As I showed in a recent post not only is the income distribution at record levels of inequality, but the rich aren’t pulling their oar the way they used to in the gung-ho, we’re-all-in-this-together postwar era that began during World War II. It is that social contract that is broken.

It is well-known that the bulk of tax revenues come from upper income earners, and that approximately the bottom 40 percent of the income distribution pay no explicit federal income tax (but we do apply the highly regressive “payroll tax” for Social Security to them).

So when I read stuff like the quote below from John Mauldin (or Mish Shedlock, or Peter Schiffer or any number of other pseudo-libertarians shills who advocate tax cuts for the rich to stimulate the economy)—well, insert your own synonym for “gag me”:

The Great Experiment

So this is the backdrop as we look into the future. Unemployment is rising and is likely to remain stubbornly high (over 10%) for some time, except for the few months this coming summer when the Labor Department will hire hundreds of thousands of temporary census workers. The savings rate is rising, and consumer spending is at the very least challenged. The stimulus starts to drop sharply in the latter half of the year. States, counties, and cities are short about $260 billion and will either have to cut services (and thus jobs) or increase taxes. Housing is likely to get weaker, as there are large numbers of defaults coming because of mortgage-rate resets this year and next (more on that in a few weeks). Valuations on stocks are in the high range, and do not portend well for long-term returns.

Further - and this is the most important item to me - Congress is likely to allow the Bush tax cuts to expire and to add insult to injury with some form of large tax increase for heath care. Between the local, state, and federal tax increases, we could see a massive increase in taxes of perhaps $500 billion in a $13-trillion economy, or about 4% of GDP.

Think about that for a moment. It is likely we will begin 2011 with close to 10% unemployment, if not higher. Christina Romer's work shows that tax cuts have a three-times benefit to GDP. Tax increases presumably have a similar negative effect. (Ms. Romer, by the way, is President Obama's Chairwoman of the Council of Economic Advisors. This is not a partisan idea.)

This is the great experiment to which we are going to be subjected. There are those who agree with Art Laffer and company that tax cuts are a positive for the economy (that would include your humble analyst). And there are those who contend that the economy did just fine in the Clinton years before the Bush tax cuts and that we will do just as well if we take them away. And further, taxing the rich a little more is not really going to change their behavior.

My contention is that if such a tax increase is enacted all at once, the economy will at a minimum dip back into a nasty recession. If I am wrong, then I will have to abandon one of my long-cherished beliefs. I will have to stop arguing that tax cuts are as important as I think. Right now, when I read the data and studies, they confirm my tax-cutting bias. But I have to be willing to change my mind if The Great Experiment proves me wrong.

But if you think unemployment is high now, you will really not like what happens if we dip back into recession. It could go a lot higher. They are truly risking a great deal if they decide to pursue this experiment.

When the problem is the distribution, not the level, focusing on aggregates (like the economy is probably “out of recession” now according to GDP and Industrial Production, dude) is wrong. We need to rebalance aggregate demand, not stimulate it with tax cuts for the people who already have all the money.

It is important to remember that in this analyst’s opinion one of the “authorities” cited in the article, Arthur Laffer, is one of the great intellectual frauds of the past couple of generations in America, providing, as the story goes, the intellectual justification for Ronald Reagan’s tax cuts for the rich on the back of a cocktail napkin (there is poetic truth in the urban legend).

We know that supply side economics failed miserably. The tax cuts were not “self-financing,” and the federal government led the country down the primrose path of living on plastic. From this point of view Bill Clinton and his foes in the Republican Congress were the best thing to happen to American fiscal policy in the past fifty years. Reagan inflamed the brass-ring dreams of Americans cut taxes for his “base.”

At the same time, in virtually every line of work in America, those at the top decided that they deserved a bigger share and went ahead and took it, because they could (as Ronnie had sufficiently bamboozled everyone else with his gub’ment-and-taxes-are-evil, you-too-can-be-rich Irish charm). Until we can get income multiples from CEO to average worker back into a range that most people consider fair (possibly through some sort of incomes policy), it is fair to say the top 1 percent will not be significantly damaged if their taxes went up to levels that have been acceptable to the American people for most of the last two generations.

It is the greedy manipulation of the American economy and government by the rich that is different today. Their tax burden is in fact a lot less than historical averages.

Tax cuts in the current environment will accelerate the transformation of America into a neo-feudal state. We need to raise marginal tax rates on the top 1 percent, in part to dispel the notion that they are “sovereign individuals.” As John Dunne put it, no man is an island. Or to quote another source (which I have recently been enjoying in an illustrated version by R. Crumb), the answer to the question, “Am I my brother’s keeper?” is, “Yes.”

From an economic point of view, the American productivity miracle of the postwar period was based on more than technology, but on a spirit of teamwork that may very quickly be lost if American turns into a society of moneyed gentry and neo-serfs.

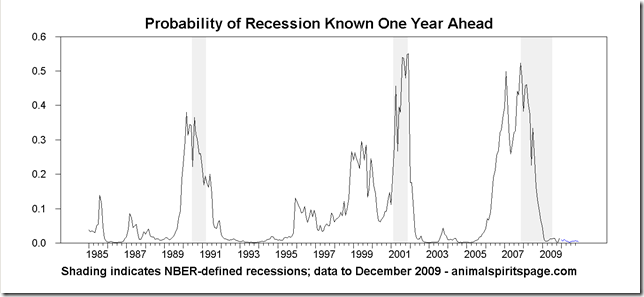

I forgot in the update yesterday to include the updated “recession probability” chart. No NBER-type recession in sight.

But American society and its economy continue to be very sick. At at time when the have-nots most need work it appears to harder to get than any time in the past thirty years.

Here’s query that produces a plethora of references on the adverse impact of highly unequal socioeconomic status on health.

It’s my view that there are innate standards of fairness in the human breast that must be satisfied if pathologies are not to become severe. Whether the corporate state can ever overcome its bias toward greed is unclear. But I will speculate, optimistically, that corporations with flatter corporate income distributions will at some point gain a productivity advantage, that may lead to social change. “Pension fund socialism,” as Peter Drucker called it, has failed—even if American workers technically own American companies through their pension funds and 401(k)’s the money managers have insulated company managements from any meaningful shareholder action by voting the “Wall Street rule” (for management) routinely.

Let’s see the leaders of American corporations take the lead in reestablishing a sense of fairness by taking less out of their companies for themselves. Economists can quibble endlessly about whether inequality has in fact increased or whether it has any effect on productivity (see a realclearmarkets.com summary of a recent study by Robert J. Gordon indicating that it’s all an illusion…) but the perception of gross unfairness is out there.

Social change is coming, but not from Barack Obama. It my fellow (exceedingly hard working) blogger George Washington is fond of saying, change springs up from the grass roots.

Enjoy your Saturday!

This is just a drop in the bucket, my friend. If you're a 1st class passenger on the Titanic and you know that disaster is inevitable, long before the coach passengers, what would you do?

ReplyDeleteGet a job with the government?

ReplyDeleteI like your points of view here. Sometimes, there are really problems that we thought won't happen yet they come.

ReplyDelete