Alan Greenspan’s face says it all: “I am a servant of the ruling class, I will accommodate the ruling class, whether as a Fed chief or as an ex-Fed chief.” BTW, I find a certain similarity between the faces of Greenspan and the President. These are not strong men.

Greenspan correctly diagnoses the split between the economy of the ruling class and that of everyone else. Here is Barry Ritholtz at The Big Picture:

“Our problem, basically, is that we have a very distorted economy in the sense that there has been a significant recovery in a limited area of the economy amongst high-income individuals who have just had $800 billion added to their 401(k)s and are spending it and are carrying what consumption there is. Large banks, who are doing much better, and large corporations, whom you point out and the–and everyone’s pointing out, are in excellent shape.

The rest of the economy, small business, small banks, and a very significant amount of the labor force, which is in tragic unemployment, long-term unemployment, that is pulling the economy apart. The average of those two is what we are looking at, but they are fundamentally two separate types of economy.”

-former Fed Chair Alan Greenspan, Meet the Press

Fascinating quote from Easy Al on Meet the Press via Bloomberg. It has 3 subtexts that might not be readily apparent — until we break it down:

1) Extend the Bush tax cuts on highest bracket earners: Since its the 401(k) crowd that are carrying the recovery, Greenspan suggests, then we best not crimp the income of these big spenders

2) Two Americas: Greenspan seems to be channeling John Edwards when he discusses two economies. The bailouts reduced competition. They extended the life of badly structured financial firms, and forced smaller firms to scramble.

3) Greenspan’s Legacy: It seems that Easy Al can figure out precisely what he has wrought. The secret to getting such candor out of the former Fed chief is to trick him into discussing the broader economy. That way, he does not realize that he is discussing the effects of his tenure as FOMC chair.

Of course, Greenspan is still wrong on Housing. Recall that he failed to recognize the impending housing correction (collapse more accurately) and made claims that the worst was behind us — just as housing was accelerating downwards:

“If home prices stay stable, then I think we will skirt the worst of the housing problem. But right under this current price level, maybe 5, 7 or 8 percent below is a very large block of mortgages which are underwater, so to speak, or could be underwater, and that would induce a major increase in foreclosures. Foreclosures would feed on the weakness in prices, and it would create a problem. So that–it’s touch and go.”

One last thing: I have to give Greenspan credit for this touch of tax cut honesty:

“Look, I’m very much in favor of tax cuts, but not with borrowed money. And the problem that we’ve gotten into in recent years is spending programs with borrowed money, tax cuts with borrowed money, and at the end of the day, that proves disastrous.”

For once, I agree with him . . .

Ah, Barry, you are usually so reasonable. Why don’t we raise marginal tax rates on the ruling class who have manipulated the tax system and the governance of big corporations so much in their favor? Are CEOs really worth 400 times the average workers salary today when the multiple was a tenth of that thirty years ago? In other times of fiscal distress marginal tax rates on super-high incomes were higher, almost as if there were a sense that “shared sacrifice” was a good thing. Are you and Alan the Mess-Meister suggesting that we should leave marginal tax rates on high incomes alone and raise them on the middle class?

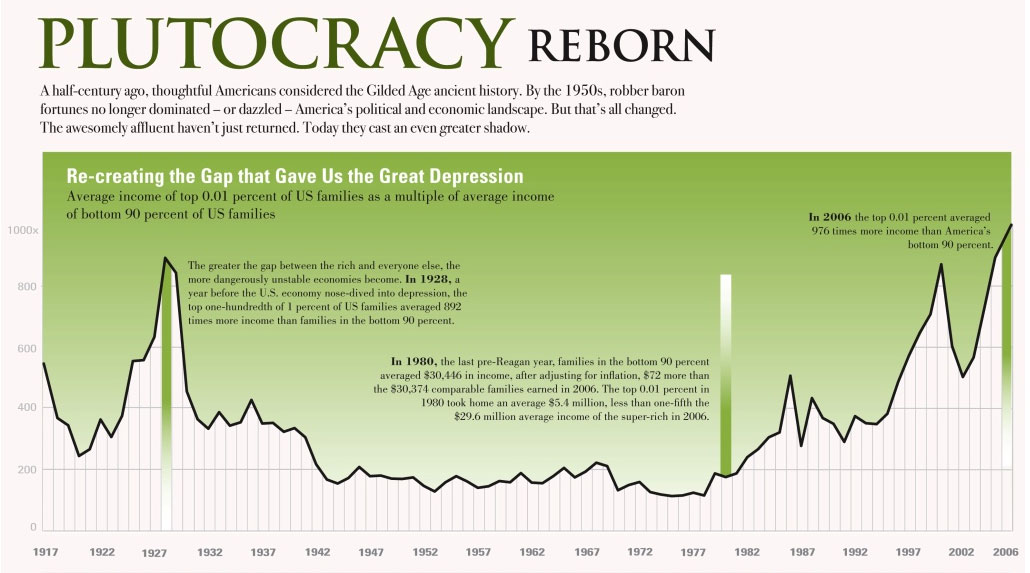

Let’s get real. Here’s the picture that tells the story of how America has moved from “we’re all in this together” to “you first, after me—it’s the free market way!":

Until Americans start to function as a nation again, we descend into deeper banana republicdom. Is it the end of the nation-state? Is the only path to survival to join a strong corporation (i.e., “gang”)? Will corporations that perpetuate stark inequality survive, if there is truly an “optimal” degree of income inequality that American corporations have clearly exceeded? Will more egalitarian corporations benefit from higher productivity and resiliency, if the nation-state dies, and prove the template for the next major form of social organization? (Unfortunately, the immediate associations that come to mind are of the perpetually-warring native American tribes prior to European overrun; and the incredibly funny scenes of warring office buildings in Monty Python’s “The Meaning of Life.”…)

Big changes coming. The old order is falling apart. Do unto others as you would have them do unto you.

Great blog. Very interesting material. I think a good rule of thumb regarding Fmr FOMC Chairman Allen Greenspan is: He thought Ayn Rand was more than a deeply troubled, meth-addicted novel writer. To many bad-but-powerful politicians are also in this group (Paul Ryan comes to mind).

ReplyDeleteQUESTION: I'd like to use the Plutocracy/wealth gap infographic in my blog post, but want to make sure I'm attributing it correctly. Where did you get it?

Thanks!

I linked to:

ReplyDeletehttp://images.huffingtonpost.com/2008-09-17-Plutocracy_graphic.jpg

but I believe the image originated in The Nation in a 2008 article devoted to extreme inequality:

http://www.thenation.com/image/extreme-inequality-chart

This latter chart is nice because it includes a lower panel showing top marginal income tax rates.

Please send me a link to your blog post.