From those to whom much has been given, from them much shall be expected. -- Luke

Wednesday, August 31, 2011

25 Signs That The Financial World Is About To Hit The Big Red Panic Button

Nice compendium with good links. Sentiment is still so bearish the market may yet rally in the historically weakest month of the year....

This is not investment advice. You trade at your own risk, unlike the Wall Street banks, who also trade at your risk.

Tuesday, August 30, 2011

Bruce Bartlett: The Case Against a Payroll Tax Cut - NYTimes.com

How about just taking the income cap off and leaving the tax cut in place? It's a flat tax that conservatives should be able to support, right? My guesstimate is that taking the income cap off would increase revenues.

Monday, August 29, 2011

Laura D'Andrea Tyson: Recovering From a Balance-Sheet Recession - NYTimes.com

This whole thing is worth a read. When unemployment is concentrated among the less skilled, doesn't it make sense to launch public works infrastructure programs, as FDR did? Can it be done without the pork all ending up in the hands of rich friends of Barack?

If the Tea Party has its way, we have some pretty big pot holes in our future.

Hussman - A Reprieve from Misguided Recklessness [Please!]

On this note, it is critical to remember that nearly all financial institutions have enough capital and obligations to their own bondholders to completely absorb restructuring losses without customers or counterparties bearing any loss at all. So keep in mind that the debate here is not about protecting customers or counterparties - it is really about whether the stockholders and bondholders of banks and other financial institutions should bear a loss. The "failure" of a bank only means that existing stockholders and bondholders are disenfranchised - the company simply takes on a new life under new ownership. Existing stockholders lose everything, unsecured bondholders typically lose something, and senior bondholders get any residual obtained as a result of the sale or transfer of the company. If the global economy is fortunate, the financial system two or three years from now will look much the same as it does today, but the ownership and capital structure will have changed almost entirely. A major restructuring of debt is the clearest path to long-term economic recovery, and the accompanying losses to those who recklessly made bad loans would be the highest realization of Schumpeter's idea of "creative destruction."

From that perspective, Warren Buffett's $5 billion investment in Bank of America preferred stock last week was essentially a defense of the old guard. Buffet observed, "It's a vote of confidence, not only in Bank of America, but also in the country."

Yes - to be specific, it's a vote of confidence that the country will bail out Bank of America in any future crisis. We should all hope that Buffett's investment is successful - provided there is no future crisis - and we should equally hope that Buffett loses the entire investment otherwise."

The monetary madness continues. Hussman's statistically infallible indicators of recession indicate we're already in one; see also Mish here citing the work of several others.

See also Barry Ritholtz's article on the banking crisis at A how-to guide for fixing America’s banks

I will do an "animal spirits" update Friday if the unemployment rate is published. I don't think we've seen the downward acceleration phase of the alleged current recession yet.

Sunday, August 28, 2011

Saturday, August 27, 2011

The slow disappearance of the American working man

The bottom line: As women saw workplace gains in recent decades—68 percent of those 25 to 54 have jobs—men's prospects have diminished."

The numbers behind the headline numbers.

Friday, August 26, 2011

Education & class: can you say “indentured servitude”?

While it is well known that “education pays,” at least for the seasoned worker, the barriers to entry into well-paying jobs are being raised. The popping of the student debt bubble promises to be extremely unpleasant, with many heavily indebted graduates entering a state of virtual indentured servitude. Like health care, education in America seems to be only for those that can afford it. The ruling class tightens its grip on the country.

A few excerpts from articles worth reading in their entirety:

Student debt in America will surge past $1 trillion next year and has already surpassed credit card borrowing, promising to turn out the most hocked generation of college graduates in history.

http://moneywatch.bnet.com/retirement-planning/blog/bank-dad/students-in-debt-1-trillion-hole-and-more-dropouts/740/#ixzz1W9OR3MSEStudent loans are tough. They can follow you for a long time after graduation and can be hard to manage with other debts you take on. Generally, you can't get rid of student loan debt in bankruptcy. This is non-dischargeable debt, which means it remains after bankruptcy and you must pay it.

However, there is one exception you should know about. Some student loans may be considered an undue hardship, and can be discharged, or eliminated, if the loan payments put an extreme burden on you or your family.

Show Your Hardship to the Bankruptcy Court

The first step to filing for undo hardship is to file a separate motion with the court and then meet with the judge to explain your hardship. This isn't easy to do. You have to show three things to prove undue hardship:

- That in your current situation, you can't maintain a minimum standard of living and repay your loans

- Your bad financial situation is likely to continue

- You made honest efforts to pay off the loans

It's almost impossible to show undue hardship unless you're physically unable to work and your situation isn't likely to improve in the future. So, if your student loans make up most of your debt, it probably isn't wise to attempt this unless you're disabled.

