Warning: this is research, not investment advice. You invest at your own risk.

Birds can stay aloft for hours riding thermals or updrafts of warm air. I look at the human responses to adaptation level effects in much the same way. When things are better than what we have in recent memory, we feel good, relatively speaking. The stock market now is riding an emotional thermal upward and may continue to do so for a while. Of course, it is also riding a tsunami of Fed-supplied liquidity that has engendered a new carry trade in paper assets.

My best guess is still that the market will make a final top this winter before entering a multi-year period of turbulence and flat to negative growth as the most severe economic contractions and bear markets tend to occur early in the decade (see this). The current period most resembles 1970, 1974-1975, or 2001-2003.

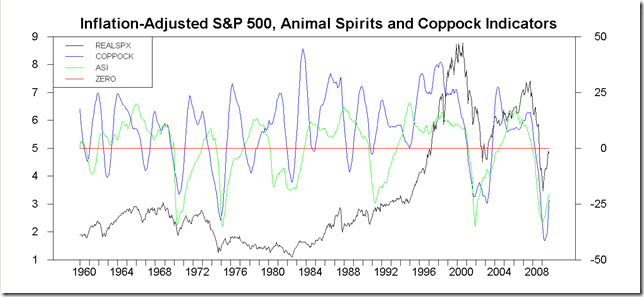

The graph shows my “animal spirits” stock market oscillator and the venerable Coppock Guide, both of which are still coming off impressive bottoms.

Just for kicks, here is the picture if you adjust the S&P 500 by the CPI. We could very easily have another big down leg coming in real terms (using any reasonable price index). Note that it took fourteen years from the 1968 top to hit a final bottom in 1982. A similar interval from the top in 2000 would put our final bottom in 2014, which is consistent with my general view of the current business cycle. It’s also generally consistent with the Great Depression experience. The biggest debt-deflationary collapse is yet to come, and may be “stagflationary” in the event given tightness in critical commodity markets.

No comments:

Post a Comment