The last time the U.S. was in ZIRP—Zero Interest Rate Policy—was in the Great Depression, and short rates stayed low for a surprisingly long time, from 1934 to 1947, with the much-maligned blip in 1937 being blamed for the recession of 1937-38 by some, while others point to fiscal tightening—together it’s a knock-out punch. Until 1942 three-month T-bill rates were like today’s, ten or twenty basis points, until 1942 when they were pegged at 38bps for the duration of the war.

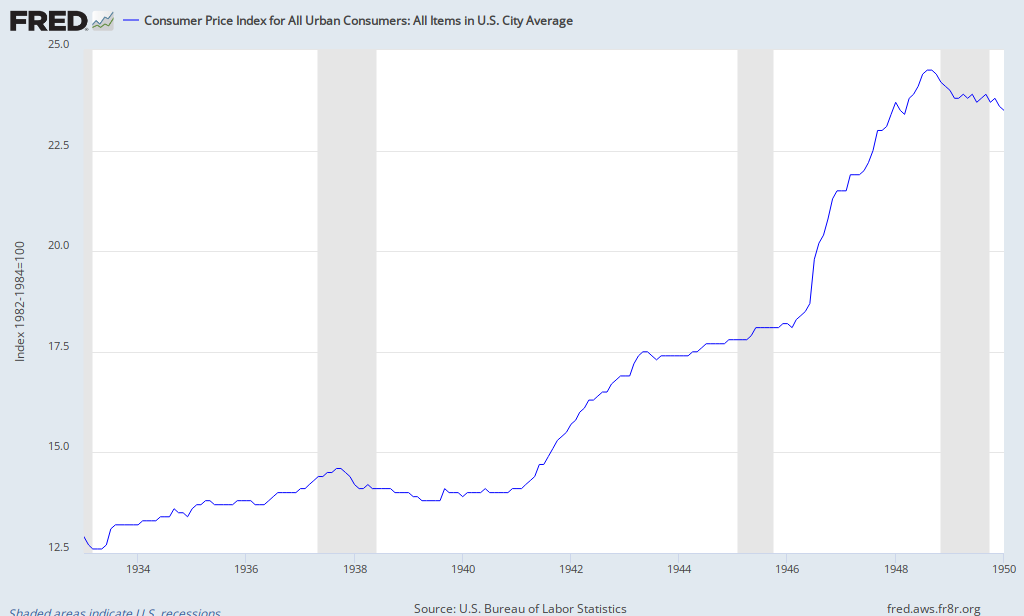

That’s eight years with rates mostly below 20bps, and 14 years if you call 38bps low. Here’s what was going on with inflation:

Price controls were used during World War II (and later the Korean War, and later during the early ‘Seventies) to try to control inflation that accelerated after the war until monetary tightening brought on the recession of 1949.

We entered ZIRP at the end of 2008. It’s only been a little over three years. It could be a long ride.

No comments:

Post a Comment