Via Yahoo Finance: U.S. consumers' mood strongest in 9 months. Up, as forecast.

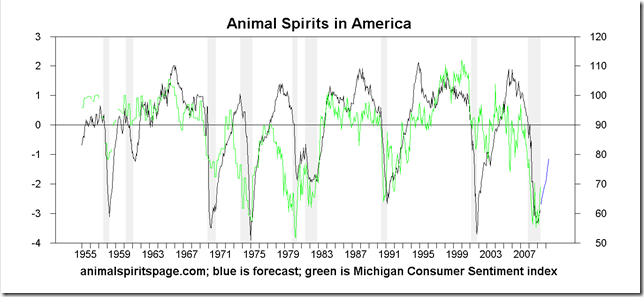

The June preliminary Michigan consumer sentiment number is shown, with my “animal spirits” index to May with a 12-month-ahead forecast.

The historical data show that an upturn in “animal spirits” is associated with an upturn in investment spending as a percent of GDP, so—barring it all being crowded out by the government’s borrowing—a rebound in capital formation should be in the offing. Recall that Keynes’ original references to “animal spirits” were as drivers of investment spending. The “animal spirits” are advancing.

However, real private nonresidential investment has yet to turn up (residential investment? Fuggedaboudih):

Data to 2009Q1.

Investment tax credits and much government infrastructure spending are on offer as part of the stimulus package (see this). An injection of investment spending from the private sector would greatly assist in changing the gradient of economic growth from negative to positive. It may take a couple of quarters after the recession ends before nonresidential investment spending turns up, if it follows the pattern of the last couple of recessions, or by the end of the year in my estimation.

No comments:

Post a Comment