N.B. The following is research, not investment advice. You invest at your own risk, unlike the Wall Street banks, who also invest at your risk.

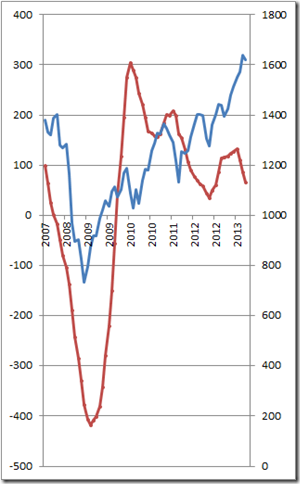

The Coppock curve is tracking downward.

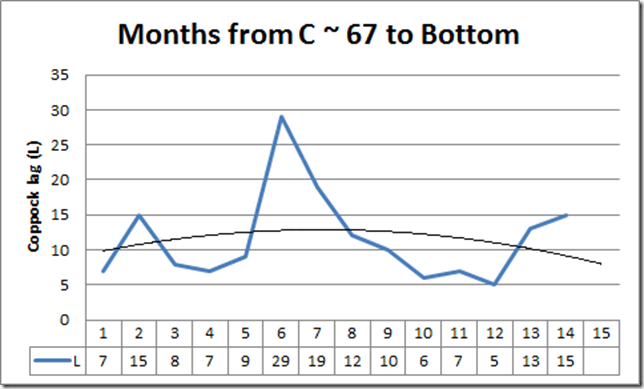

The Coppock curve sends a long-term bottom signal when it turns up from a negative reading. Assuming the curve does not bounce up again—anything is possible but it has only bounced from this low before once, in 2012—how long until the next major market bottom? The mean number of months from a similar Coppock value ~67 to the next bottom (the signal in 2001 was the only false positive and is ignored, taking the second signal in 2002 as the true signal) was 11.6 months, with a max of 19 and a min of 5.

So the average expectation would be for a bottom in the summer of 2014, a very crude second degree polynomial fit to the the series of signal leads gives a lead time of ~8 months for a bottom in spring 2014, which has a certain harmonic resonance with the Seventies big bottom which was in March 1974.

By the way, long interest rates rose all the way up to the bottom in 1974—and beyond, of course. However, if the world economy hits an air pocket (failure of effective demand) we could see stock prices falling and further disinflation or deflation. Remember, the last ZIRP lasted from 1934 to 1946, a dozen years. It could be 2021 before short rates rise. It is really hard for me to imagine a scenario where inflation takes off except for isolated supply shocks in the current environment.

Pushing on a string seems to work for the stock market, if not the economy.

No comments:

Post a Comment