In the past, some privately funded student loans could be discharged in a Chapter 7 bankruptcy. However, the law changed with the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005. Now, any education loan that qualifies for a tax deduction is non-dischargeable, unless you show "undue hardship."

http://bankruptcy.lawyers.com/consumer-bankruptcy/Student-Loans-In-Bankruptcy.htmlJust like the labor force as a whole, recent college graduates have seen a near doubling of their unemployment rates. This pattern is similar to the labor market experience of recent college graduates during the cyclical recession of 2001.

http://www.frbsf.org/publications/economics/letter/2011/el2011-09.htmlNow evidence is emerging that the damage wrought by the sour economy is more widespread than just a few careers led astray or postponed. Even for college graduates — the people who were most protected from the slings and arrows of recession — the outlook is rather bleak.

Employment rates for new college graduates have fallen sharply in the last two years, as have starting salaries for those who can find work. What’s more, only half of the jobs landed by these new graduates even require a college degree, reviving debates about whether higher education is “worth it” after all.

“I have friends with the same degree as me, from a worse school, but because of who they knew or when they happened to graduate, they’re in much better jobs,” said Kyle Bishop, 23, a 2009 graduate of the University of Pittsburgh who has spent the last two years waiting tables, delivering beer, working at a bookstore and entering data. “It’s more about luck than anything else.”

The median starting salary for students graduating from four-year colleges in 2009 and 2010 was $27,000, down from $30,000 for those who entered the work force in 2006 to 2008, according to a study released on Wednesday by the John J. Heldrich Center for Workforce Development at Rutgers University. That is a decline of 10 percent, even before taking inflation into account.

Of course, these are the lucky ones — the graduates who found a job. Among the members of the class of 2010, just 56 percent had held at least one job by this spring, when the survey was conducted. That compares with 90 percent of graduates from the classes of 2006 and 2007. (Some have gone for further education or opted out of the labor force, while many are still pounding the pavement.)

Even these figures understate the damage done to these workers’ careers. Many have taken jobs that do not make use of their skills; about only half of recent college graduates said that their first job required a college degree.

The choice of major is quite important. Certain majors had better luck finding a job that required a college degree, according to an analysis by Andrew M. Sum, an economist at Northeastern University, of 2009 Labor Department data for college graduates under 25.

Young graduates who majored in education and teaching or engineering were most likely to find a job requiring a college degree, while area studies majors — those who majored in Latin American studies, for example — and humanities majors were least likely to do so. Among all recent education graduates, 71.1 percent were in jobs that required a college degree; of all area studies majors, the share was 44.7 percent.

http://www.nytimes.com/2011/05/19/business/economy/19grads.html

SACSIS.org.za » News » The World » Why Iceland Should Be in the News, But Is Not

The EU would seem to be in deep doo-doo.

Thursday, August 25, 2011

The Cause Of Riots And The Price of Food - Technology Review

If we don't reverse the current trend in food prices, we've got until August 2013 before social unrest sweeps the planet, say complexity theorists"

Monday, August 22, 2011

Big trouble ahead - macrobusiness.com.au | macrobusiness.com.au

Very nice summary of the global financial mess, and the reasons some of the best minds are pessimistic. The focus on aggregate demand rather than distribution is unfortunate, but that reflects the dominant economic paradigm. The world is awash in excess supply....

Friday, August 19, 2011

Study shows powerful corporations really do control the world's finances

Using data obtained (circa 2007) from the Orbis database (a global database containing financial information on public and private companies) the team, in what is being heralded as the first of its kind, analyzed data from over 43,000 corporations, looking at both upstream and downstream connections between them all and found that when graphed, the data represented a bowtie of sorts, with the knot, or core representing just 147 entities who control nearly 40 percent of all of monetary value of transnational corporations (TNCs).

Wednesday, August 17, 2011

Tax the super-rich or riots will rage in 2012 - Paul B. Farrell - MarketWatch

Listen to that hissing: The fuse is rapidly burning, warning us. Wake up before the rage explodes in your face. This firestorm is endangering America’s future. From forces outside, yes. But far more deadly, from deep within our collective psyche. We have lost our moral compass. We are self-destructing.

Crackpot warning? No. This warning comes from the elite International Monetary Fund. A recent IMF report looked at 'the causes of the two major U.S. economic crises over the past 100 years, the Great Depression of 1929 and the Great Recession of 2007,' writes Rana Foroohar, an economics editor at Time magazine.

'There are two remarkable similarities in the eras that preceded these crises. Both saw a sharp increase in income inequality and household-debt-to-income ratios.' And in each case, 'as the poor and middle-class were squeezed, they tried to cope by borrowing to maintain their standard of living.'"

Economic History 101, The Distributional Dynamics of Revolutions. A fine rant by Paul Farrell, who has brought views put forth by this blog for years into the mainstream.

