The Panic of 2008 is over. American confidence levels will rebound early in 2009 from generational lows as Americans become adapted to the new realities of the economy. Americans will feel as if they've "been down so long it looks like up to me."

This forecast includes unemployment rate, yield curve and Michigan consumer sentiment series data to month-end January.

The forecast is for a return to positive real GDP growth likely to be slow. The model has been accurate in back-testing for over 50 years and has called the last two turning points in real time well ahead of consensus.

The "animal spirits" of Americans can be modeled accurately by

A = - (U - UMEAN)/Stdev(U)

where U is the current unemployment rate, UMEAN is an exponential moving average over the past three years, and Stdev(U) is the standard deviation of U over the past three years. This measure correlates highly with the Michigan consumer sentiment index (green; blue is forecast based the unemployment rate forecast below).

"Animal spirits" hover at very low levels. However, continued increases in unemployment will have little negative effect on confidence. We are at or very near the nadir of "animal spirits" for this cycle that typically coincides with the end of the recession. A close-up shows that the Michigan series, which tends to lead the “animal spirits” indicator slightly, has turned up briefly recently.

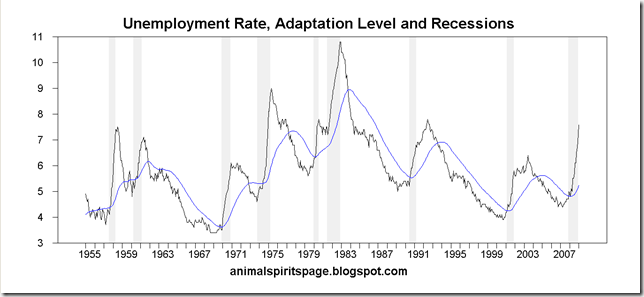

To understand why we are at or within a few months of the confidence low it is important to understand that after rises in the unemployment rate, people get used to it. In the 1980s, when unemployment began to drop from its highs over 10 percent, confidence soared. The adaptation level is now catching up with the current rate. Other things equal, confidence will increase as the difference between the two decreases. The blue line below is the adaptation level.

The blue line below represents a one-year unemployment rate forecast, which is not meant to be indicative, but to gauge the response of “animal spirits.”

The other thing impacting confidence in the model is how much volatility people are used to. In part due to excessively accommodative efforts to "stabilize" the American economy in recent years, unemployment volatility fell to very low levels. The risk of over-insuring a society is that it loses the ability to respond coherently to perturbations. The blue line in the graph below represents what will happen to volatility over the next 12 months if unemployment rises to over 9 percent over the next 12 months as shown above.

The net result of the adaptation level rising to catch up with current unemployment and volatility rescaling perceptions of the gap between adaptation level and current unemployment is that even if unemployment increases as shown to over nine percent in 2009, confidence will turn up. And this generally signifies the end of a recession in the American economy.

The "animal spirits" variable can be combined with the slope of the yield curve, a powerful forecasting tool in its own right, to create a recession forecasting model that gives an estimated "probability" of a recession occurring from a full year in advance without forecasting any explanatory variables. This model has forecast the onset of the last two recessions in real time well ahead of the consensus of professional economic forecasters, and now forecasts an end to the current recession in early 2009. The model was featured in Nature's prestigious Science News column in August 2001 when it was forecasting a recession and the consensus was not; see references. Here is the current recession “probability” forecast (blue)—no recession in sight:

This model has an excellent record over the past 55 years as the next graph shows.

The model's forecasts are qualitative, of the sort generally found most useful by practical people. As one of my professors in graduate school used to say, "It is better to be approximately correct than precisely wrong." There is a rough proportionality between the size of the forecasted recession's probability and severity of the ensuing recession, but not much should be made of this in light of the current global slump in economic activity. The parameters of the model worked well over the postwar period, but the parameters may have changed. If there is a recovery in GDP growth in 2009, it will be from a far lower level for the simple reason that much of recent GDP (especially consumption) was debt-financed, and much of that isn't happening any more (“home equity ATM”). The best we can expect is an "L-shaped" recovery at a much lower run rate of GDP in 2009, probably. But a depression does not seem to be in the cards.

The unemployment rate will probably remain elevated for some time as it has tended to lag the cycle the last two cycles. In the opinion of this commentator, the government should make income support for the involuntarily unemployed its top priority. Most are the victims of a systemic credit crisis not of their own making. Also, income support to the unemployed is guaranteed to be spent. It will enter the spending stream faster than any other fiscal stimulus. Extending unemployment insurance benefits is not enough. There needs to be a livable poverty-level dole for the unemployed.

The forecast also draws into question the treatment of debt and deficit problems by policy makers. First, it suggests, at least in the classical terms of “counter-cyclical stimulus,” that the stimulus will be mistimed. The long lags in the stimulus package and the relatively little support for the unemployed are serious flaws. If Americans could face the fact that there is “enough for all” if Americans would learn to share (especially the plutocrats who have been draining the country’s wealth at such a high rate), everyone would be fine. We are still one of the richest countries in the world.

