The Panic of 2008 is almost over. American confidence levels will rebound in 2009 from generational lows as Americans become adapted to the new realities of the economy. Americans will feel as if they've "been down so long it looks like up to me."

The forecast is for a return to stabilization or positive real GDP growth likely to be slow. The model has been accurate in back-testing for over 50 years and has called the last three turning points in real time well ahead of consensus. The prestigious scientific journal Nature cited the model’s forecast in advance of the 2001 recession at a time when the consensus saw no recession in sight. The model also accurately foresaw the current slump as early as 2006, although not its severity.

The "animal spirits" of Americans can be modeled accurately by

A = - (U - UMEAN)/Stdev(U)

where U is the current unemployment rate, UMEAN is an exponential moving average over the past three years, and Stdev(U) is the standard deviation of U over the past three years. This measure correlates highly with the Michigan consumer sentiment index (green; blue is forecast based the unemployment rate forecast below).

"Animal spirits" hover at very low levels. However, continued increases in unemployment will have little negative effect on confidence. We are at or very near the nadir of "animal spirits" for this cycle that typically coincides with the end of the recession.

To understand why we are at or within a few months of the confidence low it is important to understand that after rises in the unemployment rate, people get used to it. In the 1980s, when unemployment began to drop from its highs over 10 percent, confidence soared. The adaptation level is now catching up with the current rate. Other things equal, confidence will increase as the difference between the two decreases. The blue line below is the adaptation level.

The blue line below represents a one-year unemployment rate forecast, which is not meant to be indicative, but to gauge the response of “animal spirits.” Even under quite pessimistic assumptions about unemployment, confidence increases.

The other thing impacting confidence in the model is how much volatility people are used to. In part due to excessively accommodative efforts to "stabilize" the American economy in recent years, unemployment volatility fell to very low levels. The risk of over-insuring a society is that it loses the ability to respond coherently to perturbations. The blue line in the graph below represents what will happen to volatility over the next 12 months if unemployment rises to over 9 percent over the next 12 months as shown above.

The net result of the adaptation level rising to catch up with current unemployment and volatility rescaling perceptions of the gap between adaptation level and current unemployment is that even if unemployment increases as shown to over nine percent in 2009, confidence will turn up. And this generally signifies the end of a recession in the American economy.

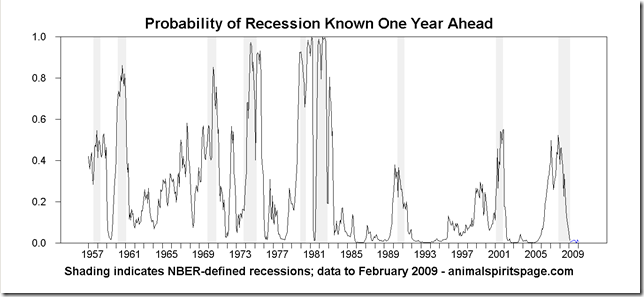

The "animal spirits" variable can be combined with the slope of the yield curve, a powerful forecasting tool in its own right, to create a recession forecasting model that gives an estimated "probability" of a recession occurring from a full year in advance without forecasting any explanatory variables. This model has forecast the onset of the last two recessions in real time well ahead of the consensus of professional economic forecasters, and now forecasts an end to the current recession in early 2009. Here is the current recession “probability” forecast (blue)—no recession in sight:

This model has an excellent record over the past 55 years as the next graph shows.

The model's forecasts are qualitative, of the sort generally found most useful by practical people. As one of my professors in graduate school used to say, "It is better to be approximately correct than precisely wrong." There is a rough proportionality between the size of the forecasted recession's probability and severity of the ensuing recession, but not much should be made of this in light of the current global slump in economic activity. The parameters of the model worked well over the postwar period, but the parameters may have changed. If there is a recovery in GDP growth in 2009, it will be from a far lower level for the simple reason that much of recent GDP (especially consumption) was debt-financed, and much of that isn't happening any more (“home equity ATM”). The best we can expect is an "L-shaped" recovery at a much lower run rate of GDP in 2009, probably. But a depression does not seem to be in the cards.

The unemployment rate will probably remain elevated for some time as it has tended to lag the cycle the last two cycles. In the opinion of this commentator, the government should make income support for the involuntarily unemployed its top priority. Most are the victims of a systemic credit crisis not of their own making. Also, income support to the unemployed is guaranteed to be spent. It will enter the spending stream faster than any other fiscal stimulus. Extending unemployment insurance benefits is not enough. There needs to be a livable poverty-level dole for the unemployed.

The ratio of private domestic spending for productive investment also responds to “animal spirits”:

In the current context increased savings by Americans might be plowed directly back into aggregate demand if “animal spirits” pick up and businesses begin to invest for future production. Government infrastructure spending would be an additional investment-type stimulus independent of confidence-induced private investment spending. The cloud hanging over any investment spending is the heavy debt load being carried by the U.S. economy.

Of course, the current debt deflation is unlike anything that occurred in the sample period used to develop this model. However, if the adaptation level theoretic response of Americans to the unemployment rate remains intact, a forecast of increasing confidence and domestic investment is plausible, within financing constraints. Bad debts need to be written off to make room for new lending that, one hopes, will be more oriented toward productive purposes than recent domestic investment has been.

References

Middleton, Elliott, ‘Animal spirits’ and expectations in U.S. recession forecasting, http://arxiv.org/abs/nlin/0108012, 8 August 2001.

This paper provides citation for Middleton (1996) "Adaptation level and 'animal spirits'", JEconPsych.

Ball, Philip, “Hard times ahead: depressions caused by lack of economic confidence might be predictable,” Nature, http://www.nature.com/news/2001/010815/full/news010816-12.html, 15 August 2001.

While it is intriguing to propose a formula for measuring animal spirits and to backtest it against the last 50 years of data, your sample size could be insufficient to have any predictive power with respect to this recession.

ReplyDeleteThis will indeed be a very interesting out of sample test. Arguing for the model is the virtual universality of adaptation level responses.

ReplyDeleteMy personal hope is that any such renewed confidence will be put to use cleaning the corruption out of the American government and financial system.

I suspect that this is one main parameter of at least two needed to be fully predicted. This measures willingness to spend. The missing parameter is ability to spend. Back to the 50's, the ability to spand was based on good US consumer savings, into the 70's-80's that began to shift to debt financing and the assets bubble. Both of those resources are gone. Your statement about this being an L-shaped recovery is probably correct, due to the lack of ability to spend. After the Great Deleverage is complete, and consumer's repair thier banks account's, then we should see and uptick. That maight be 10 years from now, since the deleveraging process is at most 1 year inro a 3 year process. Then the asset base will have to be built back at a more historic level of about 2-3% year.

ReplyDelete