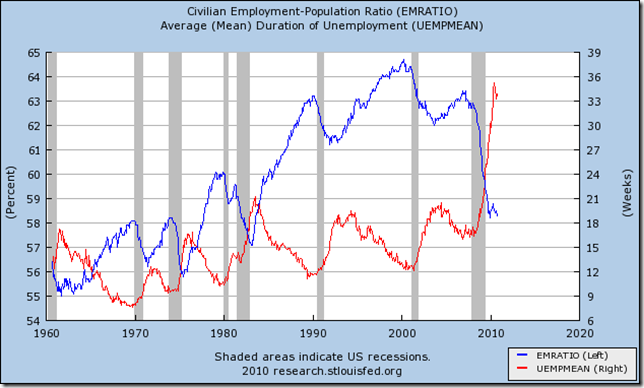

The inequality of wealth and income are strangling the economy. There is no healthy circular flow of income and product. The failure of demand will increase as the households back down from the unsustainable and historically anomalous 70 percent of GDP consumption levels financed by home equity lending. Forty-one percent of the unemployed have been out of work six months or more.

Final sales to domestic purchasers continue to slump. The wealthy will invest overseas, where rates of return are higher, especially if the dollar weakens. Domestic demand is at 2007 levels in nominal terms, as the dollars buy less due to

Industrial production is at decade ago levels.

Risk aversion as proxied by the Baa minus 3-month T-bill spread remains at Great Depression levels. This probably reflects the presence of “Knightian uncertainty,” the term that economists use to describe levels of uncertainty deriving from agents not having any probability distributions they believe in because they are confronting problems of a nature and on a scale they have never experienced in their lifetimes. It is the limitations of living human memory that drive many long-cycle models.

The Fed may lower short-term rates, but if the spread doesn’t narrow, the market hasn’t bought into it, in other words, and Investment will be majorly impaired.

Animal spirits or confidence levels are struggling to get back to positive. Assuming a flat unemployment rate until the Presidential election, a collapse of confidence in 2013 seems assured, as continued political dysfunction dispirit the American people.

The animal spirits + yield curve model shows no collapse of confidence in the next 12 months, qualifying this to mean no negatively skewed change in our current situation of depressed output levels and about zero to two percent real growth rates.

My judgment is that we will have a deflationary collapse within the next five years as the debt overhang overwhelms consumers and the federal government. After that, the risks of war increase exponentially, as history shows that the quickest way to get an inflation going is to start (or expand) a war(s).

As Paul Farrell points out (here) The American people have no one to blame but themselves. They would rather defend their right to be pigs than accept that everyone needs to share the burden of sacrifice for this nation—if there still is an American nation at all.

The American people have bought into the wrong dream at this moment in history. The collapse is coming.

Prepare.

No comments:

Post a Comment