If the unemployment rate drops below its adaptation level, consumer sentiment should improve markedly.

The yield curve certainly is not signaling recession:

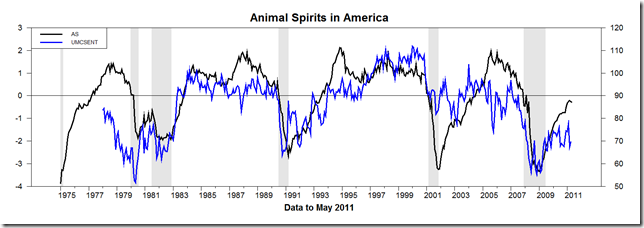

And my “animal spirits” metric, A = –(U – UMEAN)/Sigma(U), correspondingly seems poised to go positive.

However note the divergence of the survey measure and the adaptation-level-theoretic measure.

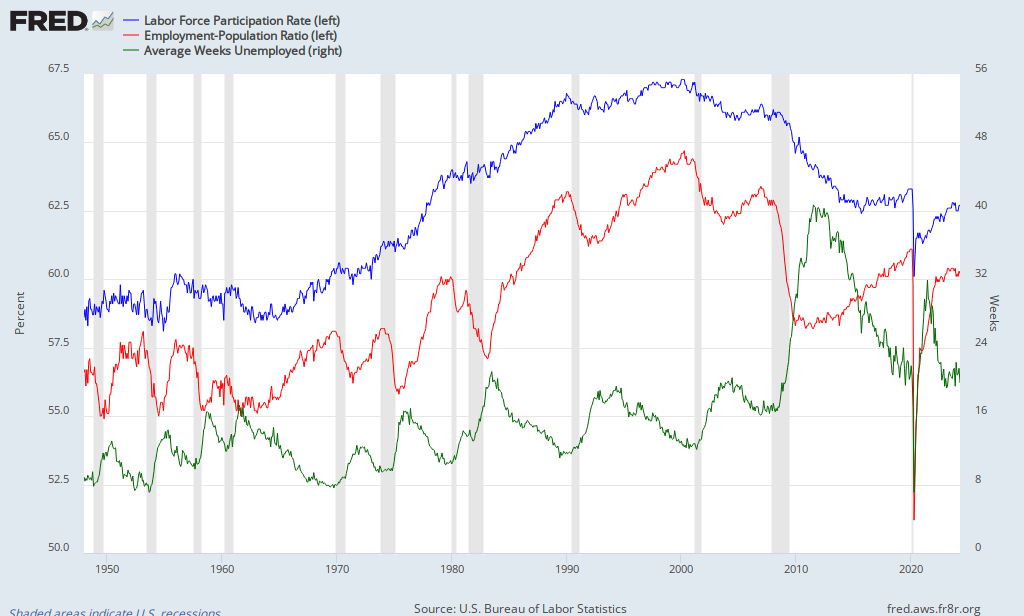

It can be said that the main reason the unemployment rate went up last month was that there were a quarter of a million entrants into the labor force. Hence, the more optimistic those on the sidelines become and the higher the civilian participation rate, the more likely it is that the unemployment rate—which is still the headline rate—will go up. The labor market is at generational lows in terms of overall employment and the ability of unemployed persons to get a job.

Look for massive stimulus measures, overt or covert, as America ramps up for the presidential election. I continue to expect any exhilaration to be short-lived, as it was in the early ‘Seventies, and for unemployment to make new highs this decade. Any pronounced move toward fiscal austerity will likely cause a deflationary collapse rather quickly. Hence, I believe Obomba or Romney or whoever is the next puppet of the military-industrial-financial complex will take America into a wider, inflation-inducing war than the three we are already in. There may a big deflationary hiccup that precipitates the final escalation. A currency-depreciating inflation is the wet dream of all mainstream economists, and many in business, and to a certain extent, it makes sense: if the dollar tanks and oil becomes more expensive, American labor becomes cheap and America becomes a good place to invest and manufacture.

Unfortunately, a world war would probably strengthen the dollar.

And who knows what derivative liabilities would be triggered in a deflationary collapse? Bernanke confused keeping the banks open with bailing them out. He did not permit their bad loans to charge off. Until the bad debts in the world banking system are charged off, there will be no healthy growth. This is the lesson of Reinhart and Rogoff (see references on left). The Bretton Woods II supernova has flashed, and now we are waiting for gravitational collapse. It will come. Note how quickly debt-to-GDP declined during the Depression.

No comments:

Post a Comment