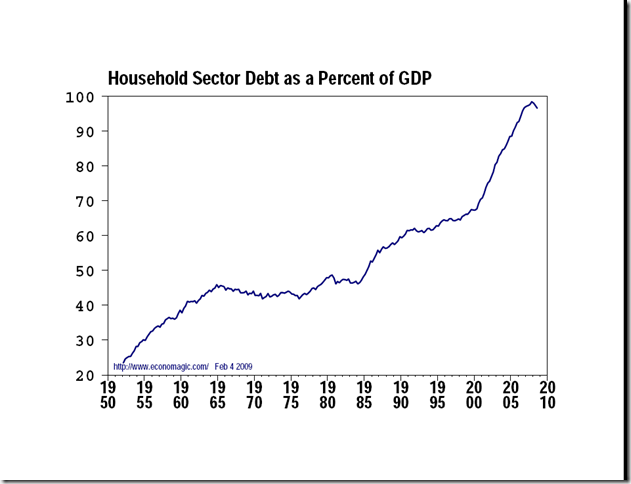

Second, it appears the United States has too much debt; our national debt-to-income ratio is at or near record highs.

Much of this debt is in the household sector, which is having trouble paying it back.

Corporations, instructed by modern finance, have also piled on the debt. Somewhat surprisingly, compared to some other developed countries, our federal government debt is less than 100 percent of GDP. However, it has doubled as a percent of GDP since 1980 when Reagan and “supply-side economics” put in the first of many tax cuts without spending reductions.

But we have more debt than we can pay back, in the view of many, which leaves the question: On which debt should we default? And how, explicitly or through inflation?

I submit that the current efforts to tidy up the private bad debts of plutocrat-run financial institutions on the backs of taxpayers are exactly counter-productive, as for the foreseeable future the creditworthiness of U.S. Governments (bonds) is instrumental to the financing of our government and trade deficits. We need to write off a large amount of private debt to get the country’s debt-to-income level back to something sustainable. The banking bailouts are going to put the onus for paying back these bad private debts on exactly the wrong obligor, the U.S. Government and its squeeze, the American taxpayer.

The American economy is beginning a massive structural adjustment from a largely debt-financed consumption-led economy with zero or negative household savings to a government-investment-led economy, with a significantly smaller share of GDP probably going to consumption. In a consumption-based economy, business investment is a “derived demand” from the demand for consumer goods. In the current situation, we’re seeing a great example of multiplier-accelerator interaction, as paused consumer spending impacts business spending with a bang. The good news is that multiplier-accelerator interaction operates both ways.

Massive structural adjustments take time. So estimates of “required stimulus spending” to hit some level of GDP or unemployment by back-of-the-envelope calculations using questionable multipliers from even more questionable econometric models that have, in aggregate, missed every turning point in the postwar period—this is all highly suspect activity.

Stimulus spending should inject government investment to replace lost consumption and its derived business investment demand, sure, but we don’t really know how to do this--we need to slow down. If we are going to share the sacrifice, it makes a lot more sense to take care of the people who are hurting mostly through no fault of their own and plan our next moves carefully. There is enough to go around. The rate of growth of government debt is beyond the capability of anyone to grasp. We need to be more careful. Our policymakers have been operating in panic mode and that needs to stop.

And what about China? What about the massive amounts of money the U.S. borrows every year from its trading partners, now about to shoot skyward? Will they want to lend to us? So long as the dollar remains a viable reserve currency, maybe they will, even if they lose holding it—but maybe they won’t. Will Uncle Sam need to sow chaos in Europe or Japan to knock out the Euro or yen? This is George Friedman kind of thinking. Do we really want to do that?

The American people need to set up a hue and cry for things they need:

- health care for everyone

- income support for those that need it

- carefully monitored government investment in infrastructure, education and energy

- getting rid of tax cheats and pawns of the plutocracy (Wall Street types whose primary loyalties are to Wall Street) in the government

You do this by calling your Congress people and emailing them and basically screaming your head off. They are near deaf but can hear a loud noise. Why President Obama is listening to people like Larry Summers or Bob Rubin and Geithner, architects of the regulatory fiasco that produced this crisis, suggests that being inside the beltway is too much for him to handle and that he’s caving under the pressure from the plutocracy.

Pray that President Obama can deliver on the promises of accountable government and social justice that got him elected.

And then scream your head off.

Otherwise, we are indeed a banana republic with nukes, and we’re going try the old Vietnam trick of inflating our way out of our debt, throwing gasoline on the fire, while beefing up for the Big Oil War in ten years or so, when our greenback will be toilet paper and we’ll have to go steal what we need, using the military bases George II built in Iraq, with an army drawn from our sons and daughters.

Let’s not go there.

Addendum: the non-partisan Congressional Budget Office estimates that the stimulus bill approved today will actually do more harm than doing nothing over the next ten years.

References

Middleton, E., ‘Animal spirits’ and expectations in U.S. recession forecasting, http://arxiv.org/abs/nlin/0108012, 8 August 2001. This paper provides citation for Middleton (1996) "Adaptation level and 'animal spirits'", JEconPsych.

Ball, Philip, “Hard times ahead: depressions caused by lack of economic confidence might be predictable,” Nature, http://www.nature.com/news/2001/010815/full/news010816-12.html, 15 August 2001.

No comments:

Post a Comment