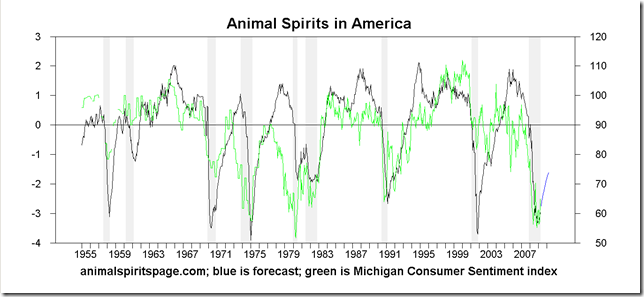

Even if the unemployment rate goes to 11.9 percent over the coming year, the “animal spirits” or confidence levels of Americans are forecast to improve. The bottoming of confidence levels is also seen in the Michigan Consumer Sentiment series.

Our yield-curve-plus-“animal spirits” recession forecasting model shows the recession coming to an end (keep in mind that this model has correctly predicted in real time the beginning and end of the last recession and the onset of this one, and performs similarly on every recession since 1957 in backtesting). The “probability” of negative real growth continuing is nil by these lights.

Note that the model does not foresee a “double dip” within the next 12 months, while it clearly signaled the 1982 relapse. The very severity of the declines of many output variables makes it more likely that they will be able to find a bottom.

More detail on the model is available here.

Discussion: It is very common at the extreme points of economic and stock market cycles to assert that “it is different this time.” The recession forecasting model is a single equation model with parameters estimated on data available before 1990, so for its parameters to change the world would in fact need to be very different in this cycle. That is possible, and we shall soon have the answer. What distinguishes this cycle is its global debt-deflationary aspect, which has exacerbated the downturn everywhere. Countering this, however, is the stated and demonstrated willingness of monetary authorities to provide credit. Commercial and industrial lending slowed after the last two recessions (as I showed here) as businesses and lenders alike become more risk averse. Given the debt load on consumers, businesses and government, the recovery can be expected to be slow. Much of the “real” GDP growth of this decade was financed by a huge and unsustainable run-up in consumer debt, so the country appears to be dropping back to a “pay-go” level of consumer spending (as they say within the Beltway) with some saving.

My personal opinion on the financial sector: the lunatics are running the asylum in Washington. Perhaps because he isn’t a financial person, President Obama brought on board the very actors who opened the Pandora’s box of deregulation, Larry Summers and Tim Geithner. The greatest danger now is that the government throws more good taxpayer money after bad private debts; I subscribe to the IMF view that America is close to a tipping point of debt-deflationary implosion with respect to government spending. It is better to do nothing than to bail out more banks. There are plenty of healthy banks that can meet needs of business as recovery unfolds. It is clear that the big money institutions control this administration, and the people are up in arms about throwing good money after bad, so Congress is letting it all happen under the table, through the Fed and the FDIC. The problem with activist cries like Paul Krugman’s to clean up the mess is who would be doing the clean up. Bad private debts need to charge off, not be added to the public debt at par or something close to it, and private investors need to take the hit. It is these very same private investors who “own” Congress, however.

Long term, it is my surmise that the inequality of the income distribution will continue to cause “failures of effective demand” like the current one. (See this.) A disproportionate amount of money gets sucked out of the economy by the rich, who control the financial system, manipulate the markets, and tell the government what to do. In a society in which personal assets are required for access to education and opportunity, the majority of the population can be kept in a pseudo-meritocratic servitude. Already one third of American students do not complete high school, a characteristic of a feudal society or a banana republic. Nothing President Obama is doing will reverse this, in my opinion; nor will anything less than a total breakdown and renegotiation of the social contract make fundamental change possible. The rich have their hooks too far into the economy and the government for that to happen. Hence I subscribe to the thesis of Strauss and Howe that we’re heading toward a national crisis in about ten years that will define a new America, with a new social contract. The present one is broken. (See here and here for background on Strauss and Howe’s historical long wave theory.) In the meanwhile, over the next decade we can expect to see failures of effective demand like the one we’re in now, over and over again, until we reach the crisis point.

No comments:

Post a Comment