Assuming that the unemployment rate does not materially improve over the next two years, “animal spirits” or confidence levels will fail in about 2013, after the next Presidential election. I premise the lack of improvement in the labor market on the extreme dysfunctionality of the American political system at this historical juncture. At a time when unemployment shows a persistence unprecedented in the postwar business cycle, the Tea Party and Republicans are snookering Americans into seeing government as their “enemy,” which in many ways it may be; but not in the respect that a humane and macro-economically sound government response to human suffering caused by unemployment would be a sensible redistribution of income—now at multigenerational levels of inequality—to those most damaged by the macro economy.

As I have written, the macro economy would be better off if the Bush tax break on households with over $250,000 incomes—some 3 percent of Americans or about 9 million “souls”—were to lapse and the estimated $70 billion annual run rate given to the 15 million officially unemployed person, or less than $5,000 each. The unemployed would spend the money, every penny, and would do more to boost the macro economy than letting the rich keep it.

It is a characteristic of human nature that we get used to things, and judge accordingly. Hence, we speak of “the new normal.” My model suggests that we will forbear the new normal for another couple of years, after which any deterioration in the economy will sink “animal spirits” again. The same qualitative result holds if we see some intermediate improvement in unemployment.

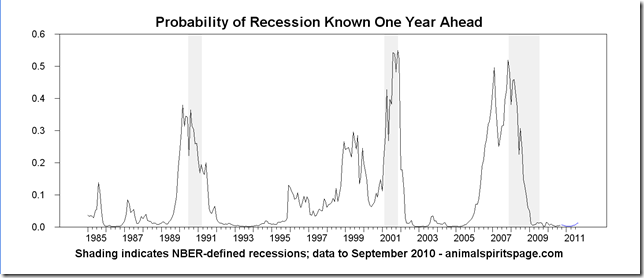

My yield curve plus “animal spirits” recession forecasting model shows virtually no potential for a new collapse in the year ahead (this is not to say the economy is healthy, just that there is little chance of an NBER-type recession ahead, which I identify with a failure of confidence).

The Great Depression saw its financial panic in 1929, its economic bottom in 1933, followed by about seven years of depressed output and employment, followed by war. I do not think we have seen the economic bottom of this cycle, and I believe the financial problems are worse than in the ‘Thirties, when America was the world’s greatest creditor nation. Today we are the world’s greatest debtor nation.

The next great failure of American confidence is likely to be more challenging to the already stretched social fabric than the last one, or the one before it, the Civil War.

No comments:

Post a Comment