By the measure of final sales to domestic purchasers, domestic aggregate demand has not recovered to 2007 levels; the chart shows final sales to domestic purchasers deflated by the personal consumption expenditures deflator:

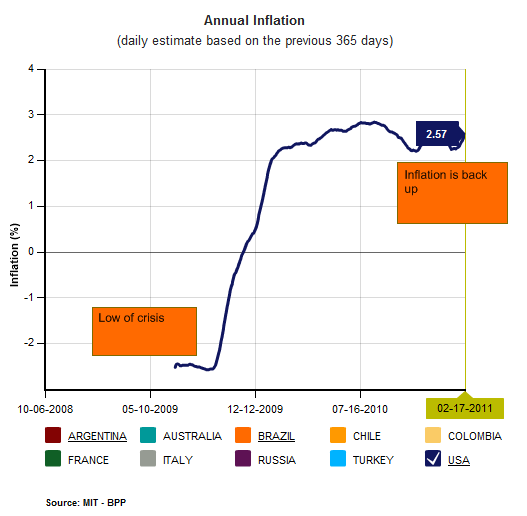

Inflation is running ahead of official estimates, according to credible sources cited here:

What happens next is deflationary stagflation: food and energy prices rise, consumer purchasing power takes a hit, and the constraints on the flow of income contribute to further declines in house prices and other consumable assets.

Overall, the intermediate term—debt deflation, asset price declines, exacerbated by supply shocks to items with relatively inelastic demand.

To get a real wage-price spiral going you have to actually pay people enough to cover inflation and then some, and right now the movement in the labor market is toward bashing labor whenever and wherever possible. This is Bernanke’s and every liberal economist’s wet dream, that we get to inflate our way out of our debt once again, just like the old days.

The difference this time is the debt mountain on our backs. When debts don’t get repaid—because of income insufficiency—asset values fall.

The wild card is war. Throughout history, wars have been associated with inflation, and with a larger role for government in the economy. The mainstream parties, Republican and Democrat, have supported all the recent wars slavishly. Only Ron Paul and the Tea Party oppose more war. Whether they really mean it is a mystery to me. There is a lot of unfortunate baggage that goes along with the Tea Party, but at this time, they are the only movement willing to take on the military-industrial complex and provide real change—for which the American public is hungry, as Obama demonstrated. Whether they could actually accomplish anything given the way Congress works is doubtful to me. It would take a sweeping repudiation of the mainstream parties, and the Tea Party so far seems to be traditional Republicanism in sheep’s clothing (financed by the Koch brothers, etc.).

The system is currently dysfunctional. We are entering a crisis episode in which new rules of the game will emerge, one way or another. I believe in peaceful protest. Egypt was inspiring in this regard.

Peace.