N.B. This is research, not investment advice. You invest at your own risk, unlike the Wall Street banks, who also invest at your risk.

The uptick of the unemployment rate from 7.8 to 7.9 has caused our ‘animal spirits’ indicator to put in a top. Continued increases or merely stability of the unemployment rate will cause further losses of confidence.

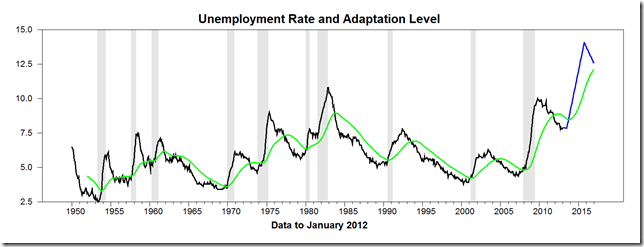

The underlying judgmental unemployment rate forecast is this:

My forecast is still that the US economy enters recession in the second half of 2013. The two big proximate drivers: the continuing assault on consumption from higher taxes and medical costs; a precautionary demand for liquidity (increased saving rate); the sequester—to any degree—of federal government spending; and to the extent that it impacts the small segment of the population current salivating over stock market gains induced by QEternity, a diminished wealth effect (yes, the implicit stock market forecast is that we’re at a major top—I called it a year ago but the presidential election year got in the way—this cycle is very reminiscent of the early 1970s, and we’re at about the turn from 1972 to 1973). Throw in Europe in various states of severe recession and depression, and the likelihood of some slowdown in China, and we have the potential for a coordinated global contraction, almost as if the signs all say we are at the end of the [high?] growth age….

Here is the whole history:

Note how depressed the Michigan Consumer Sentiment index is, just as it was in the early ‘Seventies. The drop-off from here could be precipitous from here. Even somewhat proven indicators such as the “Rule of 20” show the market looking toppy (yellow line is where the blue S&P line is supposed to be):

Source: News-to-Use

As bad as you have it in America, here in the UK we are entering our third recession in the last five years!

ReplyDeleteGreenworld Alternative Investments

Benign,

ReplyDeleteA couple of questions.

Two years ago or so, when there was much dread (shared by me) of a "double dip" recession, you pointed out that the yield curve was not predicting a recession and that it was very unlikely. You were correct. Now, with perpetual ZIRP making a yield curve inversion impossible, I am wondering how this impacts your call for a recession in 2H 2013?

I am a little confused regarding your comment on News-to-Use "Rule of 20" Barometer. This indicator, which is based on the gap between market valuation and theoretical "fair value", is well inside the Lower Risk zone and implies that substantial upside remains. I don't see at all how this implies that the market is looking toppy. As an aside, I am very unimpressed with this indicator. Note the false signal in the early 90's and the fact that the massive bear market of 07/08 was only signaled after it was well underway.

Thanks as always for your unique and incisive analysis.