“Effective demand” is the dollars flowing into actual demand. In a collapse of effective demand most people simply don’t have or spend enough money, and aggregate demand collapses. This is where I think we are heading.

Final dollar sales to domestic purchasers are on a downward trend…this the flow of money in dollar terms from Americans into the spending stream….

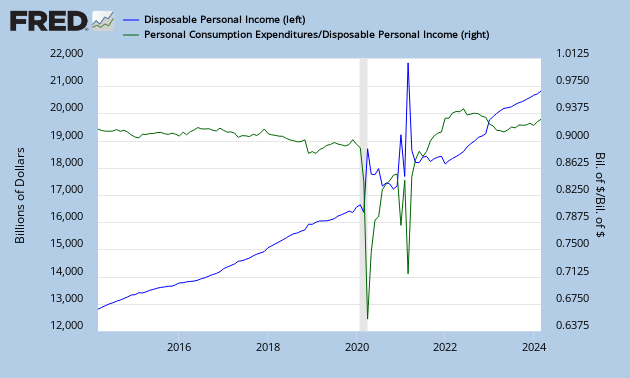

…even as dollar disposable income staggers upward with help from occasional fiscal injections with the rate of consumption spending out of disposable income returning to a long-term trend rate of 93 percent…

…while the components of nominal (dollar) aggregate demand, Y = C + I + G + (X – M), show chronic weakness in investment and net exports, with consumption growing fastest and government spending chugging ahead….

Of components contributing demand, only consumption has risen to pre-Great Recession levels in dollar terms. Any whiff of inflation is translated immediately into lower real purchasing power. Private domestic investment is at 2002 levels in dollar terms; it is at 1998 levels inflation-adjusted. Consumption depends on the household sector that depends on jobs and income to spend. Wisely, Congress extended unemployment benefits through 2010. But a second round of exotic mortgage rate resets is due later in 2010 and 2011, and it is more difficult than any time in the past 30 years to get a job in America…

…while a strong dollar, so necessary to our continued successful Treasury auctions, hurts us in exporting manufactured goods, the United States still having the largest industrial output of any nation, and the developing world growing much faster than we are and in need of manufactured capital goods. Our net exports are solidly negative and cannot be counted on to pull up aggregate demand in the near future, though they may drag it down less.

Thus a rebalancing of domestic demand would seem to be required to forestall a potential humanitarian disaster in the United States, namely entrance into a depression as domestic effective demand collapses. As I have maintained all along, the government needs to provide poverty level workfare to the unemployed and health care to all Americans. The next recession is likely to be even more severe than the recent one. Those to whom much has been given (as all products are joint) need to step up to the plate.

However, it may be that Americans’ collective distrust of government, and the power of entrenched interests, will prevent any rebalancing. The trash talk about the Democrat’s health bill is illustrative. The bill applies tax surcharges only to small business owners making more than $1 million a year, affecting only about 1 percent of small business owners. If the health bill goes down, I would guess that the odds of an equitable rebalancing of demand diminish radically.

America may fracture in this case, with state and local governance becoming much more important.

The last great leveling of the income distribution, that “corrected” the imbalances of the 1920s and the Great Depression (the New Deal didn’t do it) occurred in a few short years in the early 1940s, as the United States entered into a world war.

Can the income distribution become more equitable without another world war? Or do we collapse into neo-feudalism and a rigid class system for generations to come?

No comments:

Post a Comment