Sunday, August 14, 2011

Mainstream Economist: Marx Was Right. Capitalism May Be Destroying Itself | AlterNet

The "mainstream economist" is Roubini. As I've said in the past, the "immiseration of the proletariat" was not supposed to happen because "a rising tide lifts all boats." The latter was true when there was some modicum of decency governing what management and traders took out of their companies and the economy. No longer.

The big question now is whether the nation-state has the ability to tell multinational corporations what to do, or will they be blackmailed with threats to "do what we say or we'll take it all offshore."

That's where the front lines are.

Saturday, August 13, 2011

It's the Economy, Dummkopf! | Business | Vanity Fair

With Greece and Ireland in economic shreds, while Portugal, Spain, and perhaps even Italy head south, only one nation can save Europe from financial Armageddon: a highly reluctant Germany. The ironies—like the fact that bankers from Düsseldorf were the ultimate patsies in Wall Street’s con game—pile up quickly as Michael Lewis investigates German attitudes toward money, excrement, and the country’s Nazi past, all of which help explain its peculiar new status."

Incredible reporting on how Wall Street dirt-bombed the Euro, to protect the dollar's reserve status and to make a lot of money for a bunch of fraudsters good at lying. Who can you trust anymore?

Friday, August 12, 2011

Consumer confidence crashes

The last two times we saw this configuration (1972 and 1980) the economy went into recession—growth accelerated downward—within a year.

Consumer Confidence Plummets To May 1980 Level | ZeroHedge

Can the Middle Class Be Saved? - Magazine - The Atlantic

The Great Recession has accelerated the hollowing-out of the American middle class. And it has illuminated the widening divide between most of America and the super-rich. Both developments herald grave consequences. Here is how we can bridge the gap between us."

Thoughtful analysis that implies the development of a class society in America.

Income inequality is bad for rich people too - Glenn Greenwald - Salon.com

Yves does a nice job summarizing some of this research, that I have covered in the past. See also the references (including a great video) here

Thursday, August 11, 2011

This is not investment advice

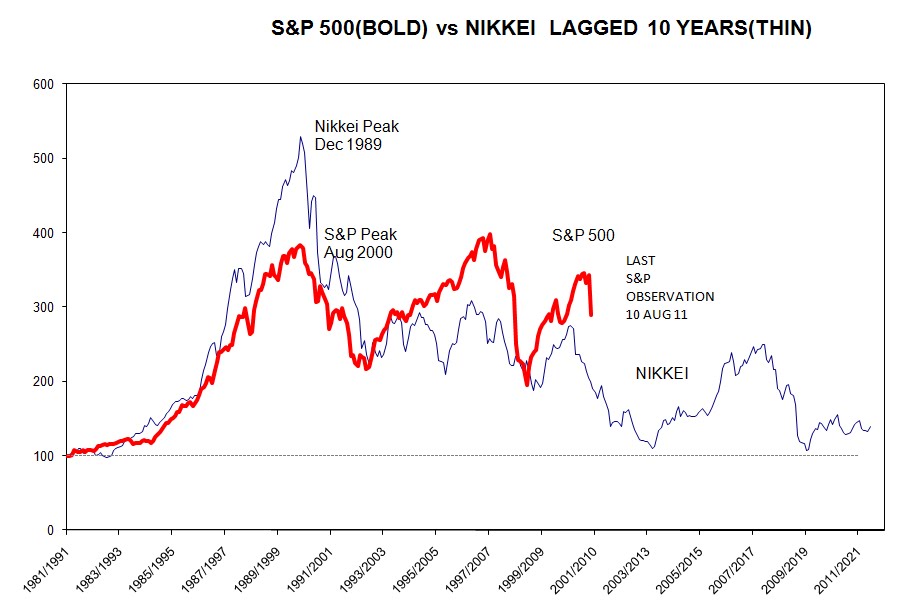

The first chart is from www.angrybear.com, the second from www.stockcharts.com.

This is research, not investment advice. You trade at your own risk, unlike the Wall Street banks, who also trade at your risk.

The S&P 500 is about to make a “death cross” when the 50 day moving average crosses below the 200 day moving average. Downward momentum could easily build.

Wednesday, August 10, 2011

When will confidence finally fail?

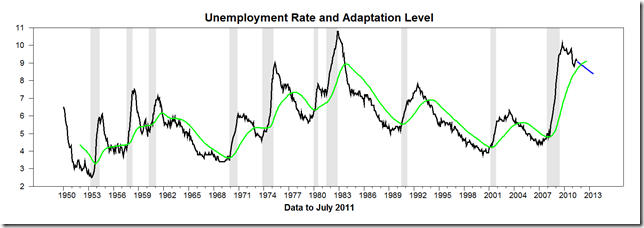

It is the hypothesis of this web site that the entrance into recession is most distinctly characterized by the crossing of the unemployment rate above its recent exponential moving average.

