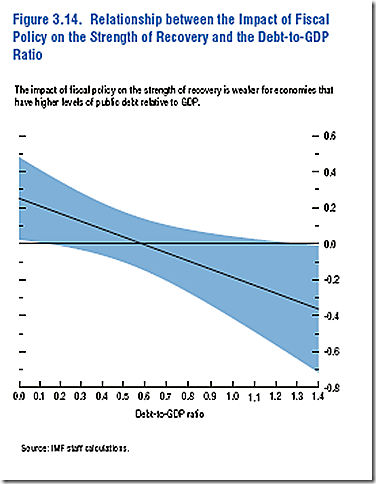

Recently released IMF analysis (via Telegraph) indicates that federal debt/GDP ratios in excess of 60 percent tend to become deflationary black holes.

"The impact becomes negative for debt levels that exceed 60pc of GDP," said the Fund.

While no countries were named, this would raise questions about Japan, Germany, France, Italy and ultimately Britain and the US after their bank rescues.

The IMF said the US is at the epicentre of this crisis just as it was in the Depression, setting the two episodes apart from normal downturns. However, the risks are greater this time. "While the credit boom in the 1920s was largely specific to the US, the boom during 2004-2007 was global, with increased leverage and risk-taking in advanced economies and many emerging economies. Levels of integration are now much higher than during the inter-war period, so US financial shocks have a larger impact," it said.

The IMF said the global financial system is still under acute stress, with output tumbling and inflation falling towards zero in key nations. "The risks of debt deflation have increased," it said.

Abrupt halts in capital flows can have "dire consequences" for emerging economies, it said. Eastern Europe has already suffered the effects, with a 17.6pc fall in industrial production in February. The region is highly vulnerable to the credit crunch since it owes more than 50pc of its GDP to Western banks.

The U.S. nominal GDP is about $14 trillion, the gross federal debt is $10 trillion, or 71 percent (the ratio is 46 percent if debt held by the public is used. (I am not going to go into the issue of which number is “correct,” but the latter is most commonly used.) Neither of these debt figures, both from fourth quarter 2008, include any of the multifarious bailout commitments. Just adding a projected $2 trillion fiscal deficit for 2009 to the debt and assuming no growth in GDP takes the ratio using debt held by the public squarely to 60 percent.

Obama’s budget will tip America into a debt-deflationary downward spiral if the IMF is right. No wonder the American public is slow to warm up to the stimulus plan—and why the public views the banking bailouts as throwing good money after bad.

The American people have a low opinion of government spending and contracting programs. We read creditable stories about missing billions in Iraq and missing trillions throughout the federal budget. We have seen how this administration has furthered Wall Street’s class warfare on the American people in its handling of the banking “bailout.” President Obama looks more and more like a fiscal Manchurian candidate.

So, again, I propose a “middle way”: let the objective be to take care of the American people, not to achieve some figment of “potential output.” The Democrats may have good intentions, but they’re listening to the wrong economists, Keynesians who have been out of power for too long and who now are listening to a scribbler of 70 years ago (that they read in their halcyon graduate school days), a Keynes, most of them seem not to realize, who was preaching to an America that was the largest creditor nation in the world, not the greatest debtor.

Let the economists go yell at China, today’s great creditor nation. China seems to be listening.

IMF links via Econbrowser:

MF World Economic Outlook

- Link to webpage.

- Link to Chapter 3. From Recession to Recovery: How Soon and How Strong? (graph p. 128)

- Link to Chapter 4. How Linkages Fuel the Fire: The Transmission of Financial Stress from Advanced to Emerging Economies (a preview of some results was in this post).

I'm totally with you on the middle way thing. It seems like you hardly hear anyone talk about helping the people. Instead, the crony capitalists and politicians are focused on saving institutions. It's so ridiculous.

ReplyDeleteWith a trillion dollars, the U.S. could have given 30 million unemployed $30,000. The unemployed can then use that money to start new businesses are just get back on their feet. It disgusts me to see so many trillions going to criminal institutions who were the cause of all this mess while the people get nothing.

