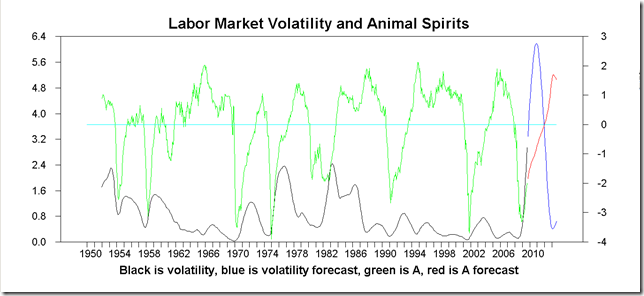

Not because the fundamentals of the economy are better, but because people are becoming accustomed to the higher unemployment rates (rising adaptation level), some degree of confidence is returning to American consumers, although they are still in technically “depressed” territory because the current unemployment rate at 9.8 percent is above the current adaptation level of 6.4 percent. Recall that my formula for imputed “animal spirits,” A, is

A = - (U – UMEAN)/Stdev(U)

over a recent four-year period, where UMEAN is an exponential weighted average.

Click on graphs for a larger image in new window

The primary distinguishing feature of this slump is the credit crisis. But not everything is different this time, to coin a phrase. “Animal spirits” still drive economic activity to a large degree, and inversions of the yield curve (perhaps as reflections of expectations) accurately signal “recessions” as defined by the NBER, what ordinary folk call business cycle slumps, troughs, depressions or panics. My model predicted this past slump in 2006, and the previous recession in 2001, both at times when the majority of professional forecasters were predicting “no recession in sight.”

So it is with a bit of irony that I report that my “animal spirits” plus slope of the yield curve recession forecasting model is saying “no recession in sight.”

That little blue squiggle near the zero line extending a year into the future represents the “probability of recession” over the coming year. It is negligible, in the NBER-defined sense of recession. The components of output they look at will probably turn upward and show positive growth rates. Unemployment will continue to climb for about a year, and there will be no reform of the financial institutions that created this mess. Wall Street is squarely to blame. Barry Ritholtz and Andrew Ross Sorkin have books out that do a good job describing how. Our entire monetary system is compromised, our financial markets manipulated at a prima facie level beyond dispute (e.g., Goldman Sachs and Morgan Stanley, now “banks,” can borrow at a zero interest rate from the Fed in a carry trade and turn around and speculate with taxpayer money); our Congress and President are totally flaccid in the grip of Big Money.

I expect, with others, that the United State of America is heading toward a major crack-up that will change the way we live permanently. Whether the rich and their mercenaries take over the country and subject the rest of the populace to a form of neo-feudal servitude (likely the result here and in China), or whether there will be a splitting up of the American states (unlikely), or whether there will be a “revolution” and a new government put in place (possible), who knows? But the additions to debt that Congress and the President are blithely talking about—coming on top of existing indebtedness—will bankrupt the US and destroy the value of its currency, so a hand-to-mouth existence for many is entirely possible.

As Proverbs says,

He who oppresses a poor man insults his Maker,

but he who is kind to the needy honors him.

The fate of America depends largely on the wisdom of the wealthy, who have feathered their nests so well since Reagan (symbolically, at least) began the movement toward false wealth (debt) for the majority, lower taxes and massive worldly wealth for the tiny upper crust. It is the now-inbred arrogance of the American “aristocracy” (oligarchy?) that makes me think the best near-term remedy for what ails us would be to raise marginal tax rates on incomes over a million dollars to something like 75 percent—to bring these knuckleheads down to earth and make them realize they breathe the same air the rest of us do. Man up, Congress! Man up, Mr. President! And this is coming from a quasi-libertarian classical liberal! There is no escaping the state; there will always be a state; the question is what do we want it to do.

I still expect a greater collapse to come after the next Presidential election, in about 2014. It may come with war. Our Federal Reserve is on record stating that some inflation would be good for us. But they have the problem that excessive debt, debt that doesn’t get repaid, causes deflation, not inflation, as we’ve seen in real estate. Historically, a hot war is the best way to get an inflation going. The secret hope of the Federal Reserve is that the rest of the fiat money central banks in the world, many in as bad shape as ours, inflate more quickly than we do, causing our currency to retain relative value.

This will be the final supernova of Bretton Woods II, pure fiat money with no backing.

But it will take a long time to get an inflation going, easily five years, I would guess. We could continue to have deflation in some major asset prices like houses while experiencing inflation in day-to-day consumer prices like food and energy.

In other developments, labor market volatility, which serves to soften the blows of rising unemployment when volatility is rising, and to amplify the psychological effects of small increases of unemployment when volatility is very low, as it was early in this decade—labor market volatility will peak around yearend 2010 and begin a steep decline.

“Animal spirits,” in turn, will “go positive” a year later, about the beginning of 2012. The sense of a stabilizing labor market will be strong. If this occurs as forecast, it will herald a time of seeming happiness (that Shakespearean “seeming” is added because I don’t think people will really believe it). It may be quite euphoric and strange.

“Animal spirits” will peak in early 2013 shortly after the president’s inauguration. Then “animal spirits” and the economy will probably drop like a rock as the federal debt binge and drying up international credit squeeze the last drop of effective demand out of American households. By rights, this should be a deflationary collapse because it will be caused by too much debt. As I say, I think it will take a hot war to get a general inflation going. In passing, I note that when you have a carry trade in a quantitatively-eased currency, the Big Money can create spot inflations and hyper-inflations in commodities or paper assets at will, as happened with commodities last year. Certainly the sharpies are keeping an eye on oil, as a little trumped-up panic about the stability of the Middle East could create a situation they could play going up and coming down.

I do believe that our thoughts have power, not only on other people, but in the physical world. Lynn McTaggart’s wonderful books provide an introduction to the now three or four decades of scientific research on such topics. It is necessary for the mass of humankind to pray for the new aristocrats, the oligarchs, who bestride the globe with their unimaginable wealth and their plans for the rest of us. Let’s all pray that they come back down to earth, that they realize that it is not they who are going to determine what our rights are, but a power far higher than we or they.

For the love of money is the root of all evils; it is through this craving that some have wandered away from the faith and pierced their hearts with many pangs.

Peace.

No comments:

Post a Comment