Now if the unemployment rate trends downward as forecast by the blue line, there will be a secular exhilaration, even as survey measures like the Michigan series are still very low; this was the case in the early ‘Seventies. We could have a few quarters of slow but positive economic growth.

Recall that our confidence measure is given by A = – (U – UMEAN)/Sigma(U).

Here’s a close-up of what would drive a (weak) secular exhilaration:

However, given the wave of fear sweeping the globe, how likely is it that businesses will add enough to employment—even with labor force participation rate trending down—to lower the unemployment rate? At this point, there might be a yin-and-yang, goal-gradient-climbing desire for a return of confidence (as Baby Boomers hope desperately for growth in their retirement portfolios), but methinks it will be dashed by several months of increasing unemployment rate reports, in which case we will fall into a “double dip” as we did in the early ‘Eighties. Why should this one number hold such power over popular psychology? Because since the Great Depression, it has been the focus of most macroeconomic policy.

However, any such turning “positive” of our “animal spirits” measure between now and election time is likely to be as short-lived as was the early ‘Seventies upturn, which ceased almost immediately with the reelection of President Nixon—whose pathetic economic policies, including wage and price controls and taking the U.S. off the gold standard and throwing the world into the chaos of Bretton Woods II, are yet another indication that our political parties stand for absolutely nothing other than pork.

Any increases of the unemployment rate in the current environment will be truly “high-powered” in determining when confidence will “finally” collapse in this cycle.

Just to be perfectly clear

Another two or more years of ZIRP (zero interest rate policy) is a subsidy to banks carrying bad debt at inflated “extend and pretend” values permitted by today’s phony accounting.

The Fed is willing to bleed the rest of the American economy to subsidize the banks.

The “bad banks” will not “grow solvent” as a result of this policy. The enormity of the bad debt is simply too great.

ZIRP hasn’t helped the economy yet, so why should it going forward?

However, those who fear inflation in the intermediate term are premature. Bad debts don’t get repaid, they only get papered over until their failure is so absolutely plain to see it can’t be covered up any more…. Deflation lies between now and the future Great Inflation.

Which is why we’re probably in for another round of “quantitative easing” in which the Fed buys bad debt from weak banks and hides it away where bad debts never see the light of day.

At this point, some of the Modern Monetary Theory solutions to our problems seem actually attractive. Why shouldn’t the Fed write off (i.e., charge off, write down to a zero value) the U.S. Treasury debt it holds. That’s not a default, it’s more like the kind of favor rich people do for each other (as when the board of a Colorado savings and loan “charged off” a $100,000 loan to a son of George H.W. Bush).

We’ve been here before. The Fed pursued a ZIRP in the 1930s. It didn’t end well.

See also the estimable Joseph Stiglitz’s four-part solution to our problems here.

Tuesday, August 9, 2011

Upper-class people less empathetic than lower-class people: study | The Raw Story

'What I think is really interesting about that is, it kind of shows there’s all this strength to the lower class identity: greater empathy, more altruism, and finer attunement to other people,” Keltner said.

“One clear policy implication is, the idea of nobless oblige or trickle-down economics, certain versions of it, is bull,' Keltner added. 'Our data say you cannot rely on the wealthy to give back. The ‘thousand points of light’—this rise of compassion in the wealthy to fix all the problems of society—is improbable, psychologically.'"

Matt Stoller: Standard & Poor’s Predatory Policy Agenda « naked capitalism

It was a critical blow. S&P’s move meant Georgia lenders would have no access to the securitization money machine; they would either have to keep the loans they made on their own books, or sell them one by one to other institutions."

These slime are now responsible for a new cascade of fear that may prove to rival the fear inspired by the death of Lehman.

Saturday, August 6, 2011

Comment on the S&P downgrade

Could we have a more obvious example of a rating agency serving its oligarchic Wall Street masters more servilely?

S&P participated in the massive frauds of the real estate boom, certifying junk as AAA, and enabling Wall Street to dispossess many Americans of their homes at taxpayer expense after having profited from the pump-and-dump (and short, in some vile cases), so why shouldn’t they enable their masters to further enhance their relative social and financial position by sending the remains of the American middle class into old-age serfdom? www.angrybear.com has the best data on Social Security, and it says the system if funded for decades to come if Treasury obligations are honored. Moreover, relatively small changes to the payroll tax, like taking the ceiling off, would render the system solvent indefinitely, if I am not mistaken.

Obama should strike back, and take S&P to court for fraudulent activities during the real estate fraud boom. It’s time to put the rating agencies completely out of business.

S&P should have downgraded the entire Bretton Woods II monetary system.