I say screw the institutions and focus on the people.

Count me amongst the complete and total skeptics on the IMF analysis applying to the U.S.

ReplyDeleteIF the U.S. had to pay interest on its enormous stock of external debt in foreign currencies instead of dollars, then the IMF analysis would apply. But we don't. And there's no sign of "Roosa Bonds" anywhere on the horizon - I think there should be, but there's not.

Btw, nothing above should be construed as any sort of approval of U.S. fiscal or monetary policy - the wasted trillions of dollars of government spending are an abomination and outrage. But as long as the U.S. government can eventually stiff the external debtors (and conservative U.S. savers) by cranking up the Bernanke helicopters, the IMF analysis just reeks of gross and total inapplicability.

MarketBlogic - perhaps. But we have too much total public + private debt already to service, so how is more going to help? Interest rates aren't going to stay down like this forever?

ReplyDeleteMy main point is to focus on supporting the people as a way of getting the most aggregate demand per government buck and restoring some sense of a social contract.

Please don't credit the superior instincts of the American People. The American People, one at a time, signed tens of millions of ridiculous mortgages on overpriced homes and spent their credit cards through the stratosphere. If there is one myth that can be put to rest now, in addition to the myth of efficient markets, it should be that Americans are smart or even capable. All the easy lending and low interest rates on earth should not have convinced anyone to spend 15 years earnings on a house. Americans by the millions were absolute fools, and brought this upon themselves.

ReplyDeletePlease don't forget that mortgage underwriters were greater fools (or villains, take your pick) in OK'ing mortgages on 15x income. Or not bothering to verify income at all. I am not absolving consumers entirely for irrational exhuberance, however the gatekeepers were nowhere to be found for about 5 years.

ReplyDeleteAs for help and bailouts, consider $20 billion, an average amount of money received by said bankers to help them along in this "difficult time". That $20 billion would pay off 200,000 mortgages of $100K each, or some 10 billion pounds of bulk food (rice, beans, etc) for foodbanks around the country, which is 33 lbs of food for every single person in America. Extrapolate that 2/3 of Americans don't need food help--that's 100 lbs of food for each hungry person. Think that wouldn't create some relief in the economy? The $784 billion TARP program would've allowed for an avg write-down or repayment of $200,000 each on 3,920,000 mortgages in this country. Imagine that many households out of distress. What crisis then?

I'd like to add two points.

ReplyDelete(1) At first glance, the argument seems potentially compelling . . . BUT . . . there are two critically important "ifs" in the article that are all too easily overlooked (actually the first one is an "assuming"), and that when attended to, severely dilute the merit of the argument and relegate it to what reads like partisan hyperbole. The referred to conditions are capitalized in the following copy of the lines from the article;

"Just adding a projected $2 trillion fiscal deficit for 2009 to the debt and ASSUMING no growth in GDP takes the ratio using debt held by the public squarely to 60 percent.

Obama’s budget will tip America into a debt-deflationary downward spiral IF the IMF is right."

If each of these conditions are given 50/50 probabilities of their outcome, the situation the article warns us about has a 25% chance of occurring. Seems like much to do about not much at that point.

(2) Basing the immediately following statement - "No wonder the American public is slow to warm up to the stimulus plan—and why the public views the banking bailouts as throwing good money after bad." - on the economic model presented assumes that the American public has some sore in ate economic intelligence, which seems pretty humorous when you stop to realize that you are reading this on a web site dedicated to how we operate on animal spirits. Are we to then infer that our ancient animalistic heritage developed profound capabilities at connecting economic variables that they weren't even truly conscious about?

Thanks for the good humor!

anonymous -

ReplyDeleteGlad you enjoyed the post. I hope you are right about the IMF being wrong. But my working hypothesis is that America is on the way to a big crack up.

Cheers,

Benign