Nothing on this web site should be construed as investment advice. This is pure research and speculation. You trade at your own risk, unlike the Wall Street banks, who also trade at your risk.

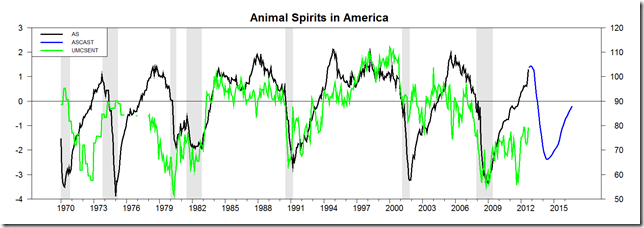

Confidence stalls when things stop getting better than what we’re used to. Confidence fails when they become worse than what we’re used to. Defined solely in terms of the unemployment rate, confidence now has a one percentage point cushion between current rate (7.8 percent) and adaptation level (~8.8 percent). If the unemployment rate stabilizes and climbs a percentage point because the economy falls off some form of fiscal cliff, the actual rate will hit the adaptation level, which historically has almost always precipitated a failure of confidence and a negative jag in output and employment. The forecast is below. The remainder of the decade is likely to resemble the ‘Seventies (the 30 year inflation cycle was staggered a year by mini-depression and QE) as cost-push inflation rears its ugly head (see South Africa today) and reserves liquidity feeds into a wage price spiral.

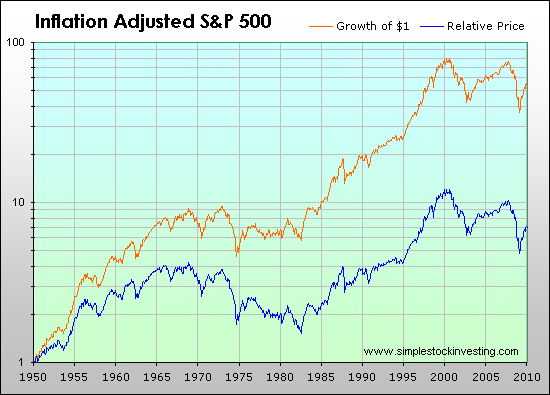

If the American stock market follows the ‘Seventies pattern, there will be a steep bear market bottoming in about first half 2014, and then a “bull market” in which total return to shares is something less than the rate of inflation.

No comments:

Post a Comment