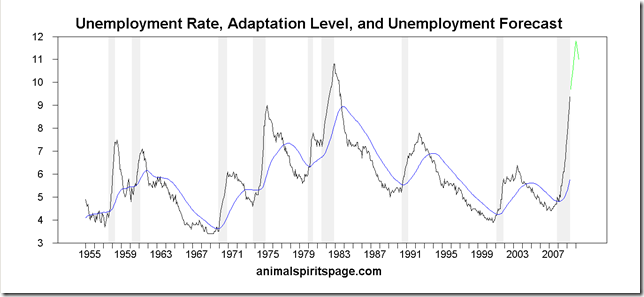

The confidence levels or “animal spirits” of Americans continued to increase in May as forecast as Americans became more adapted to the new realities of the labor market. The increase was confirmed by the Michigan Consumer Sentiment Index, a survey measure.

Our estimate of confidence levels is given by

A = - (U – UMEAN)/Stdev(U)

where U is the unemployment rate, UMEAN is an exponential moving average over the past 4 years, and Stdev(U) is a moving standard deviation over the same period. The forecast for rising '”animal spirits” (in blue above) is based the following conservative unemployment rate forecast:

“Animal spirits” are still literally “negative” as unemployment is above its adaptation level. In addition to their manifest financial losses of wealth, Americans have suffered a loss of psychological “wealth” in their confidence levels. If “animal spirits” follow a track similar to recent 8-10 year-long cycles, they will go positive in second half 2010, peak in about 2013, with the next recession in about 2017. We don’t think the cycle will last that long, but our forecasts don’t try to go out more than a year; and there is no “recession,” in the historical NBER sense, in the next year:

We expect the economy to at least stabilize and exhibit nonnegative growth. The opposing forces of debt deflation and simultaneous massive monetary and fiscal stimuli cloud the picture of growth rate, which we don’t forecast in any event. Note that the unemployment rate rose following the last two recessions, as we expect this time.

What are the implications for the stock market? As pointed out here, the recent upturn of the granddaddy of long-term momentum oscillators in May comes after the first false signal in the postwar period in 2001-2002; and with the P/E on the S&P 500 over 100, and given the ferocity of the recent run-up and seasonal weakness going into summer, we side with Peter Eliades’ expectation of a pull-back in the near term. However, “animal spirits” are rising, there’s lots of money still on the sidelines, and we know from prospect theory that people have a tendency to gamble when they feel they’re losing—so a blow-off is possible. Be careful!

Is this investing? NO! This is gambling and speculation on the national level, aided and abetted by the clowns who are making up policy as they go along (they’re riverboat gamblers all in Washington D.C.). Whether the market goes straight up, pulls back for a retest of the lows and then goes up—or the Coppock curve signal is false, and the market waffles while going to new lows—the surest bet would seem to be on volatility.

Personally, we are waiting for single digit P/Es on the S&P, but even that may not happen in this strange environment. As Marc Faber says, the Dow could go 50,000 in a hyperinflation while losing value against every other currency or commodity in the world. We expect that as CPI inflation rises north of Fed targets and above 3 percent, short rates will have to adjust, and the consequent flattening of the yield curve will spell the beginning of the end. But this could be several years away. If the next downturn takes us all the way into depression, as we expect, single digit P/Es should be on offer. Conservative investors will wait for that buy point.

This is research, not investment advice. You invest at your own risk.

Conclusion

Our judgmental view is for the economy to enter into a full-blown depression over the next five or so years (see this and references). This will occur after the cyclical expansion we appear to be entering, which we expect to be weak because of debt overhang. Our judgmental view is informed by historical patterns of what happens to nations who acquire too much debt while the income and wealth distributions become highly unequal: effective demand collapses because most households simply don’t have enough money to keep the circular flow going at a healthy rate. The money largely gets diverted to rich households that don’t spend as high a proportion of income; and who today are probably more likely to send their savings abroad for investment in the high-growth, non-dollar economies of the world, reducing funding for American capital formation. Most Americans probably have some understanding of this at a gut level and are saving more and moving into a generally more precautionary mindset as a result. But the national propensity for risk-taking has always been high. Americans are a bunch of self-selected risk takers. We may witness a national “doubling-down” in the near term as folks try to make themselves whole in the stock market. Moreover, our relatively robust economic health internationally may fuel yet another dollar rally and inflows into American paper assets.

Ultimately, we expect the entire Bretton Woods system to go supernova, with a burst of worldwide inflation that will make paper assets anywhere of limited investment value. This will be the result of the “globally coordinated policy response” resulting from the Panic of 2008. A new monetary system will be called for.

Optimally the current upturn in “animal spirits” might facilitate an honest reappraisal of the state of the nation and a truly grassroots democratic (small “d”) demand for reform, beginning with an audit of the Fed and a reappraisal of the fairness of the payroll and personal income tax system. Barring significant reform, Americans should be prepared for even rougher times in the next slump. Put your house in order!

No comments:

Post a Comment