The natural pulse of the postwar economy has been staggered by the debt-deflation resulting from the crash of asset values over the past couple of years. The business cycle is driven by “animal spirits,” inventory accumulation and decumulation (less so recently with aggressive inventory management) and Von Mises-Minsky-type credit dynamics. The current slump resulted mostly from a collapse of “animal spirits” and credit overextension. While my models forecast the onset of the current recession from over a year in advance, they don’t forecast severity, so I had only the knowledge of the inflation of asset values, especially housing, worldwide, and the over-leveraged state of the consumer contributing debt-financed consumption spending to inform an intuition that the slump would be considerably worse than average.

Given the international collapse of trade flows and asset values, the question now is whether the heart of the world’s largest economy will begin beating again. So far, the survey measures confirm my model’s forecast from early in the year of a turn in “animal spirits” or confidence levels, measures that have tracked output closely in the past. But the turn in output is not yet evident. Although no longer the largest sector, industrial production, a monthly series, tends to turn up at the end of NBER recessions, and it has not turned (as of May; note log scale):

Click on graph for larger image in new window.

I expect that sometime next year the NBER will tell us the recession ended in mid-2009.

Recall that “animal spirits” are given by

A = – (U – UMEAN)/Stdev(U)

where A is “animal spirits,” U is the unemployment rate, UMEAN is a 48-month exponential moving average of U, and Stdev is a 48-month standard deviation of U (reference). Given a worse than consensus unemployment rate forecast, however, “animal spirits” are still forecast to rise over the next 36 months, tracing out a typical business cycle expansion from the “animal spirits” point of view, although demand is likely to be constrained by the excessive debt load of consumers and a new frugality in spending and saving:

Click on graph for larger image in new window.

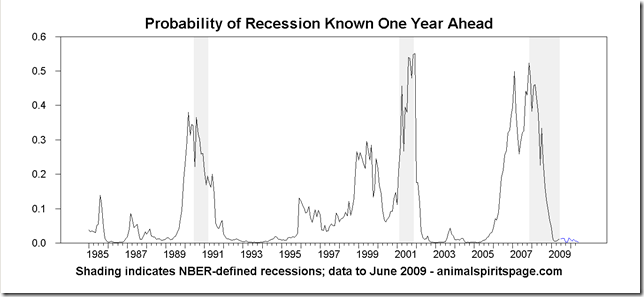

The 1/10 yield curve remains positively sloped. The yield curve plus “animal spirits” recession forecasting model shows no “recession” in sight over a one-year horizon:

Click on graph for larger image in new window.

So while it is clear that credit constrains the world economy in ways not seen since the 1930s, the important “animal spirits” driver has turned up in America and can be expected to be turning up worldwide for similar adaptation level theoretic reasons. By visual examination of the “animal spirits” graph, it appears the next recession might fall in about 2014. From an electoral standpoint, the situation in 2012 resembles 1992, as confidence levels approach “zero” or a neutral level, not quite into “positive” emotional territory. George H.W. Bush lost in 1992 under similar circumstances as Bill Clinton crowed, “It’s the economy, stupid.” Voters in 2012 are not so likely to forget that it was fiscal and monetary imprudence under the last Republican administration that was the proximate cause of the current collapse, however. My guesstimate is that real GDP growth rates over coming years will be in the 1+ percent range.

Risk premia declined significantly over the past month as measured by the Baa – Aaa spread and can be expected to continue to decline:

Click on graph for larger image in new window.

How will this cycle end?

American fiscal policy is geared for a 1930s-type depression, when America was a great creditor, and is adding debt to an already unmanageable total nonfinancial debt load. In a strikingly un-Democratic way, fiscal authorities are channeling government spending through a vast array of questionable “projects” while unemployed Americans still have no access to a livable European-style dole or health care. I credit the administration with making health care their first priority. I would limit fiscal largesse to taking care of the unemployed. They will spend the money. Minimize additions to federal debt. Let the private economy and the state and local authorities solve their own problems. The Soviet Union taught us centralized planning doesn’t work, and mainstream macroeconomists brought us this mess.

Monetary authorities with no experience in lending have decided not to recognize losses (“the first loss is the best loss”) and have instead gone to the Treasury with hat in hand, adding the bad debts of financial speculators with Wall Street connections onto the backs of the American taxpayers. Pathetically, top strategists at the Fed talk about inflation as a way of “rebuilding balance sheets.” But asset values have yet to reach long term levels relative to earnings and income. Reflation won’t work. As I pointed out elsewhere, historically the best way to get an inflation going is to have a hot war, so at some level, conscious or unconscious, the Fed and Treasury are asking for war.

Hence, it is possible that the greater deflation is yet to come, maybe in the next slump as bond markets finally recoil at the prospect of a stagnant American economy with exploding debt. Early in the next decade any military challenge to America, real or imagined, is likely to provoke a disproportionate response, as the military-industrial complex offer their “solution” to a stagnant economy and high unemployment. Chaos abroad also makes the dollar more attractive. It is at this point that high or hyperinflation becomes thinkable.

If monetary and fiscal authorities worldwide mimic the American authorities and make the bad debts of speculators the obligations of taxpayers—and peace reigns—a prolonged deflation into neo-feudalism is likely, and the next dark age begins. The international ruling class wins.

It is my view that the cause of capitalistic depressions is an increasingly unequal distribution of income and wealth driven mostly by privileged access to leverage and information (see this). All the money gets sucked up into one corner of the economy and aggregate demand sputters. The massive amounts of wealth that have flowed from the rest of the economy to Wall Street in the past several decades can be considered a form of larceny from this viewpoint, as the markets have increasingly become a shell game for relieving savers of their assets (see this).

I believe America is heading toward a renegotiation of its social contract, top to bottom, over the next decade or more, as Strauss and Howe forecast. I hope it is consistent with American ideals, not with current realities (see this and this for background).

Peace.

No comments:

Post a Comment