Via: www.zerohedge.com

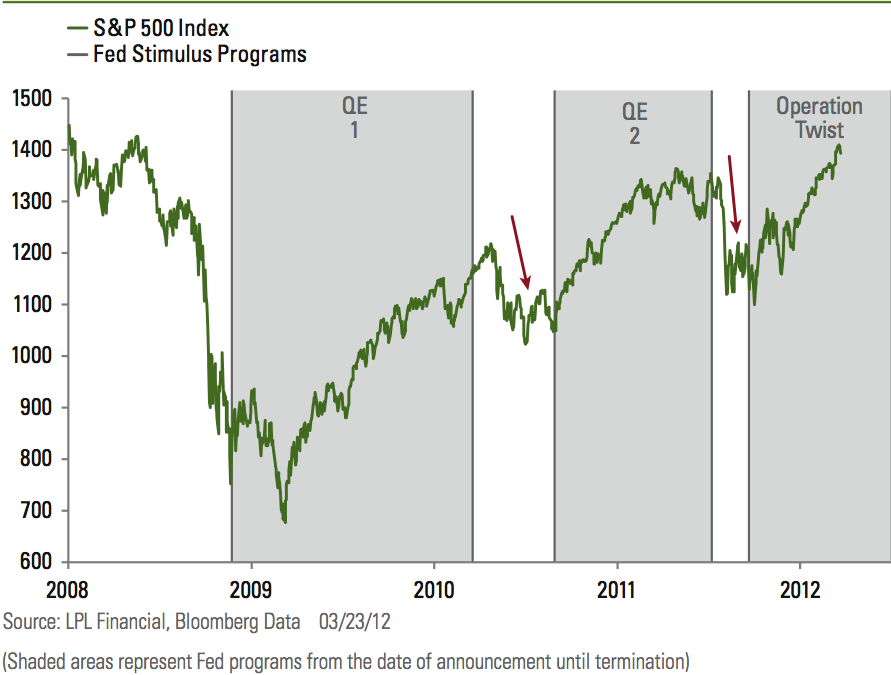

I am quoting liberally because this coverage of today’s press conference gets to the heart of the matter, that the only tool the Fed has to deal with an economy struggling under a debt load it can’t handle is to inflate it out. But Ben, the American people are scared stiff of the stock market and have come to the conclusion that Wall Street is a rigged game, are scared stiff of buying a home (if they can come up with the down payment). The other prescient insight, this one offered by Charles Hugh Smith also on zero, is that the only monetary surprises left are negative, which taken together with the fact that last several stock market advances have been undergirded by QE or Twist activities, could mean either that (1) the market will take off now for an extended upward leg, or (2) it won’t; it will collapse as the economy undeniably goes into recession. Speaking on behalf of John Q. Public, who is quaking in his boots about holding on to his job and possibly his house, I don’t find those odds appealing. We are heading into a period of unprecedented monetary instability.

The Punchline In His Own Words: Bernanke Advocates Blowing Asset Bubbles As The Antidote To Depression

If there was one absolutely must see moment exposing everything that is broken with the Fed's brand new policy of QE-nfinity, it was this exchange between Reuters' Pedro da Costa and the Chairman. It explains, beyond a reasonable doubt, that the only goal the Fed now has is to reflate the stock market bubble to previously unseen levels, to focus on generating jobs although not for everyone but only for Wall Street, consequences be damned, because by the time the consequences arrive, and they will (just recall that subprime is contained) they will be some other Fed chairman's problem. Bernake's term mercifully runs out in January 2014.

From the official transcript:

QUESTION: My question is -- I want to go back to the transmission mechanism, because speaking to people on the sidelines of the Jackson Hole conference, that seemed to be the concern about the remarks that you made, is that they could clearly see the effect on rates and they could see the effect on the stock market, but they couldn't see how that had helped the economy.

So I think there's a fear that over time this has been a policy that's helping Wall Street, but not doing that much for Main Street. So could you describe in some detail, how does it really different -- differ from trickle-down economics,where you just pump money into the banks and hope that they lend?

BERNANKE: Well, we are -- this is a Main Street policy, because what we're about here is trying to get jobs going. We're trying to create more employment. We're trying to meet our maximum employment mandate, so that's the objective. Our tools involve -- I mean, the tools we have involve affecting financial asset prices, and that's -- those are the tools of monetary policy.

There are a number of different channels -- mortgage rates, I mentioned other interest rates, corporate bond rates, but also the prices of various assets, like, for example, the prices of homes. To the extent that home prices begin to rise, consumers will feel wealthier, they'll feel more -- more disposed to spend. If house prices are rising, people may be more willing to buy homes because they think that they'll, you know, make a better return on that purchase. So house prices is one vehicle.

Stock prices -- many people own stocks directly or indirectly. The issue here is whether or not improving asset prices generally will make people more willing to spend.

One of the main concerns that firms have is there's not enough demand. There are not enough people coming and demanding their products. And if people feel that their financial situation is better because their 401(k) looks better or for whatever reason -- their house is worth more -- they're more willing to go out and spend, and that's going to provide the demand that firms need in order to be willing to hire and to invest.

And there you have it.

No comments:

Post a Comment