Whether you believe the government’s unemployment number or not, it is useful for modeling purposes (until no one believes in it at all). “Animal spirits” or general confidence levels continue to climb out of negative, depressed territory toward a projected return to the zero line in about 2012. This is bad news to anyone hoping for some reform of a broken American system, as it virtually assures that Congress and the President will do nothing significantly productive for the next several years. (Click on charts to see larger image.)

Our NBER-defined recession indicator also shows about zero probability of another collapse of confidence and double-dip recession in the coming year. The major GDP aggregates will chug upward, probably slowly.

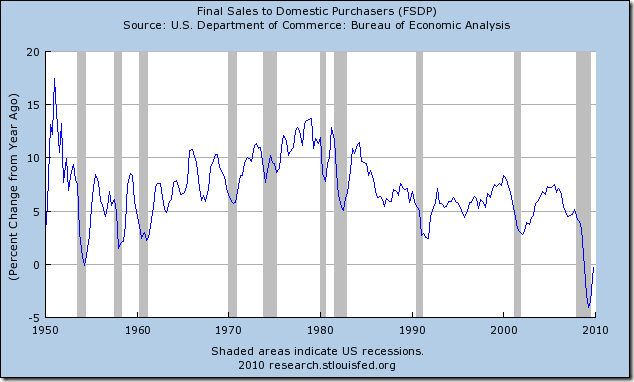

Very slow growth is indicated by the weakness of final domestic sales that are stalled on a year-over-year basis at zero growth and by the weakness of demand from our trading partners, all of whom have their own serious economic problems. Domestically, we have high unemployment, loss of jobs, increased saving, and collapsing housing prices. Final domestic sales will remain weak.

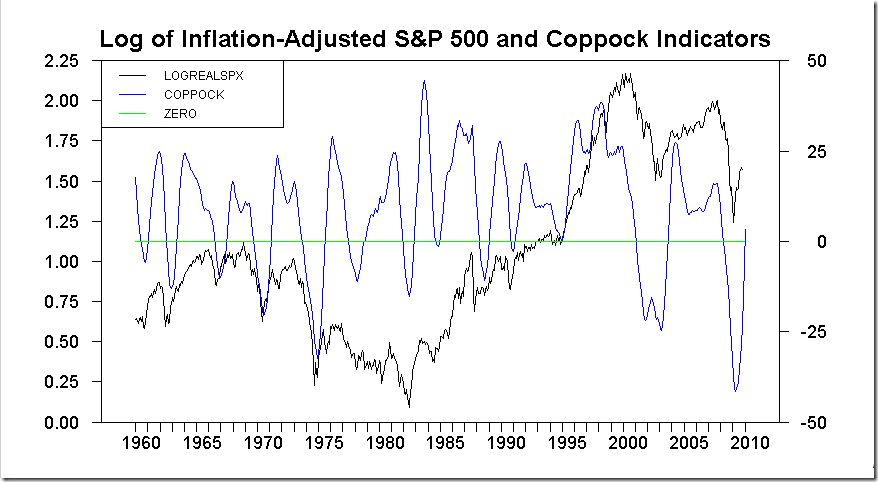

The stock market is still riding the wave of adaptation level-theoretic emotion coming off the March lows as measured by the venerable Coppock Guide. There may be a strong rally out of the current correction before putting in the final top. I thought the top would come in the winter, but it may come later.

The situation looks like the mid-Seventies to me, when the intermediate term outlook for the inflation-adjusted stock market was bad (one was better off in T-bills). I agree with the estimable Barry Ritholtz that the next long-term buy in the market is still out about five years, and that capital preservation is the name of the game in the meanwhile.

The big question to me is what form will The Crisis finally take? What will be the Resolution?

The big question to me is what form will The Crisis finally take? What will be the Resolution?

ReplyDeleteI suspect that this is now out of US hands. The Eurozone is in deep trouble. It is also questionable whether China's command economy can successfully manage its first significant economic crisis, which is also pretty sure to materialize.

I agree with Barry that capital preservation is the order the day. I suspect that the dollar and Treasuries will benefit as usual from increased uncertainty and probably growing social unrest. Those betting on hyperinflation will be forced to unwind their trades.