Warning: this is research not investment advice. You invest at your own risk.

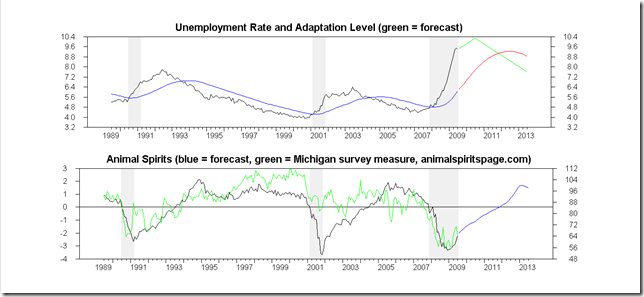

This site is dedicated to the proposition that “animal spirits” or confidence levels are a prime—if not the prime—driver of the business cycle. My models have not sent a false signal of recession in over a decade in real time, and in over fifty years in back testing. So while the markets made a pretty big deal of the drop in the Michigan consumer sentiment series on Friday, the reported number is well within the range of random variation around a rising trend.

Click on graph for larger image in new window.

Why might the pulse of the postwar business cycle stop? The ongoing collapse of effective demand that so many of us have written about (see this and this). Briefly, if consumption returns to a long-term trend share of about 65 percent from over 70 percent of GDP, that’s a ~5 percentage point drop. Private investment demand has fallen ~20 percent year-over-year recently, and the residential portion of that is not going to return to previous levels any time soon. Capacity utilization is still quite low. The government’s stimulus falls far short of replacing this lost demand.

Anticipation of a deflationary collapse might invalidate the Big Mo in the stock market (which is “discounting a V-shaped robust recovery”). Short rates would rise as T-bill auctions are crowded with refugees from the long end, and the 1/10 yield curve would invert, the reliable recession signal I use in my recession forecasting model. Unemployment would shoot up even further, and “animal spirits” would collapse.

All this may happen, but turning the macro economy is like turning a supertanker, it takes time. Even if the yield curve inverted this fall, history suggests the collapse would not come until a year or so later in 2010. In the meanwhile we are likely to see a stabilization and perhaps weak growth of real output in absolute terms although the percentages might seem high. Industrial production ticked up for the first time in nine months, often a sign of recession’s end.

Of course, a natural catastrophe or a hot war might break the mould immediately, probably in the direction of hyperinflation.

So we will probably witness yet another act of our long-running national drama, “Fake Democracy,” or “Money Gets What Money Wants.” The President has already gutted the health care “reform” bill by giving away price negotiation with the drug companies and the possibility of a public option. Wall Street continues to defecate in the faces of the American people paying themselves outsized bonuses while accepting welfare from the Feds… yada yada yada.

Abject failure of the existing system would be consistent with our over-arching hypothesis of Strauss and Howe of a revolutionary change in the American social contract within the next two decades (see this and links for an introduction. However, as a previous post indicates, we could as easily go toward neo-feudalism as toward a reformed democracy.

Big recessions and depressions tend to happen at the beginning of decades: the Great Depression, the recessions of 1973-1974 and 1980-1982. We may see one last hurrah from a stock market bid up by computers playing chicken while the insiders sell all they can—or the stock market may begin to discount the deflationary collapse before the yield curve inverts. Why not have a sucker’s rally on free Fed money and a carry trade that Wall Street may find too good to pass up? If the dollar rallies as Bob Prechter forecasts, it might bring in international hot money.

Hang on, we’ve only just begun this rollercoaster ride.

This post is written by a dog, and I'm supposed to take it seriously??

ReplyDeleteMost people think correctly that the dog is our mascot--how did you guess that the author is also a dog?

ReplyDelete