The “animal spirits” or confidence levels of Americans increased slightly in March and are forecast to increase further over coming months. Real economic activity is forecast to bottom in about second quarter and to increase in the second half of the year, although growth is subject to many constraints.

Overall, however, the “animal spirits” of Americans remain near generational lows, by both our measure (black below) and the Michigan survey of consumer sentiment (green; blue is a forecast of “animal spirits”):

(Click on any image for larger image in new window.)

It is our contention that most of observed survey measures of confidence, and indeed most of actual “animal spirits” itself, is a psycho-physiological response of Americans to changes in the unemployment rate, the most important macroeconomic variable to individuals and families, as this changes with respect to what they’re used to, or relative to their adaptation level for the unemployment rate (see this reference):

A = - (U – UMEAN)/Stdev(U)

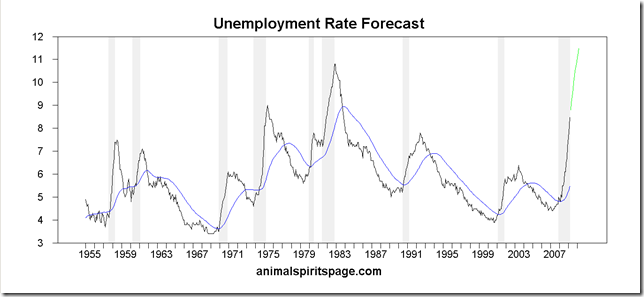

where U is the unemployment rate, UMEAN is its exponential 3-year moving average approximating the adaptation level, and Stdev(U) is a rolling 3-year standard deviation of U. The following forecast of the unemployment rate is not meant to be indicative but rather to demonstrate that confidence levels of Americans will increase largely because they have become adapted to higher levels of unemployment and its volatility, levels higher than even most forecasts (adaptation level is blue, forecast is green):

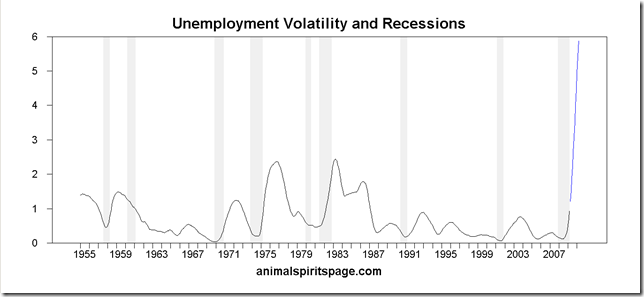

Unemployment volatility is forecast to skyrocket to levels not seen in the “postwar” period:

Labor market turbulence affects Americans more directly and more profoundly than any other kind of macroeconomic turbulence. As the scale upon which American evaluate this most fundamental issue of livelihood widens dramatically, so, I speculate, does the scale of other actions they may contemplate in response to the current situations. This is a polite way of saying that radical actions of all kinds become much more possible once behavior comes unmoored from previous norms.

Between the adaptation level catching up with actual unemployment, and the rescaling of perceptions, the effect of confidence bottoming can be thought of as being “down so long it looks like up to me.”

I note in passing that bond market risk premia measured as the difference between AAA and BAA grades vary closely with inverted A, with the forecast being that risk premia will be decreasing over the short to intermediate term:

A recession forecasting model using the slope of the yield curve from 1-year to 10-year Treasuries and the “animal spirits” metric suggests that the current recession is over. This model provides a “probability” of recession extending 12 months out that is currently bumping along near zero:

The yield curve all by itself is a pretty reliable indicator of trouble a year ahead but the addition of the “animal spirits” variable adds stability to other implementations of similar models (see this reference, and this ). Moreover, from a practical point of view, any model that has made qualitatively accurate forecasts of macroeconomic turning points over the past 50+ years and has forecast the last three turning points from a year ahead in real time, deserves to be attended to. The yield curve was sharply inverted prior to the Great Depression, and returned to normal at the bottom. Here is the long term track record of the present model:

Speculating upon risks ahead, I think the yield curve will give us a reliable indication of the next relapse. If funds become scarce at the short end, pushing short rates up, and the Fed succeeds in pushing long rates down with purchases of long Treasury and other debt (and as risk premia fall as well), any flattening or inversion of the yield curve will probably forecast a recession as serious as the current one. Students of the “postwar” business cycle know that the inflation of the 1960s took several recessions to be wrung out of the system, and the debt explosion 1980-2008 will probably take several credit crises to write off all the bad debt accumulated in several waves of asset inflation.

In sum, we are being granted a reprieve at best, and the worst thing Americans could do is return to business as usual. As I have indicated elsewhere on this site, I have formed the belief that America is heading toward a crisis of revolutionary proportions, during which the very survival of the nation will be at stake, and I hope and pray for a just outcome (see here, here, here, and here).

Viewing and Reading (added April 4, h/t naked capitalism)

Bill Black on Bill Moyers - a must watch

Girding for a Depression – Peter Morici, former Chief Economist at the U.S. International Trade Commission.

One can only hope President Obomba can make course corrections on several fronts quickly, having imbibed the Beltway Kool-Aid.

No comments:

Post a Comment