has been almost recession-proof. This time it’s not. Going back as long as the data have been collected (1955), with the one exception of the 1981 recession, local government employment continued to grow almost every month regardless of what the economy threw at it. But since the latest recession began, local government employment has fallen by 3 percent, and is still falling. In the equivalent period following the 1990 and 2001 recessions, local government employment grew 7.7 and 5.2 percent. Even following the 1981 recession, by this stage local government employment was up by 1.4 percent.

Source: Bureau of Labor Statistics

Who is losing these local government jobs? In 1981 it was mostly teachers. Now, the losses are shared by teachers and other local government workers alike.

The recall election in Wisconsin was all about people seeing state and local government employees with good incomes and, more importantly, guaranteed defined benefit pensions, something which has eluded a majority of the graying baby boom generation (your correspondent included—I’ve always come on board just after the existing employees have been grandfathered into a DB pension; and I’ve gotten a cash balance plan instead worth literally peanuts.)

Now, given our less than stellar educational attainment as a nation, you might think that abusing the teachers is a bad idea. And it is. Most intelligent people will not even consider becoming a teacher anymore, having heard from friends and acquaintances the horror stories of classroom misconduct and lack of support from and abuse by administrators. The burn-out rate among teachers is high.

So, yes, perhaps government unions got ahead of where they should have been in pay, pension and benefits, and the envy of others was understandable.

But a society that abuses its teachers—and there was a very strong element of this present in the debate in Wisconsin—like a society that abuses its poor—is not headed toward happy or productive times.

At this point in the devolution of the Fourth Turning, America can only increase social tensions—increasing the gradient of inequality across every dimension—until the breaking point of the old social order is reached, and work begins on forging a new consensus.

The obtuseness of Krugman and Bernanke

Via: www.nytimes.com

Here’s Paul Krugman on the Spanish bailout:

Oh, wow — another bank bailout, this time in Spain. Who could have predicted that?

The answer, of course, is everybody. In fact, the whole story is starting to feel like a comedy routine: yet again the economy slides, unemployment soars, banks get into trouble, governments rush to the rescue — but somehow it’s only the banks that get rescued, not the unemployed.

Just to be clear, Spanish banks did indeed need a bailout. Spain was clearly on the edge of a “doom loop” — a well-understood process in which concern about banks’ solvency forces the banks to sell assets, which drives down the prices of those assets, which makes people even more worried about solvency. Governments can stop such doom loops with an infusion of cash; in this case, however, the Spanish government’s own solvency is in question, so the cash had to come from a broader European fund.

Bernanke, who studied the Great Depression, and Krugman, are both “mainstream economists,” meaning that they don’t acknowledge that the distribution in America is broken, making AgD-based macro policy a joke; and they both also seem not to realize that debts that will not be repaid do not belong on banks’ balance sheets, nor do they deserve taxpayer-funded bailouts. Bernanke seems to have missed the fact that we have something called “deposit insurance” now, so that when banks fail depositors are not wiped out and AgD does not have to collapse (for that reason).

I’ve written before that Paul Krugman is too close to New York to think independently, and the column referenced above confirms that belief.

The sooner the bad debt is written off the sooner aggregate demand can recover. Nationalize the banks, put them into receivership, do what it takes, protect the people’s deposits, but don’t bail them out. Putting any more bad debt on taxpayers is criminal.

The mainstream economists do not know the meaning of “bad debt,” and like the accounting profession, have deluded themselves into believing current balance sheets. The time-honored traditions of honest banking require debts that have no realistic chance of being repaid to be written off the books. None of these economists seem to know anything about honest banking.

From all reports the [largely unregulated] Spanish banking system is a house of cards. The Spanish real estate bubble was worse than anybody’s. And Krugman says we should bail them out?

The banks have cried wolf too much already. Shut them up.

And the same goes for Krugman, Bernanke, and the would-be rock star econo-whore from Columbia who shills for the Republicans.

The propaganda of the kleptocracy has sunk in so deep it has become very, very difficult to avoid infection of one’s own thinking. Beware.

Late add: see John Hussman’s recent comment “The Heart of the Matter” for evidence that the authorities haven’t learned anything

Friday, June 8, 2012

‘Animal spirits’ update

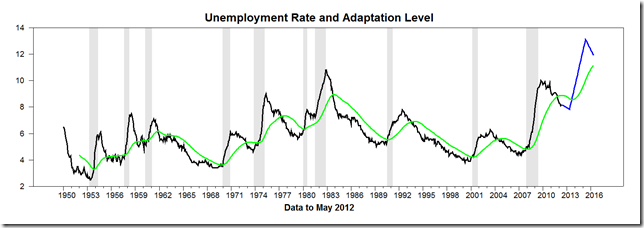

The President’s reelection chances hinge upon the unemployment rate remaining below 8.8 percent, the current adaptation level. Any rise above that level will signal the beginning of a recession or negative growth episode, if the pattern that has occurred every other time the unemployment rate rises above its adaptation level persists.

I continue to pencil in a rise in the unemployment rate in 2013 as the US falls off the fiscal cliff to one degree or another, with monetary policy impotent to do anything more than goose financial markets hooked on cheap money like heroin junkies.

The current situation continues to resemble the year 1973’s setup, with the Michigan survey measure still much lower than the A metric. Interestingly, then the Michigan measure rose going into the recession as the A metric plunged. After the cycle bottomed, the A metric shot up and the Michigan measure again became more pessimistic.

The potential for long-term pessimism, or what Keynes called “the state of long-term expectations,” becoming very dismal indeed in America is large, as Americans of even the slowest cognitive abilities wake up to the fact that the plutocracy has bought off the Congress, the President, and the Supreme Court (the justices who ruled for corporations being people in Citizens United were just thinking what they were told to think as good conforming conservatives). The plutocracy would like to set up their families as the lords and ladies of the new world, ever Anglophiliac in their pretensions, with the rest of us as their wage-serfs.

Here is Joseph Stiglitz trying to say the same things in a way that won’t get him kicked off the MSM media… this is the latest on our continuing feature, “Neofeudalism watch.”

I hope that American creativity will come up with a solution to the problem of the extreme dysfunctionality of the American political economy. What we have now cannot persist without creating blowback and further dysfunctionality.